Local banks and credit unions have their benefits, but most Americans choose national banks for their brick-and-mortar locations, vast ATM network, customer service, and extensive product lineup.

I personally bank with Chase. As a frequent traveler, I find it convenient to have access to branches on the go. On a recent trip, I was able to visit a local Chase branch, meet with a banker, and wire money to purchase my new home while I was out of town. That level of convenience is hard to beat and it’s unique to national banks.

We’ve selected our list of the best national banks based on the most important features, including ones that offer bank bonuses for opening a new account, to help you find the best bank for your financial needs.

9 Best National Banks in America

Here are the top national banks of January 2026:

- Chase Bank: Best Bank Bonuses

- Citi: Best for Savings

- US Bank: Best for Low Fees

- Discover® Bank: Best for Cash Back

- PNC Bank: Best Banking Bundle

- Bank of America: Best Online Banking

- TD Bank: Best Customer Service

- Wells Fargo: Best for In-Person Banking

- Ally: Best Online Bank

1. Chase Bank

Best Bank Bonuses

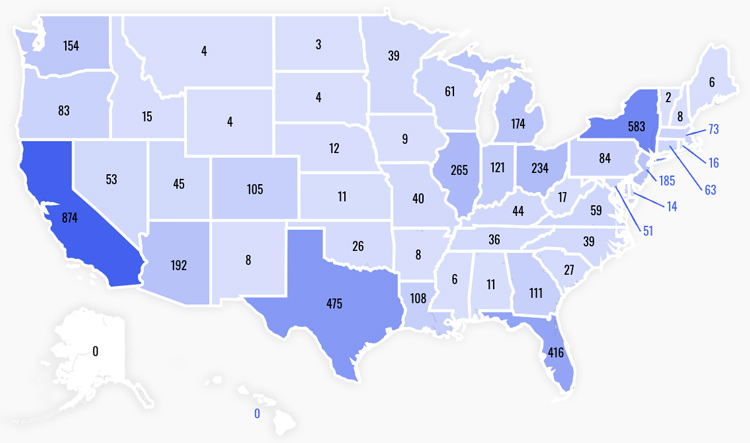

Chase Bank is the largest bank in the U.S., and our top pick for best national banks. You’ll have access to more than 4,900 physical branches, 15,000+ ATMs, and a well-liked mobile app that makes it easy to skip both.

Like most national banks, Chase doesn’t offer the highest rates, but its product breadth makes it easy to conveniently bank all in one place, with personal and business bank accounts, credit cards, and loans.

You can choose from multiple checking accounts, including a specialized one for kids, savings accounts, and CDs that you can open at a local branch or online.

When it comes to bank bonuses and perks, no one can match Chase Bank. They routinely offer nationally available sign-up bonuses for new banking customers. Chase is also well known for its credit card sign-up bonuses.

|

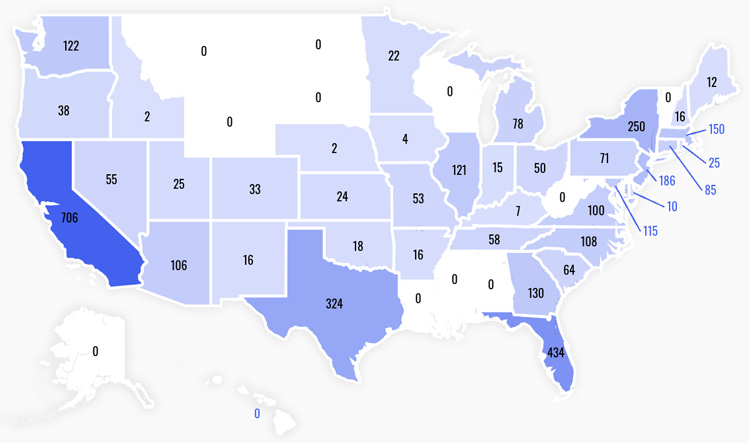

U.S. Locations By State Data Source: FDIC

|

|

| Number of Branches: | 4,900+ |

| Number of ATMs: | 16,000+ |

| Products: |

|

|

Perks |

|

| Interest on Savings: | 0.01% APY |

| Interest on Checking: | 0.01% APY |

| Consumer Bonus: | $400 bonusoffer details |

| Business Bonus: | up to $500 bonusoffer details |

|

Ratings |

|

| 2024 J.D. Power National Banking Satisfaction Score: | 677 (2nd Place!) |

| BBB Grade: | A+ |

| Apple iOS: | 4.8 based on 6.9M ratings |

| Google Play: | 4.4 based on 1.83M ratings |

Learn More:

2. Citi

Best for Savings

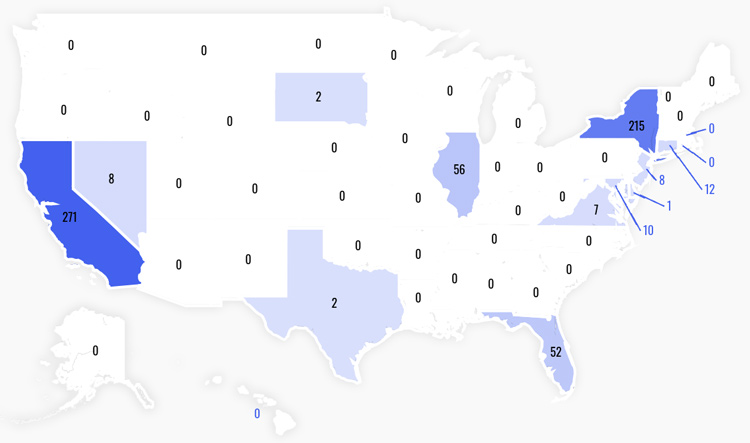

Citibank N.A., a Big Four bank, holds the title for the highest APY on a personal savings account, making it a bit of an outlier from the rest of the group.

It’s only available in certain markets, but the Citi® Accelerate Savings account claims a standard APY of 3.70%, and you only need a minimum balance of $1 to earn it.

Citi is based in New York City, and the majority of its branches are concentrated in major metropolitan areas across the country, making it a solid option for urban dwellers.

Citi is known for offering nearly year-round sign-up bonuses. What makes Citi promotions unique, however, is that they're often tiered. The low requirements make the offers accessible to most people, but even better, Citi will reward you with thousands of dollars if you can meet the highest terms.

|

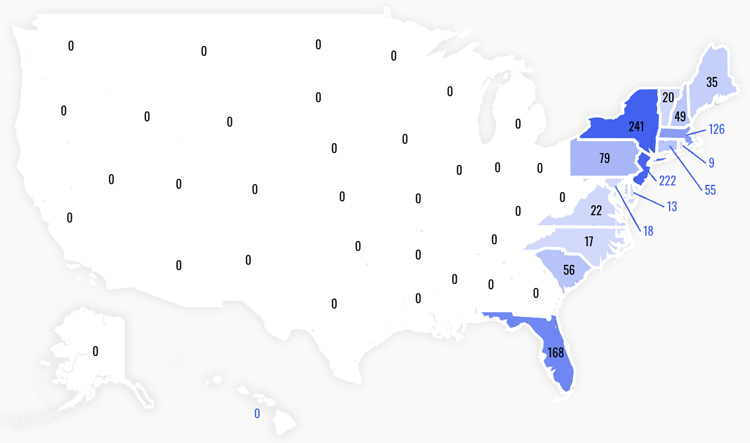

U.S. Locations By State Data Source: FDIC

|

|

| Number of Branches: | 900+ |

| Number of ATMs: | 65,000 |

| Products: |

|

|

Perks |

|

| Interest on Savings: | 3.70% APY |

| Interest on Checking: | 0.03% APY |

| Consumer Bonus: | up to $1500 bonusoffer details |

| Business Bonus: | up to $2000 bonusoffer details |

|

Ratings |

|

| 2024 J.D. Power National Banking Satisfaction Score: | 641 |

| BBB Grade: | F |

| Apple iOS: | 4.9 based on 3.9M ratings |

| Google Play: | 4.7 based on 1.2M ratings |

A note on the F rating from the BBB: In September 2020, the U.S. CFTC fined Citibank $4.5M for “supervision failures that led to the deletion of subpoenaed audio recordings.” The government action is cited as the reason for the failing grade, along with 75 unresolved complaints.

Learn More:

3. U.S. Bank

Best for Low Fees

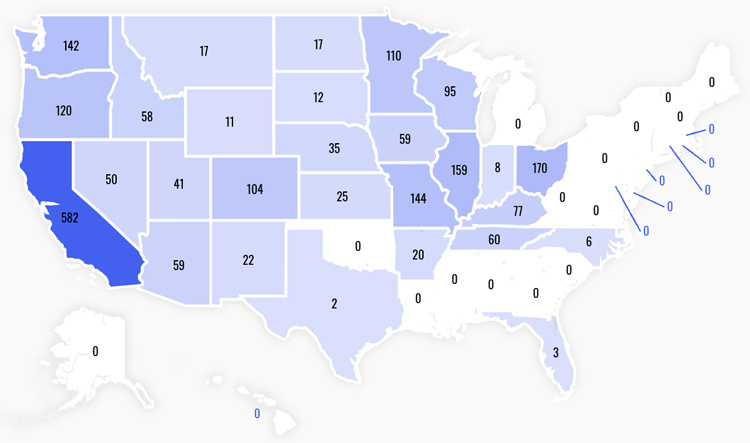

U.S. Bank is the fifth-largest bank in the United States and has over 450 locations in California. With access to 24/7 phone support, you’ll never have to worry about getting in contact with your bank if you have an issue.

U.S. Bank’s locations are mainly based in the West and Midwest, with the exception of Florida and North Carolina, U.S. Bank has no East Coast presence.

U.S. Bank offers a single checking, savings and money market account, and CDs.

Their CD rates are higher than most big national chains. For example, most barely offer a rate above 0.01%. Compared to U.S. Bank, whose best CD rate is 3.50% APY.

|

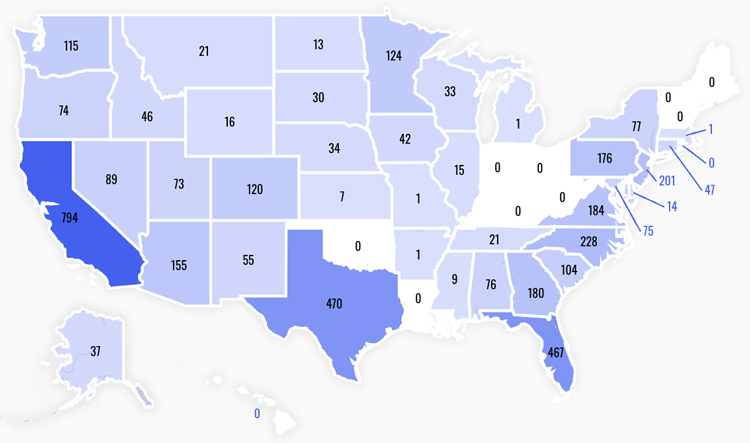

U.S. Locations By State Data Source: FDIC

|

|

| Number of Branches: | 2,200+ |

| Number of ATMs: | 4,700 |

| Products: |

|

|

Perks |

|

| Interest on Savings: | No |

| Interest on Checking: | 0.01% APY |

| Consumer Bonus: | up to $450 bonusoffer details |

| Business Bonus: | up to $1200 bonusoffer details |

|

Ratings |

|

| 2024 J.D. Power National Banking Satisfaction Score: | 660 |

| BBB Grade: | B+ |

| Apple iOS: | 4.8 based on 1.75M ratings |

| Google Play: | 4.7 based on 450k ratings |

Learn More:

4. Discover® Bank

Best Cash Back

Despite what you may think, Discover® Bank is not just a credit card company. Operating as an online bank, Discover offers a host of personal banking products, including checking and savings accounts, MMAs, CDs, retirement accounts, and loans.

What makes Discover particularly special is its fee structure. With a Discover Online Banking account, you’ll never pay a monthly maintenance fee, overdraft fee, or insufficient funds fee.

Discover also has one of the only rewards-earning debit cards, which is a good option for those who would rather earn cash back on debit purchases as opposed to with a credit card. With it, you can earn up to $360 each year.

While Discover is an online bank, the company still owns and operates the original branch of The Greenwood Trust Company in Delaware (which they acquired in 2000), making it the bank’s only physical location.

Discover consistently offers bank bonuses making signing up for a new account even more lucrative.

| Number of Branches: | 1 |

| Number of ATMs: | 415,000 |

| Products: |

|

|

Perks |

|

| Interest on Savings: | 3.40% APY |

| Interest on Checking: | No |

| Consumer Bonus: | None |

| Business Bonus: | None |

|

Ratings |

|

| 2024 J.D. Power Direct Banking Satisfaction Score: | 681 |

| BBB Grade: | A+ |

| Apple iOS: | 4.9 based on 4.4M ratings |

| Google Play: | 4.3 based on 295k ratings |

Learn More:

5. PNC Bank

Best Banking Bundle

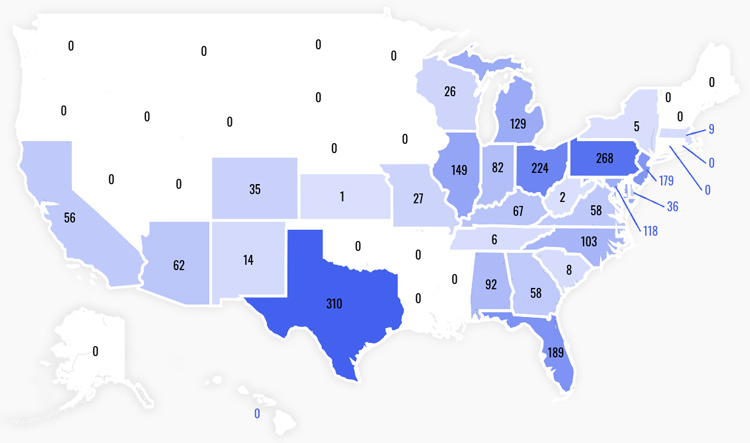

PNC Bank, based out of Pittsburgh, operates in 28 states, and Washington, D.C. across more than 2,370 locations — making it one of the biggest national banks in the country.

The most intriguing product that PNC offers is called Virtual Wallet, which is a bundle of accounts. Checking, short-term savings, and long-term savings accounts are all included in the same package.

Spend is PNC’s checking account and has no monthly fees or minimum deposit requirements.

Reserve is a short-term savings account and acts as a backup checking account. Reserve offers a low APY and is intended to be used for emergency funds, for setting money aside for future expenses.

Growth is the long-term savings account in the Virtual Wallet. It used to be a solid HYSA option with a very competitive rate, but now even after meeting the Relationship Rate requirements, balances over $2,500 will still only earn up to 0.03%. Time will tell whether the ongoing Fed rate hikes will have positive effects here.

PNC regularly offers sign-up bonuses for opening a new Virtual Wallet account.

|

U.S. Locations By State Data Source: FDIC

|

|

| Number of Branches: | 2,300+ |

| Number of ATMs: | 60,000 |

| Products: |

|

|

Perks |

|

| Interest on Savings: | 3.95% APY |

| Interest on Checking: | up to 0.05% APY |

| Consumer Bonus: | up to $400 bonusoffer details |

| Business Bonus: | $400 bonusoffer details |

|

Ratings |

|

| 2024 J.D. Power National Banking Satisfaction Score: | 653 |

| BBB Grade: | A+ |

| Apple iOS: | 4.9 based on 1.7M ratings |

| Google Play: | 4.5 based on 280k ratings |

Learn More:

6. Bank of America

Best Online Banking

Bank of America was founded in 1998 from the merger of NationsBank and BankAmerica, and has since become the second-largest bank in the country, serving more than 10% of all American deposits.

Bank of America boasts more than 3,740 physical branches and nearly 15,000 ATMs. Like the rest of the Big Four, you can count on a holistic banking relationship that meets all of your basic banking needs.

Bank of America is increasingly moving into the online banking space and has one of the best financial mobile apps available. In fact, J.D. Power’s 2023 Banking Mobile App Satisfaction Study ranked Bank of America highest, with a score of 710.

They also employ tons of customer service representatives. If you need help, their phone lines are open seven days a week. You can also get support via Twitter and online chat.

Bank of America offers a plethora of banking products, a well-reviewed digital experience, and to top it off, it consistently has promotions on offer for opening a new account.

|

U.S. Locations By State Data Source: FDIC

|

|

| Number of Branches: | 3,900+ |

| Number of ATMs: | 15,000 |

| Products: |

|

|

Perks |

|

| Interest on Savings: | up to 0.04% APY |

| Interest on Checking: | up to 0.02% APY |

| Consumer Bonus: | up to $500 bonusoffer details |

| Business Bonus: | up to $750 bonusoffer details |

|

Ratings |

|

| 2024 J.D. Power National Banking Satisfaction Score: | 646 |

| BBB Grade: | A |

| Apple iOS: | 4.8 based on 4.8M ratings |

| Google Play: | 4.6 based on 1.15M ratings |

Learn More:

7. TD Bank

Best Customer Service

TD Bank touts itself as “America’s Most Convenient Bank.” In many ways, it lives up to the tagline.

In J.D. Power’s comprehensive study of banking customer experiences, TD Bank is the 3rd highest-rated national bank as of 2023 in terms of customer satisfaction. Within the study, TD Bank ranked well in terms of convenience, branch service, and online banking satisfaction.

Most TD Bank locations are open seven days a week, and they tend to have more flexible hours than big national banks. While they have over 1,100 locations, TD Bank is exclusively East Coast-based.

TD Bank regularly offers both checking and savings account promotions for those located in one of the targeted states. Plus the requirements are relatively easy for the cash given.

|

U.S. Locations By State Data Source: FDIC

|

|

| Number of Branches: | 1,100+ |

| Number of ATMs: | 2,600 |

| Products: |

|

|

Perks |

|

| Interest on Savings: | up to 3.00% APY |

| Interest on Checking: | No |

| Consumer Bonus: | $300 bonusoffer details |

| Business Bonus: | None |

|

Ratings |

|

| 2024 J.D. Power National Banking Satisfaction Score: | 668 |

| BBB Grade: | NR |

| Apple iOS: | 4.8 based on 250k ratings |

| Google Play: | 4.0 based on 87k ratings |

Learn More:

8. Wells Fargo

Best for In-Person Banking

Wells Fargo along with JPMorgan Chase, Bank of America, and Citibank, make up the “Big Four” American national banks – meaning they manage more money than anyone else.

Wells Fargo’s offerings are comprehensive, covering everything from bank accounts, credit cards, loans, retirement planning, and wealth management services.

Account options are pretty standard for a big bank and don’t stand out one way or the other.

Wells Fargo has been rolling out several consumer-friendly policies, including eliminating NSF and overdraft transfer fees, an extra-day grace period for overdrafts, and an early payday feature that makes direct deposits available up to two days early.

If you're looking for a traditional banking experience with tellers, advisors, and free lollipops for your kids — Wells Fargo is hard to beat. Plus they consistently offer promotions for opening a new checking or savings account.

|

U.S. Locations By State Data Source: FDIC

|

|

| Number of Branches: | 4,200+ |

| Number of ATMs: | 12,000 |

| Products: |

|

|

Perks |

|

| Interest on Savings: | up to 0.02% APY |

| Interest on Checking: | 0.01% APY |

| Consumer Bonus: | $400 bonusoffer details |

| Business Bonus: | $400 bonusoffer details |

|

Ratings |

|

| 2024 J.D. Power National Banking Satisfaction Score: | 648 |

| BBB Grade: | F |

| Apple iOS: | 4.9 based on 9.6M ratings |

| Google Play: | 4.8 based on 2.6M ratings |

A note on the F rating from the BBB: In September 2021, the Office of the Comptroller of Currency (OCC) issued a Cease and Desist order against Wells Fargo Bank, N.A., based on the bank’s failure to establish an effective home lending loss mitigation program.

Learn More:

9. Ally Bank

Best Online Bank

Online banks have started to pop up more and more in recent years, and Ally Bank consistently ranks among the best. If you don’t feel the need for a physical location, an online-only bank could be a great fit.

The main benefit is that due to the lower overhead that online banks carry (no buildings, fewer employees, etc.), customers are usually rewarded with higher interest rates and low fees.

Ally Bank is no different and offers some of the highest APYs in the business. You also won’t see any monthly maintenance fees or get dinged for failing to meet a minimum balance.

As far as taking out cash goes, Ally doesn’t have their own ATMs. But, they do provide free access to over 43,000 Allpoint ATMs across the country. They also reimburse you up to $10 per statement period for any fees associated with out-of-network ATMs.

The only real downside with Ally is that making deposits can be a little tricky. There is no way to deposit cash, and checks need to be deposited through the app or the mail.

Ally Bank offers high-interest rates, a low fee schedule, and consistently offers sign-up bonuses for opening a new spending account.

| Number of Branches: | 0 |

| Number of ATMs: | 43,000 |

| Products: |

|

|

Perks |

|

| Interest on Savings: | 3.30% APY |

| Interest on Checking: | up to 0.25% APY |

| Consumer Bonus: | None |

| Business Bonus: | None |

|

Ratings |

|

| 2024 J.D. Power Direct Banking Satisfaction Score: | 702 |

| BBB Grade: | A |

| Apple iOS: | 4.7 based on 90k ratings |

| Google Play: | 4.3 based on 31k ratings |

Learn More:

Find the Best Banks Near Me

We’ve researched and rounded up the best banks in all 50 states. Use the map below to compare the top banks in your state.

Pros and Cons of National Banks

Like everything in life, choosing a national bank as your primary financial institution comes with both positive and negative trade-offs. Let’s look at a few.

Pros

- Product Offerings. National banks can be a one-stop shop for all of your financial needs. In addition to the standard checking and savings accounts, the big banks will offer mortgages, credit cards, personal and auto loans, investment services, and more. Plus, most are equally strong for business owners as they are on the consumer side (compared to credit unions, for example, who offer a wide range of personal products but are often lacking in business services.). Even if you don’t need multiple products right now, you likely will someday, and building a relationship with a single institution can lead to loyalty rates and perks.

- Convenience. One of the most obvious benefits of the big banks is the number of branches and ATMs they have across the country. While online and mobile banking makes this less of an attraction than it once was, it can still be a huge convenience if you happen to need support while traveling.

- New Account Bonuses. National banks like PNC, Chase, and Citi have the marketing dollars to offer new account bonuses nearly year-round. If you’re otherwise fairly indifferent to which bank you choose, opening a new account at a national bank will likely see you get paid.

Cons

- Lower Interest Rates. The flip side to the plethora of account options and physical locations is that national chains have higher overhead costs to support those and that typically means lower interest rates. However, this is definitely not always the case (particularly in the era of low interest rates across the board) so you should check before taking that for granted.

- Higher Fees. Similarly to the low interest rates, national banks are also more likely to ding you with fees. Monthly account fees (though these can often be waived!), overdraft fees, NSF fees, fees for wire transfers and checkbooks, and more. If you often incur fees from your bank, we recommend having a solid understanding of which activities you’re most often charged for and shopping specifically for accounts that minimize or completely eliminate these. National banks like Discover, for example, differentiate themselves specifically by charging very, very few fees.

- Less Personalized Service. Your local credit union or small regional bank will likely have more flexibility to consider scenarios on a case-by-case basis. For example, land loans are notoriously difficult because of the risk involved compared to a typical mortgage with the asset (the home) already in place. It’s common advice to check with your local credit union instead, which will better understand the value of the land in question. Another example is for those with less than stellar banking histories. If you’re actively taking steps to better your financial situation, but are still in the gray area, pleading your case to a local bank may be easier than a national chain. But those are just two small examples of the many ways that national chains may be more bound to corporate processes and operating procedures.

National Banks FAQs

What is a national bank?

Technically speaking, a national bank is a bank chartered by the U.S. government. For the sake of our list, we considered a national bank to be one that’s federally chartered, very well known, and/or with an extensive number of branches and ATMs.

Which is better, a national bank or a smaller bank?

A smaller bank will likely provide more personalized service. Many also charge lower fees and pay higher interest rates – this is particularly true of credit unions because of their not-for-profit model.

National banks, however, have more locations, stronger tech, offer higher bonuses, and typically provide more products and services.

Which is better, an online bank or a brick-and-mortar bank?

It depends on what you want in a banking experience. If you value face-to-face banking or if you deposit cash regularly, you’ll want a bank that has branches conveniently located to you.

Online banks, on the other hand, don’t have the overhead of physical locations and can typically afford to pass on the savings to you – in the form of fewer fees and higher interest rates (though they don’t always!).

It used to be true that online banks had the leg-up in terms of technology and your online or mobile experience, but that’s no longer the case. Banks large and small have invested enough in technology that your day-to-day personal banking is hassle-free. Mobile check deposits, transferring money, checking balances, deposit alerts, debit card locking, and bill pay – are all standard features nowadays.

How much interest do the best big banks pay?

Right now, the national average for savings is just 0.41% APY, and even less for interest checking at 0.07%.

Of course, there are exceptions. For example, Citi® Accelerate Savings is currently offering 3.70%.

In general, however, if you’re looking for the highest savings rates, you’ll have the best luck by focusing your search on national online banks like Synchrony, CIT, and Everbank.

So, who is the number 1 bank in the U.S.?

If this were a clear-cut answer, we wouldn’t need to take the time to make a list of 9. Looking at the numbers: Chase is the biggest bank in terms of assets under management. Ally is the best online bank, and Citibank has the best APY.

At the end of the day, no bank can claim to be the outright number one bank. It all depends on what banking services you need and identifying the bank to best serve those needs.

Which national banks will pay me a bonus?

Chase Bank and Citi are known for running promotions nearly year-round. But most of the national banks will run bonuses periodically to attract new customers: you’ll be required to open a new account and meet certain requirements.

Which national banks are the safest?

All of the banks on this list are FDIC-insured, which means that your deposits are protected up to $250,000 per person, per ownership category, and per bank.

This should be a requirement for any bank that you’re considering. Most of the bigger banks will also guarantee your money against unwanted access in the event that someone hacks your account, and some, such as Bank of America and Chase, will even reimburse you the next day while they look into it.

Is my money safer in a national bank versus a regional bank?

Nope. Your money is equally safe in any bank that’s insured by the Federal Deposit Insurance Corp (or any credit union that’s insured by the NCUA).

Learn More:

Methodology: How We Chose the Best National Banks

To gather this list, we looked at the largest, most well-known retail banks in America and factored in the following:

- Accessibility: To rate the best national banks, we looked into their footprint, focusing on banks with widespread branch and ATM access so you can easily manage your account on the go.

- Convenience: We also drilled down on convenience, looking into features like mobile check deposits, fee-free transactions, and a user-friendly online banking platform.

- Account lineup: We zeroed in on banks with a robust product lineup that can meet a variety of consumer banking needs.

- Fees and minimums: We also factored in each bank’s fee structure, opening deposits, and ongoing minimum balance requirements.

- Bonuses: At BankBonus, we always prioritize providing readers with bank bonus offers and factored each bank’s welcome bonuses into our evaluation.

- Reviews and ratings: Last, we leaned on customer reviews and third-party ratings from the Better Business Bureau. We placed a great deal of emphasis on industry studies, such as J.D. Power’s 2024 U.S. National Banking Satisfaction Study.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired or changed. The number of bank branches are up to date according to the Federal Reserve as of March 2025.

Comments are closed.

Comments are closed here.