Whether you’ve always dreamed of owning land and building your property or are struggling to find a property that meets your needs, a land loan could be a great financing option.

These loans are designed specifically for purchasing land for a home or business, and they can be harder to find than traditional mortgages, usually offered by community banks rather than large national banks.

We’ve identified some of the best banks for land loans and outlined the basics of these unique loans to help you find the right lending product for your land purchase.

What Are Land Loans?

Land loans help individuals or small businesses finance the purchase of a parcel of land for development, agriculture, or recreation. Loans for land-only make up a small percentage of the lending market because they’re considered riskier for banks and credit unions.

Existing properties are in much higher demand when compared to vacant lots and rural land. Consequently, if a lender needs to foreclose on a land loan, it’s less likely to recover the money through a sale as fewer buyers are interested.

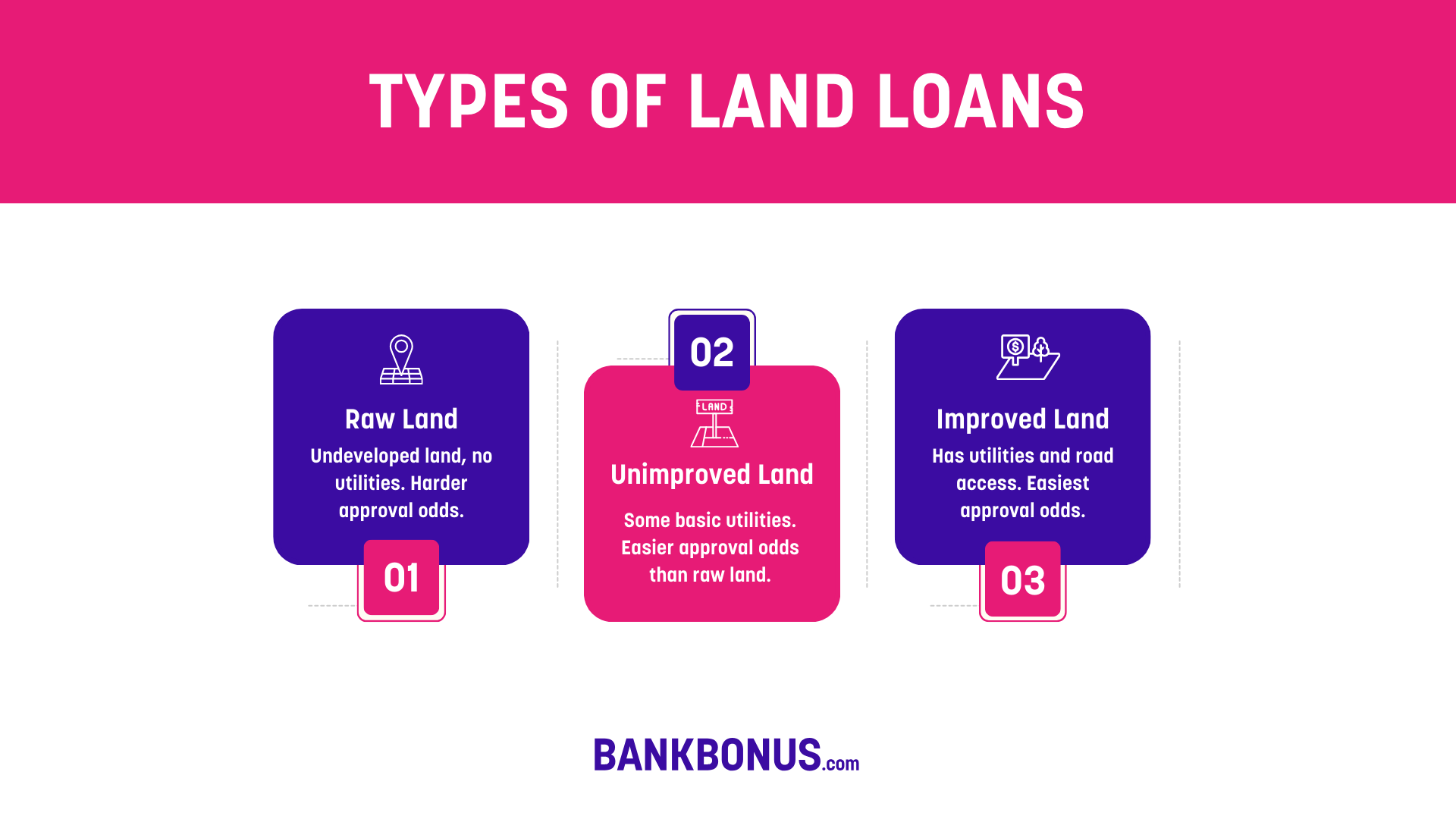

Types of Land Loans

There are three main types of land loans, and which one you need depends on the type of property you plan to purchase. Each one has its own qualifications and approval odds. Here’s an overview of each:

Raw Land

Raw land is untouched and undeveloped land that hasn’t been improved upon in any way. This type of land has no access to utilities like electricity or gas meters and might not even be connected to roads.

Raw land is typically the most inexpensive type of land. That said, obtaining financing to buy it can be more difficult. Banks and credit unions are less likely to offer financing for raw land as it poses a high risk of abandonment.

Unimproved Land

In most cases, unimproved land would already have access to basic utilities such as road access and phone lines. While these simple utilities may not seem like much, they make a major difference when the new owners come to develop the land.

Obtaining a land loan for unimproved land is easier than for raw land. However, it still poses a significant risk to the loan provider since it isn’t fully improved and ready to be built on.

Improved Land

Fully accessible by road and fitted with access to all utilities, improved land is usually ready for immediate development, making it more expensive to purchase than raw or unimproved land.

Financing for this type of land is the easiest as it poses the least risk to loan providers.

Which Banks Offer Land Loans?

Once again, your best bet for finding a land loan is to turn to a community bank or credit union with a presence in your area.

Large national banks often exclude land loans from their product lineup, and local banks are more likely to be knowledgable of land value in your area.

Since land loans normally come with higher interest rates than mortgages for ready-built properties, it’s a good idea to evaluate and compare multiple lenders and different types of loan programs before settling on one.

Also, making sure that your chosen financial institution is fully licensed to provide mortgage loans will save you plenty of unnecessary stress. The Nationwide Mortgage Licensing System (NMLS) was set up in 2008 to create a centralized database of licensed and credentialed lenders.

7 Best Banks for Land Loans

Here are some of the best banks for land loans. We considered each bank’s accessibility, loan features, and additional resources for applicants:

- Old National Bank

- WaFd Bank

- Atlantic Union Bank

- Clear Mountain Bank

- Alpine Bank

- California Bank & Trust

- Banner Bank

1. Old National Bank

Old National Bank offers lending services to Indiana, Minnesota, Wisconsin, Michigan, and Kentucky.

Loan programs are available for up to 5-acre properties, with a 15-year fixed rate or 20-year adjustable rate mortgage/ The minimum downpayment for these loans is 20%. Lot and land financing is available for improved and unimproved land and comes with no obligation to build immediately.

Since its merger with First Midwest Bank, Old National Bank now has over 250 banking centers across the Midwest, so you are sure to find a local brick-and-mortar branch where you can discuss your loan needs.

However, you also have access to an online loan calculator and online loan application if you don’t have the time to drop into one of their banking centers to speak with a loan officer.

Learn More at OldNational.com↗

2. WaFd Bank

WaFd Bank offers banking solutions in Arizona, Idaho, Nevada, New Mexico, Oregon, Texas, Utah, and Washington. You can get financing for improved land up to $700,000 without any obligation to build immediately.

There’s a helpful online loan calculator that can help you estimate the interest and tax rates you can expect to pay based on your credit score, property specifications, and development plans.

You can apply for loans online through their portal or in one of their bank branch locations. Minimum down payments and interest rates vary depending on the loan term, and they also offer lower rates when you opt for a short-term loan.

3. Atlantic Union Bank

Based out of Virginia, Atlantic Union Bank offers land loans for both undeveloped land and residential lots, with locations in Virginia, Maryland, and North Carolina.

Separate construction loans are also available for you to finance the construction of your dream home. However, they don’t offer services like loan calculators, interest rate guidelines, or down payment information on their website.

You can call or visit your local branch to speak to a loan officer about the specifics of the bank’s financing options.

Learn More at AtlanticUnionBank.com↗

4. Clear Mountain Bank

Clear Mountain Bank serves residents of West Virginia and Maryland. Land loans are offered for residential lots for future development and unimproved land for recreational purposes.

Financing of up to 90% is available on the purchase price of residential lots. Loan information is available through the loan application section on their website, over the phone, or at one of the bank’s brick-and-mortar bank branches.

Learn More at ClearMountainBank.com↗

5. Alpine Bank

Alpine Bank offers financial services to the Colorado area. Both lot and new construction loans are available with a maximum loan-to-value amount of 75% on improved land.

Lending details and information on monthly payments are not readily available on the bank’s website. There aren’t any online calculators, either.

That said, you can enquire online, request further information via email or phone, or visit one of their bank branches.

6. California Bank and Trust

California Bank and Trust, based in California, offers both land loans and construction loans. The bank offers financing of up to 65% of the lot purchase price along with multiple loan options.

Minimum down payment, loan term, and interest rates are also not listed on their website. However, the bank notes that you can avoid PMI (Private Mortgage Insurance) with a 20% downpayment, and some existing clients can enjoy relationship pricing.

You can apply for a loan online, over the phone, or through one of their branches.

Learn More at CALBankTrust.com↗

7. Banner Bank

Banner Bank offers its financial services to the areas of Idaho, Washington, Oregon, and California. The bank offers financing for purchasing land in an improved and unimproved state to keep options open for potential borrowers.

You can borrow up to 75% of the land purchase price, and the bank claims to charge competitive interest rates and fees. Loans are approved in-house to streamline the credit score verification and loan approval process.

When choosing Banner Bank, you can lock in a fixed-rate or flexible interest rate, but other details are scarce on the bank’s website. Financing for construction and personal loans are also available.

How To Apply for a Land Loan

Applying for a land loan is relatively similar to a typical mortgage loan. Here’s a quick rundown of the steps you should take to apply for a land loan:

- Find your land: Scouring the real estate market for the ideal plot of land is your first step.

- Outline your plans: Once you’ve decided which piece of land is ideal, you’ll need to draw up (or hire someone to do it) a thorough plan for development and construction along with ballpark timeframes.

- Research lenders: Next, search for lenders in your area that offer land or lot loans. Each type of land loan has its own qualifications that potential borrowers need to meet before their loan is approved.

- Gather your information: The lender will generally need all the documentation concerning plans for developing the land, along with proof that borrowers have an excellent credit score to be able to initiate the approval process.

- Contact the bank: Each bank has its own application process. Most lenders require you to contact them by phone or visit a branch to initiate the application process.

- Plan for a credit check: Banks and credit unions will run an independent credit check on loan applicants before making any decisions.

- Discuss land details: You’ll also likely need to discuss zoning, land-use restrictions, access to utilities, and land and boundary surveys.

- Wait for underwriting: Once the bank has the information it needs, it will determine your eligibility. If your loan request is approved, the bank will determine your loan terms, such as interest rates, the length of the loan, downpayment, and any other requirements it sets.

Keep in mind that land loans are considered high risk for lenders, so obtaining financing may not be the easiest of tasks. Lenders tend to require higher down payments, charge higher interest rates, and offer shorter repayment periods on land loans tham traditional mortgages to mitigate risk.

Some banks may offer lower interest rates or longer monthly payment terms to those with better credit scores and debt-to-income ratios.

Alternative Land Financing Options

1. USDA Loans

The U.S. Department of Agriculture offers financing options for those looking to build their own homes in rural areas.

The USDA’s Section 523 loans are for those looking to purchase land to develop themselves, and Section 524 loans are to finance new construction by a contractor.

Loans like these require no down payment and come with low interest rates. However, they must be paid back within two years. Both Section 523 and 524 loans are designed to help low-income families become homeowners and are restricted by zoning and land-use regulations.

2. FHA Loans

Those looking to buy land and build their residence on it within a short period might want to consider an FHA loan. FHA loans are loans insured by the Federal Housing Administration to protect lenders from risk.

These loans are not available for land purchase alone but are sometimes available in conjunction with a construction loan. Unlike many conventional loans, FHA loans require a low down payment. However, interest rates may be higher to compensate for it.

You may still be considered for an FHA loan even if you’ve declared bankruptcy or suffered foreclosures, disqualifying you from obtaining a traditional mortgage.

3. Home Equity Loans

Buyers who already own a property and have little to no debt also have the option of considering a home equity loan. Home equity loans are designed to convert your equity into collateral for a new loan to fund your purchase.

Home Equity Loans come in all shapes and sizes, so your best option is to speak to your financial institution of choice about your options.

4. Cash-Out Refinancing

Homeowners can refinance their homes to free up some equity. Refinancing of this kind is essentially paying off your current mortgage to get into another mortgage with a lower interest rate or easier monthly payments.

Once the remortgaging has taken place, your financial institution will issue a check based on the equity in your property. You may then use this freed-up cash to invest in land!

5. SBA Loans

Business owners could benefit from the 504 loan program offered by the Small Business Administration (SBA).

You would need to finance 10% of the land purchase price, the SBA will cover 40%, and a lender of your choice would need to finance the remaining 50%. Terms on these types of loans vary depending on the lender you choose to fund 50% of the land purchase.

6. Seller Financing

You may be lucky enough to obtain financing from the landowner directly. Down payments for seller financing would usually need to be substantial, and interest rates are generally less competitive.

Seller financing would cost you more than financing through a bank. Unless you don’t qualify for traditional financing, considering this type of loan may not be worth your while.

Whichever financing option you choose to fund your land purchase, always evaluate the terms thoroughly and read the fine print to save yourself from additional stress.

Comments are closed.

Comments are closed here.