If you’re looking for banks with locations in all 50 states, you won’t find one. However, several national banks come very close to nationwide availability, and with the convenience of online banking, you can still find support from almost anywhere.

In this post, we’ll cover the banks with the largest presence in the US and where you can find them. From popular household names like Chase and Wells Fargo to online-only banks like Chime and Ally, you should have no trouble finding a bank that works for you — no matter where you are.

Banks with Locations in (Almost) Every State

Even though these banks are not everywhere, the biggest and best-known national banks each have a significant presence throughout much of the US.

Of course, every major bank now has some type of online banking available as well. While the quality and usability vary from platform to platform, big national banks tend to have high-functioning online tools for banking on the go.

So, if you prefer a bank with locations in all 50 states, the largest banks are a good start if you’re looking for as many branches as possible.

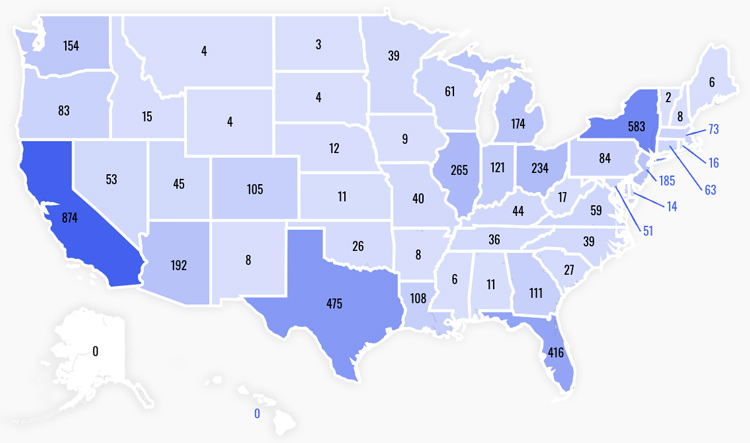

1. Chase Bank

In terms of a presence in every state, Chase Bank comes the closest, with retail locations in all of the lower 48 states. The only states without a Chase Bank location are Alaska and Hawaii.

According to Federal Reserve data, Chase is the largest bank in the country, with more than $3.50 trillion in assets.

Chase offers a wide range of checking, savings, and CD accounts, along with credit cards, loans, and J.P. Morgan investment services, making it an ideal one-stop shop for managing your finances.

|

U.S. Locations By State Data Source: FDIC

|

|

| Number of Branches: | 4,900+ |

| Number of ATMs: | 16,000 |

|

Promotions |

|

| Consumer Bonus: | $400 bonusoffer details |

| Business Bonus: | up to $500 bonusoffer details |

Learn More:

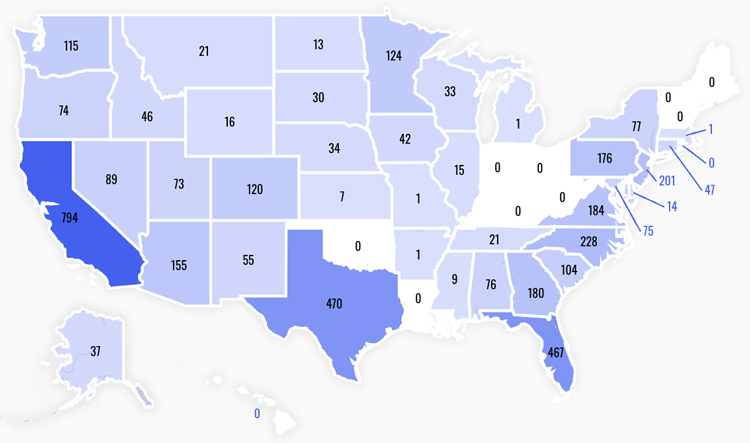

2. Wells Fargo

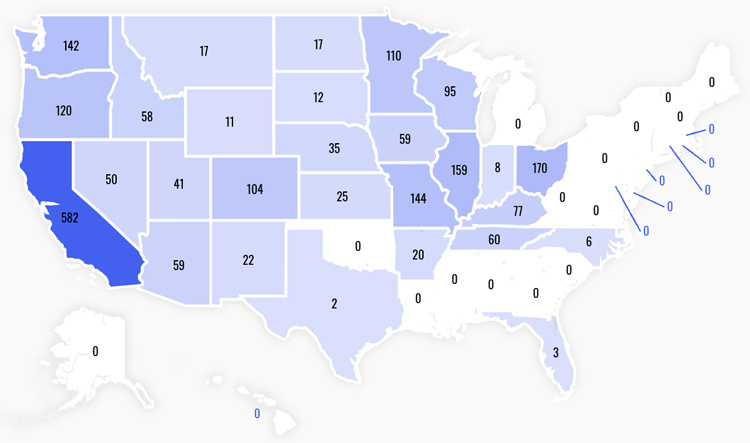

Wells Fargo has the highest number of branches but has a smaller overall service area than Chase. You’ll find a Wells Fargo branch in 36 states, with the highest number of branches in California, Texas, and Florida.

Wells Fargo is also the fourth largest bank in the US based on its assets, according to the Fed.

The bank offers a wealth of deposit accounts and credit cards, loans, and business banking products. It regularly extends bank bonuses to new customers who open Wells Fargo checking and savings accounts, which are typically available nationwide.

|

U.S. Locations By State Data Source: FDIC

|

|

| Number of Branches: | 4,278 |

| Number of ATMs: | 12,000 |

|

Promotions |

|

| Consumer Bonus: | $400 bonusoffer details |

| Business Bonus: | $400 bonusoffer details |

Learn More:

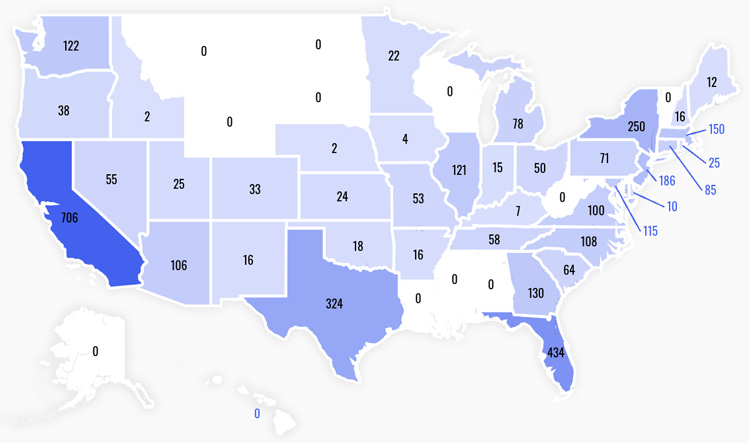

3. Bank of America

If you’re looking for a bank with locations in all 50 states, Bank of America comes close, with over 3,900 branches in 38 states. Its largest presence is in California, where it has more than 700 branches.

Bank of America is present in most areas of the US, but there are fewer branches in the Midwest and the South. It’s also the second-largest bank in the nation, with more than $2.5 trillion in assets.

Like other national banks, Bank of America offers a long lineup of bank accounts for individuals and businesses, as well as credit cards, investment accounts, and lending products.

|

U.S. Locations By State Data Source: FDIC

|

|

| Number of Branches: | 3,903 |

| Number of ATMs: | 15,000 |

|

Promotions |

|

| Consumer Bonus: | up to $500 bonusoffer details |

| Business Bonus: | up to $750 bonusoffer details |

Learn More:

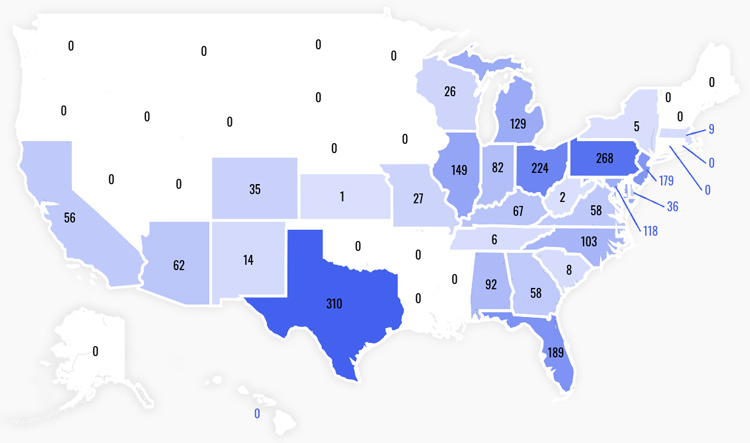

4. PNC Bank

PNC recently acquired BBVA, bringing its total number of branches to more than 2,300 in 30 states. PNC’s most significant presence remains in the Mid-Atlantic, but the expansion also gives it a large branch network in Texas.

Despite its recent growth, PNC is harder to find in the Pacific Northwest and some of the Midwest.

Customers who live in PNC’s service areas can access a number of bank accounts, credit cards, and loans. The bank’s Virtual Wallet account, which is a hybrid checking and savings account, comes with a competitive signup bonus that’s available in several states.

|

U.S. Locations By State Data Source: FDIC

|

|

| Number of Branches: | 2,334 |

| Number of ATMs: | 60,000 |

|

Promotions |

|

| Consumer Bonus: | None |

| Business Bonus: | $400 bonusoffer details |

Learn More:

5. US Bank

US Bank is one of the most well-known banks in the West and Midwest, with its headquarters in Cincinnati, Ohio. The bank operates over 2,200 branches in 26 states. It ranks fifth on the Fed’s list of the largest commercial banks in the US with more than $24 billion in annual revenue.

Whether you’re looking to open a checking or savings account, grow your interest with a CD or MMA, borrow, invest, or manage your business’s finances, US Bank’s strong product lineup may meet your needs.

US Bank has several active bank bonuses for new accountholders, and most of these offers are available in all 50 states.

|

U.S. Locations By State Data Source: FDIC

|

|

| Number of Branches: | 2,209 |

| Number of ATMs: | 4,700 |

|

Promotions |

|

| Consumer Bonus: | up to $450 bonusoffer details |

| Business Bonus: | up to $1200 bonusoffer details |

Learn More:

6. Citibank

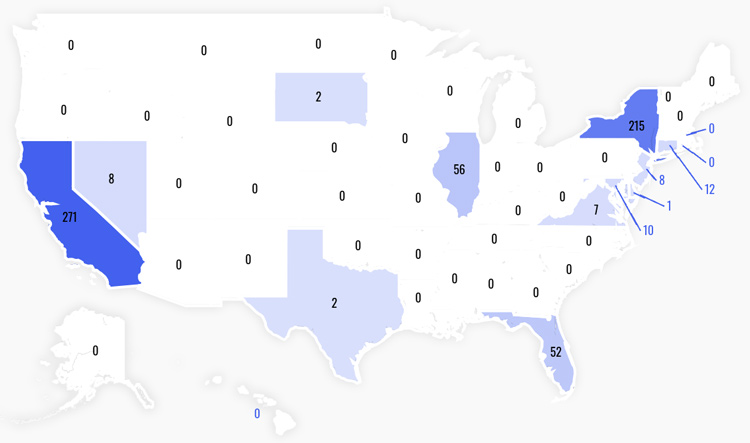

Citibank has the smallest physical presence of the Big Four (Chase, Bank of America, CitiBank, and Wells Fargo), with 939 branches across 21 states.

Despite its smaller branch presence, Citibank has a large ATM network to help customers access their funds, with around 2,300 ATMs in its branches and a network of 65,000 more surcharge-free ATMs.

While it doesn’t have branches in all 50 states, many of Citi’s accounts are available nationwide and can be opened online. You can choose from a competitive lineup of products and bank bonuses.

|

U.S. Locations By State Data Source: FDIC

|

|

| Number of Branches: | 939 |

| Number of ATMs: | 65,000 |

|

Promotions |

|

| Consumer Bonus: | up to $1500 bonusoffer details |

| Business Bonus: | up to $2000 bonusoffer details |

Learn More:

Online Banks Available Nationwide

Online banks don’t have bank branches. Instead, they operate digitally and trade the cost of brick-and-mortar for lower fee schedules and higher interest rates.

Online banking isn’t the best choice if you need a bank with branches, tellers, and in-person support. But if you don’t need those services, these digital banking options are among the best.

Additionally, some features of online banks are more widespread than large national banks. For example, Chase Bank has over 16,000 ATMs scattered throughout the US. This might seem like a lot until you compare it to the network of an online-only bank like Chime with 60,000 ATMs.

Next, let’s look at some of our favorite online banks.

Chime

Chime is an online bank and a member of the Allpoint ATM network. Customers also have access to fee-free transactions at MoneyPass ATMs inside 7-Eleven stores. This means Chime customers have fee-free access to over 60,000 ATMs in all 50 states.

While it doesn’t have physical banks with locations in all 50 states, you can live anywhere and own an account. Even though you can’t visit a Chime branch, you can easily access your funds.

Learn More:

Ally

Ally is one of the largest online banks in the US. You can open an account from anywhere in the nation without worrying about minimums or fees.

Like Chime, Ally has no branches or ATMs, but it has a top-tier mobile app and offers ATM reimbursements every month.

Aside from the robust ATM networks, there’s much to like about digital banks compared to the largest banks in the US. Online banks typically don’t charge monthly fees, and their APYs are usually significantly higher than the national average.

Learn More:

Most Popular Banks by State

Here are the most popular banks in each of the 50 states, based on the number of branches they have there.

| State | Most Popular Bank |

| Alabama | Regions Bank |

| Alaska | Wells Fargo |

| Arizona | Chase |

| Arkansas | Arvest |

| California | Chase |

| Colorado | Wells Fargo |

| Connecticut | M&T Bank |

| Delaware | M&T Bank |

| Florida | Wells Fargo |

| Georgia | Truist |

| Hawaii | First Hawaiian |

| Idaho | Chase |

| Illinois | Chase |

| Indiana | Chase |

| Iowa | US Bank |

| Kansas | Capitol Federal Savings |

| Kentucky | US Bank |

| Louisiana | Chase |

| Maine | Bangor Savings Bank |

| Maryland | PNC Bank |

| Massachusetts | Citizens Bank |

| Michigan | Huntington Bank |

| Minnesota | Wells Fargo |

| Mississippi | Regions Bank |

| Missouri | US Bank |

| Montana | First Interstate Bank |

| Nebraska | Pinnacle Bank |

| Nevada | Wells Fargo |

| New Hampshire | Citizens Bank |

| New Jersey | Wells Fargo |

| New Mexico | Wells Fargo |

| New York | Chase |

| North Carolina | Truist |

| North Dakota | Gate City Bank |

| Ohio | Huntington Bank |

| Oklahoma | BancFirst |

| Oregon | US Bank |

| Pennsylvania | PNC Bank |

| Rhode Island | Citizens Bank |

| South Carolina | First Citizens Bank |

| South Dakota | First Interstate Bank |

| Tennessee | Regions Bank |

| Texas | Wells Fargo |

| Utah | Zions Bank |

| Vermont | M&T Bank |

| Virginia | Truist |

| Washington | Chase |

| West Virginia | City National Bank |

| Wisconsin | BMO |

| Wyoming | Wells Fargo |

Combined, Wells Fargo and Chase take the prize as the most popular banks in 1/3 of the United States.

But just because a bank is among the most popular in the nation overall doesn’t mean it’s the most popular bank locally. As you can see from this list, many of the top banks in each state don’t come close to cracking the list of the nation’s most popular banks overall.

That’s because many of the best banks specialize in serving an individual state or region, with a lot of localized branches near their headquarters.

It’s also important to note that these rankings are constantly changing, with the number of banks in each state fluctuating from year to year.

Here are the biggest contributors:

- Bank mergers and acquisitions

- Bank expansions into new territory

- Branch closures

Keep Reading: How Many Banks are in the US? (2026 Statistics)

Frequently Asked Questions

Which is the best bank in my state?

Looking for the best bank in your state? Click on your state to find the best bank for you.

- Best Banks in Connecticut

- Best Banks in Georgia

- Best Banks in Mississippi

- Best Banks in New Jersey

- Best Banks in New York

- Best Banks in Virginia

- Best Banks in Alabama

- Best Banks in Arizona

- Best Banks in Arkansas

- Best Banks in California

- Best Banks in Colorado

- Best Banks in Delaware

- Best Banks in Florida

- Best Banks in Idaho

- Best Banks in Illinois

- Best Banks in Indiana

- Best Banks in Iowa

- Best Banks in Kansas

- Best Banks in Kentucky

- Best Banks in Louisiana

- Best Banks in Maine

- Best Banks in Maryland

- Best Banks in Massachusetts

- Best Banks in Michigan

- Best Banks in Minnesota

- Best Banks in Missouri

- Best Banks in Montana

- Best Banks in Nebraska

- Best Banks in Nevada

- Best Banks in New Hampshire

- Best Banks in New Mexico

- Best Banks in North Carolina

- Best Banks in North Dakota

- Best Banks in Ohio

- Best Banks in Oklahoma

- Best Banks in Oregon

- Best Banks in Pennsylvania

- Best Banks in Rhode Island

- Best Banks in South Carolina

- Best Banks in South Dakota

- Best Banks in Tennessee

- Best Banks in Texas

- Best Banks in Utah

- Best Banks in Vermont

- Best Banks in Washington

- Best Banks in West Virginia

- Best Banks in Wyoming

- Best Banks in Wisconsin

- Best Banks in Alaska

- Best Banks in Hawaii

- Best Banks in Washington DC

See Also:

Which bank is in the most states?

Chase has locations in the most states of any bank, with branches in 48 states, excluding only Alaska and Hawaii.

What banks have the most locations nationwide?

The banks with the most widespread national presence are Chase, Bank of America, Wells Fargo, U.S. Bank, and Citibank. These banks all offer branches in many U.S. states, from Florida to Illinois to Oklahoma, to name a few.

Is Bank of America located in all 50 states?

Bank of America has retail locations in 38 U.S. states, making it one of the most widespread national banks. Still, it does not operate branches in several states, such as Mississippi and West Virginia.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired or changed. The number of bank branches are up to date according to the Federal Reserve as of March 2025.

No comments yet. Add your own