If you’re considering opening a new bank account or moving your existing accounts to a new bank, regional banks might have come up on your radar.

These types of banks have some advantages over other types of banks. There are also several things that you need to look out for to ensure that your experience remains a positive one.

This article will explain regional banks and their offerings and examine some of the top regional banks available today.

15 Best Regional Banks of 2025

Here’s a list of the top regional banks available across the country:

- Fifth Third Bank

- Wintrust Bank

- Huntington National Bank

- TD Bank

- Valley National Bank

- PNC

- Arvest Bank

- EverBank

- Synovus Bank

- FirstBank

- FrostBank

- MidFirst Bank

- Cathay Bank

- Umpqua Bank

- First Interstate Bank

Best Regional Banks in the Midwest

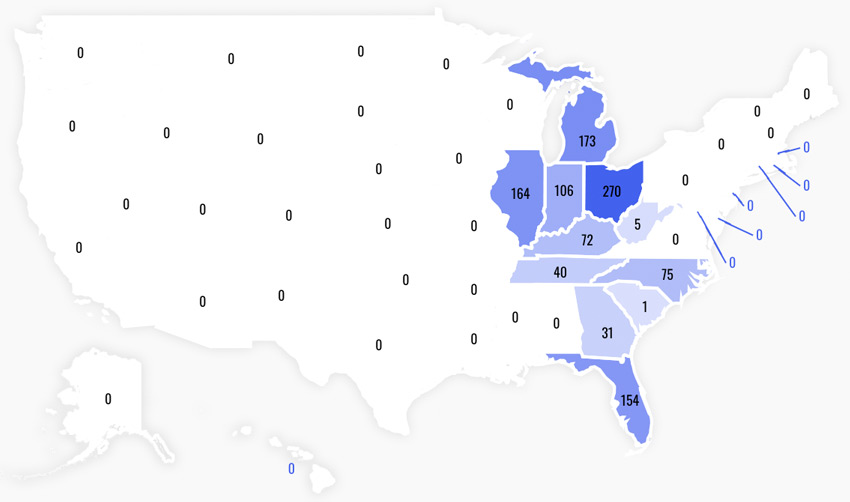

1. Fifth Third Bank

Headquarters: Ohio

Fifth Third Bank is a regional bank that offers a full suite of products to both personal and business customers. They are headquartered in Ohio, with more than 1,100 branches across the Midwest region as well as Florida and several Southern states.

Fifth Third offers several personal checking account options, including their most popular Momentum® Checking, which has no monthly fee and includes fraud protection and early access to your pay.

Many of their other accounts have monthly fees that you can avoid by meeting certain requirements, but keep an eye on their other charges because those can sometimes be steep.

Fifth Third also offers loans and mortgages, investment options, and insurance.

In addition, if you’re in one of the 11 states where Fifth Third does business, you could benefit from tremendous sign-up bonuses that the bank consistently offers new checking customers.

|

U.S. Locations By State Data Source: FDIC

|

|

| Number of Branches: | 1,100 |

| Number of ATMs: | 40,000+ |

| Interest on Savings: | No |

| Interest on Checking: | No |

| 2022 J.D. Power Retail Banking Satisfaction Score: | 671 (Southeast Region) |

| BBB Grade: | A+ |

| Apple iOS: | 4.7 based on 445.6k ratings |

| Google Play: | 4.7 based on 164k ratings |

Learn More:

2. Wintrust Bank

Headquarters: Illinois

Wintrust Bank started in 1991 as an alternative to larger banks. Today they have over 170 locations and offer many banking services for personal, business, and commercial banking needs.

Wintrust Bank offers a large selection of personal banking products for banking, borrowing, and wealth management. This includes a checking and savings bundle that provides overdraft protection and only a $5 monthly maintenance fee.

Wintrust Bank also offers savings accounts, mortgage loans, credit cards, investment services, coin counting, safe deposit boxes, and bank accounts meant for kids. Wintrust Bank is a community bank with a big bank feel, ensuring you feel welcome, but also have all the banking products you need.

| Number of Branches: | 170 |

| Number of ATMs: | 40,000+ |

| Interest on Savings: | Up to 4.00% APY |

| Interest on Checking: | Variable |

| BBB Grade: | A+ |

| Apple iOS: | 4.8 based on 19.7k ratings |

| Google Play: | 4.7 based on 2.86k ratings |

Learn More:

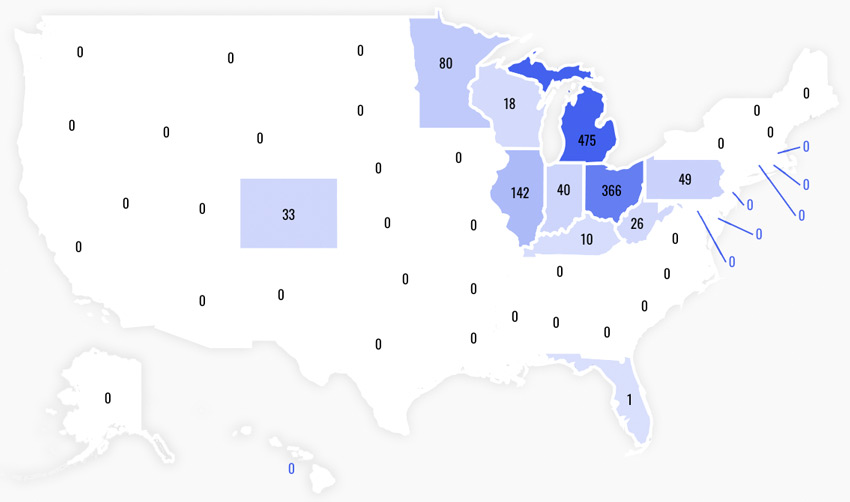

3. Huntington Bank

Headquarters: Ohio

Another well-known bank catering to Midwesterners, Huntington Bank is a popular one-stop shop for banking. It offers checking, savings, investing, insurance, and loans, along with business and commercial banking services.

It also stands out for offering a user-friendly app and straightforward online tools. Among its offerings, Huntington has a credit card that allows you to select your bonus rewards.

The bank offers free checking as well, and unique from some competitors, it gives you a 24-hour grace period before enforcing overdraft fees if you exceed your account balance.

Huntington has over 1,000 local branches and even more ATMs for fee-free withdrawals.

|

U.S. Locations By State Data Source: FDIC

|

|

| Number of Branches: | 1,000+ |

| Number of ATMs: | 1,330 |

| Interest on Savings: | up to 0.06% APY |

| Interest on Checking: | Varies |

| 2022 J.D. Power Retail Banking Satisfaction Score: | 701 (North Central Region) |

| BBB Grade: | A+ |

| Apple iOS: | 4.8 based on 211.7k ratings |

| Google Play: | 4.1 based on 50.1k ratings |

Learn More:

See our full list of the best regional banks in the Midwest

Best Regional Banks in the Northeast

4. TD Bank

Headquarters: New Jersey

TD Bank has 1,100 branches in 16 states, making it an average-sized regional bank. It is known for its later banking hours, including weekends, in many locations.

TD Bank has three checking accounts plus one just for students. Most accounts have a monthly fee, but there are ways to waive them, such as direct deposit, meeting the minimum required balance, or meeting a combined balance across all accounts.

TD Bank also offers savings, CDs, credit cards, home loans, personal loans, and IRAs to help you reach your financial goals. It has robust wealth management options for individuals and small businesses.

| Number of Branches: | 1,100 |

| Number of ATMs: | 2,600 |

| Interest on Savings: | Up to 4.00% APY |

| Interest on Checking: | Up to 0.01% APY |

| BBB Grade: | A+ |

| Apple iOS: | 4.8 based on 247.9k ratings |

| Google Play: | 4.1 based on 85.3k ratings |

Learn More:

5. Valley National Bank

Headquarters: New Jersey

Valley National Bank has been in business for 90 years and has 200 regional branch locations. It offers personal banking services and many business solutions to help with all your banking needs.

Valley Bank offers a checking account for any stage of life, whether you are a teen, young adult, or adult over 55. Checking account holders have options between earning interest or rewards, or if you fit the demographic of their age-specific accounts, you can avoid monthly maintenance charges.

In addition to checking accounts, Valley National Bank offers robust savings account options, CDs, IRAs, and credit cards. They help with financial planning and have a robust learning center to help you get control of your finances. Valley National Bank also offers many options for small business owners.

| Number of Branches: | 200 |

| Number of ATMs: | 200 |

| Interest on Savings: | Up to 1.35% APY |

| Interest on Checking: | Up to 0.02% APY |

| BBB Grade: | A+ |

| Apple iOS: | 4.8 based on 14.9k ratings |

| Google Play: | 4.2 based on 3.41k ratings |

Learn More:

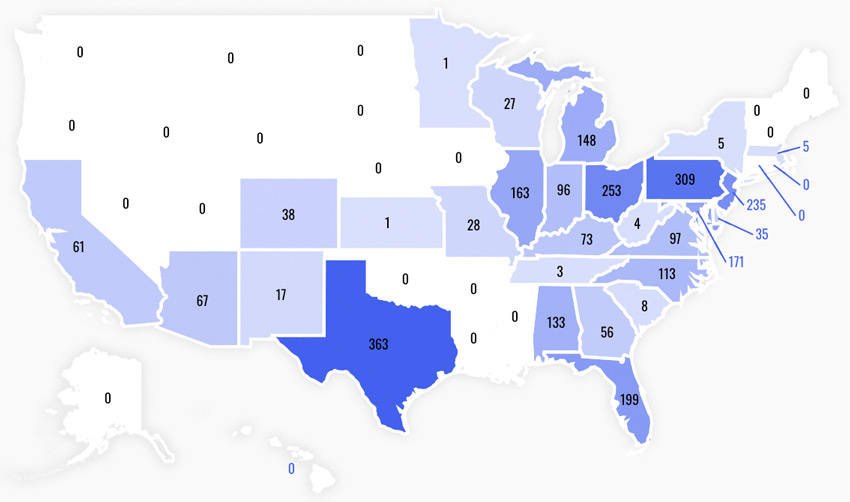

6. PNC Bank

Headquarters: Pennsylvania

Headquartered in Pennsylvania, PNC is a popular regional bank with a presence in 29 states, making it one of the larger regional banks. It also recently acquired BBVA USA, lending even more to its strength and reputation.

PNC offers a versatile range of services to meet bankers’ unique needs. In addition to traditional checking accounts and savings accounts, it also offers a Virtual Wallet. This tool combines resources for managing your money with a checking and savings account. The bank also offers banking services for students and military personnel, with special packages available to meet their needs.

The website also features an extensive library of educational resources to help account holders manage their personal finances.

|

U.S. Locations By State Data Source: FDIC

|

|

| Number of Branches: | 2,300 |

| Number of ATMs: | 60,000 |

| Interest on Savings: | 3.95% APY |

| Interest on Checking: | up to 0.05% APY |

| 2022 J.D. Power Retail Banking Satisfaction Score: | 685 (NY Tri-State Region) 657 (Pennsylvania Region) |

| BBB Grade: | A+ |

| Apple iOS: | 4.8 based on 1.6M ratings |

| Google Play: | 4.5 based on 260k ratings |

Learn More:

See our full list of the best regional banks in the Northeast

Best Regional Banks in the Southeast

7. Arvest Bank

Headquarters: Arkansas

Arvest Bank serves Arkansas, Kansas, Missouri, and Oklahoma in over 110 communities. It began as a small bank and quickly grew to a community-focused regional bank, keeping the customer at the forefront of its business.

Arvest has six checking accounts to consider, including those with no monthly fees or checking accounts that earn interest. Each account has different requirements but includes features like a free debit card, free online bill pay, and notary services.

Along with checking accounts, Arvest Bank offers several savings accounts, IRAs, CDs, home, personal and auto loans, and many investment services. You’ll also find a selection of business banking products there too.

| Number of Branches: | 220 |

| Number of ATMs: | 320 |

| BBB Grade: | A+ |

| Apple iOS: | 4.9 based on 225k ratings |

| Google Play: | 3.9 based on 11.9k ratings |

Learn More:

8. EverBank

Headquarters: Florida

EverBank is TIAA Bank rebranded, an independent bank committed to superior customer service that operates solely online. What you’ll find at EverBank are high-yield accounts that pay interest rates much higher than your traditional big banks but without the opportunity to visit them in person.

Their account selection is smaller than the other banks on our list, but they offer many advantages, including ATM fee reimbursements and no monthly maintenance fees. If you’re looking for somewhere to park your money that pays high APYs with minimal requirements, you’ve found it in EverBank.

EverBank Overview EverBank Overview |

|

|---|---|

| Number of Branches: | 9 |

| Number of ATMs: | 100,000 |

| BBB Grade: | A+ |

| Apple iOS: | 4.6 based on 7.6k ratings |

| Google Play: | 4.0 based on 5.83k ratings |

Learn More:

9. Synovus Bank

Headquarters: Georgia

Synovus Bank started as a textile mill over 130 years ago. Today, it is a highly respected bank in the Southeast. It has over $61 billion in assets and is committed to customer satisfaction.

Synovus Bank offers various personal banking accounts, including checking, savings, money market accounts, CDs, HSAs, credit cards, home mortgages, and personal loans.

They have a robust online banking program and provide exemplary personal finance education to help you stay in control of your money.

| Number of Branches: | 340 |

| Number of ATMs: | 335 |

| BBB Grade: | A+ |

| Apple iOS: | 4.8 based on 36.9k ratings |

| Google Play: | 4.8 based on 7.63k ratings |

Learn More:

See our full list of the best regional banks in the Southeast

Best Regional Banks in the Southwest

10. FirstBank

Headquarters: Colorado

FirstBank is one of the largest privately held banks in the country. They have over $28 billion in assets and 100 locations throughout the Southwest.

They have many bank account options for consumers and businesses, including interest-bearing checking accounts, savings accounts, CDs, college savings accounts, HSAs, IRAs, and loans for various reasons.

Most of their checking accounts have monthly maintenance fees, but you can waive them by meeting the simple requirements. They also have a robust online banking program to make it easy to bank from home without stepping foot in a branch.

FirstBank Overview FirstBank Overview |

|

|---|---|

| Number of Branches: | 100 |

| Number of ATMs: | 37,000+ |

| Interest on Savings: | Up to 4.6% APY |

| Interest on Checking: | Up to 1.00% APY |

| BBB Grade: | A+ |

| Apple iOS: | 4.8 based on 82.5k ratings |

| Google Play: | 4.8 based on 21.2k ratings |

Learn More:

11. Frost Bank

Headquarters: Texas

Frost Bank has been in business since 1868 providing customers in the Southwest a place to keep their assets safe. They have banking products for every stage of life.

You’ll find checking, savings, loans, investments, and insurance at Frost Bank. They have a great online and mobile banking program, and all their checking accounts have ways to waive the monthly fee.

Frost Bank has attractive APYs on its CDs, starting at 3.25% with only a $1,000 deposit. They also offer education funding to help you save for your child’s college education.

Frost Bank Overview Frost Bank Overview |

|

|---|---|

| Number of Branches: | 170+ |

| Number of ATMs: | 1,700 |

| Interest on Savings: | Up to 0.90% APY |

| Interest on Checking: | Up to 0.10% APY |

| BBB Grade: | A+ |

| Apple iOS: | 4.9 based on 51.3k ratings |

| Google Play: | 4.8 based on 10.8k ratings |

Learn More:

12. MidFirst Bank

Headquarters: Oklahoma

MidFirst Bank is one of the highest ranking banks in the Southwest region, putting people and culture before business. They have over 1 million accounts nationwide and a strong presence in the commercial real estate lending industry.

MidFirst Bank has a checking account for people in all life stages with low opening balance requirements and features like Zelle, mobile deposit, and online banking. They also offer savings, money market accounts, CDs, IRAs, and investment services. In addition to these services, they offer robust business and commercial banking services, and private wealth services.

| Number of Branches: | 81 |

| Number of ATMs: | 80+ |

| Interest on Savings: | Up to 4.00% APY |

| BBB Grade: | A+ |

| Apple iOS: | 4.8 based on 42.9k ratings |

| Google Play: | 3.8 based on 7.07k ratings |

Learn More:

See our full list of the best regional banks in the Southwest

Best Regional Banks in the West

13. Cathay Bank

Headquarters: California

Cathay Bank has been in business since 1962, providing financial security and local community support throughout the Los Angeles area. Today, it has over 60 branches throughout the United States.

Cathay Bank offers personal, business, and international banking services, including five checking accounts, three savings accounts, and various money markets and CDs. It also has accounts for certain ages, such as students, and free account options for those who don’t want to worry about waiving monthly fees.

For lending, Cathay Bank offers home mortgage loans and credit cards, and they have a robust online banking program that includes Zelle and SavvyMoney®, an account to check your financial well-being.

Cathay Bank Overview Cathay Bank Overview |

|

|---|---|

| Number of Branches: | 600 |

| Number of ATMs: | 80,000 |

| Interest on Savings: | based on balance |

| Interest on Checking: | Varies |

| BBB Grade: | A+ |

| Apple iOS: | 4.3 based on 1.7k ratings |

| Google Play: | 4.1 based on 223 ratings |

Learn More:

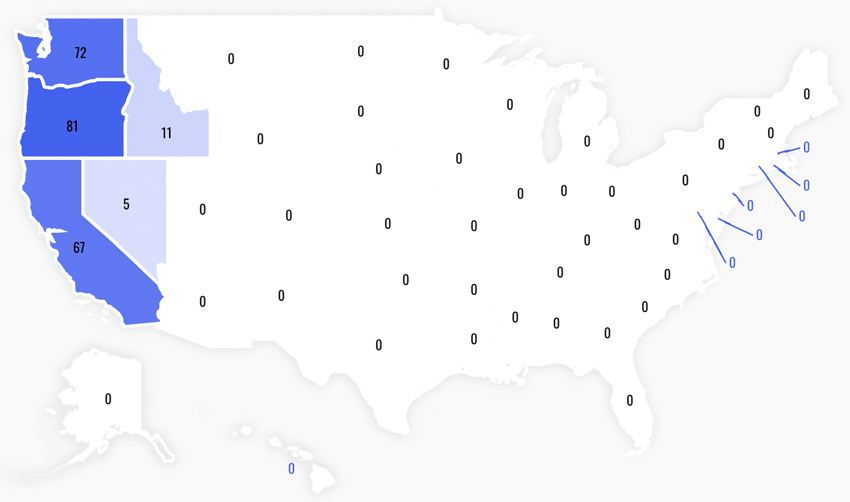

14. Umpqua Bank

Headquarters: Oregon

If you’re looking for a full-service bank and live in the West, Umpqua Bank should be on your radar. It has more than 300 branches in California, Washington, Oregon, Idaho, and Nevada.

Like the other banks in this review, Umpqua offers a long lineup of financial products, such as checking and savings accounts, loans, credit cards, and business and commercial financial resources.

All of Umpqua’s checking accounts give you access to a dedicated go-to banker and a savings account.

Umpqua also offers private banking, an exclusive membership with premier benefits. Umpqua private bank account holders get access to investment reviews, estate management experts, financing, banking, and more.

|

U.S. Locations By State Data Source: FDIC

|

|

| Number of Branches: | 300 |

| Number of ATMs: | 260+ |

| Interest on Savings: | 0.01% APY |

| Interest on Checking: | 0.01% APY |

| 2022 J.D. Power Retail Banking Satisfaction Score: | 675 (Northwest Region) |

| BBB Grade: | A+ |

| Apple iOS: | 4.4 based on 13.5k ratings |

| Google Play: | 4.2 based on 8.64k ratings |

Learn More:

15. First Interstate Bank

Headquarters: Montana

First Interstate Bank is a community bank built for people. They operate across 14 states, and they serve a diverse group of customers with banking products for individuals and businesses available.

First Interstate Bank offers a handful of checking and savings accounts to appeal to people of all backgrounds and financial needs. Their checking accounts range from the most basic (no interest or checks) to more robust accounts that earn interest and have overdraft protection.

They also offer home, auto, and personal financing, wealth management, and investment services. Their business bank product selection is robust, too, giving you many options to handle your banking needs.

First Interstate Bank Overview First Interstate Bank Overview |

|

|---|---|

| Number of Branches: | 306 |

| Number of ATMs: | 37,000 |

| BBB Grade: | A+ |

| Apple iOS: | 4.7 based on 18.5k ratings |

| Google Play: | 4.2 based on 8.07k ratings |

Learn More:

See our full list of the best regional banks in the West

What Is A Regional Bank?

A regional bank is, for all intents and purposes, a bank. In most cases, the only difference is that they operate in a specific area and do not service customers nationwide.

Regional banks sit between community banks and national banks. While the term national bank technically means any bank that operates within a regulatory structure, it can also mean a bank with branches and ATMs across the nation.

Regional banks, on the other hand, only service select areas that can range from a few counties to a handful of states. In a way, their business model is similar to that of credit unions.

Regional banks are bigger than community banks, so they tend to offer a wider selection of products and services. Yet, they can still provide more personalized service, which is something that the big banks often lack.

The term big banks can be pretty confusing since most banks are rather big. However, some banks, such as the Big Four banks, can be considerably bigger. These include:

- Wells Fargo: California Headquarters

- Bank of America: North Carolina Headquarters

- Citi: New York Headquarters

- JP Morgan Chase: New York Headquarters

They have branches and ATMs across the entire US, unlike regional banks, which tend only to service specific areas.

What Products Do Regional Banks Offer?

In most cases, you’ll find all of the products and services typically offered by the bigger banks.

However, this is a generalization since nothing binds regional banks from providing one service and not the other. Regional banks can also vary a lot in size, which can limit what they offer.

You should find many different deposit accounts, including:

Most regional banks, especially the bigger ones, will also offer debit cards, credit cards, loans, mortgages, and other financial products and services.

Features of Regional Banks

As we discussed, regional banks have many, if not all, of the features and banking services you find at any other bank. It is still important to check if the bank has all the features and perks you need.

Here are some things to keep in mind when looking at regional banks to open your bank account.

- Branches: Regional banks tend to have a limited number of branches located in a relatively small area.

- Mobile App: A mobile banking app, much like internet banking, allows you to carry out many banking tasks from the comfort of your own home. If you’re particularly opposed to visiting a branch, you’ll need to make sure that the app caters to your needs.

- FDIC Insurance: While regional banks are unlikely to fail, it is not impossible either. Having FDIC insurance will make sure you are covered should the worst happen.

- ATM Networks: ATM networks are an important feature if you withdraw cash regularly. Make sure the bank’s network services the area you visit most to avoid paying unnecessary ATM fees.

- Interest Rates: Like other financial institutions, regional banks offer interest rates on their savings accounts, with rates varying from one bank to the next.

Regional Bank Fees

While smaller banks tend to have more advantageous fees, this will not be the case in every situation.

Fees and costs are very fluid and while banks do their best to remain competitive, being cheaper is not always the winning formula for banks.

Nobody likes to pay fees, but you’re more than likely to get extra services and perks for those fees you pay. Here are some of the most common regional bank fees you may encounter:

- Monthly Fees: Just like other banks, regional banks can charge fees unless you meet some requirements to avoid the checking account fees, such as keeping an average balance or making several deposits.

- Overdraft Fees: Overdraft fees tend to be some of the most expensive bank fees, with some banks offering overdraft protection to help you limit how much you end up paying should you overdraw your account.

- ATM Fees: ATM fees are a particular concern with regional banks since these tend to have a more limited presence, which is why a number of them partner up with nationwide ATM networks to allow you more fee-free withdrawals

These are not the only fees regional banks have, but they tend to be very common and somewhat unavoidable. That’s why you need to plan to ensure you don’t pay more fees than is strictly necessary.

If you already have a bank account, read the statement to see which fees weigh you down the most. Make a list of them to find the regional bank that offers these fees for lower costs.

Regional Banks In The Stock Market

If you’re not ready to open a bank account with a regional bank yet but like the idea, you can also invest in them by purchasing stocks in the SPDR S&P Regional Banking ETF (Ticker: KRE).

This ETF tracks many regional bank stocks, included in the S&P Regional Banks Select Industry Index.

Frequently Asked Questions

What is considered a regional bank?

A regional bank is a bank that operates within a limited geographical area. This area’s size will vary from one regional bank to another, with some banks being much bigger than others.

How many regional banks are there in the US?

There are over 19,000 regional banks in the US; however, this depends on which definition of regional banks you use. This statistic includes banks with assets under management totaling between $50 billion and $500 billion.

What are the four types of banks?

The four types of banks are:

- Central Banks

- Retail Banks

- Investment Banks

- Regional Banks

While there can be overlap between these types (for example, all regional banks are commercial banks but not all commercial banks are retail banks), others, such as Central Banks, serve a very specific purpose.

In this case, Central Banks manage all of the other banks that fall within their jurisdiction.

Comments are closed.

Comments are closed here.