Chase Bank is the largest bank in the US, with more than 4,700 branches across the nation and an impressive reputation for customer service.

While Chase doesn’t have the most competitive interest rates, you can earn some stellar bank bonuses when you switch to a Chase account, refer a friend, or open a Chase credit card and meet a few requirements. Here’s a rundown of Chase’s best bank bonuses, with important details on each promotion.

Current Chase Bank Promo Codes & Bonus Offers

Here are the active Chase bonuses that you can benefit from today:

- Chase Business Complete Checking®: up to $500 bonus

- Chase Total Checking®: $300 bonus

- Chase College Checking℠: $100 bonus

- Chase Private Client Checking℠: up to $3000 bonus

- Chase Secure Banking℠: $100 bonus

- Ink Business Preferred® Credit Card: 90,000 bonus points

- Chase Sapphire Preferred® Card: 60,000 bonus points

- Chase Sapphire Reserve®: 60,000 bonus points

- IHG One Rewards Traveler Credit Card: 80,000 bonus points

- Chase Freedom Unlimited®: $250 bonus

- Chase Freedom Flex℠: $200 bonus

- Ink Business Unlimited® Credit Card: $750 bonus

- Ink Business Cash® Credit Card: up to $750 bonus

- Refer-A-Friend: up to $500 bonus

Chase Business Complete Checking®

- Bonus Amount

- up to $500

- Account Type

- Business Checking

- Availability

- Nationwide

- Offer Expires

- April 17, 2025

- Bonus Requirements

-

- Obtain a Chase business coupon using the link below and open a new Chase Business Complete Checking® account.

- Within 30 days, deposit at least $2,000 in new money into the account to earn $300 bonus or at least $10,000 in new money to earn $500 bonus.

- Maintain that balance for at least 60 days from offer enrollment.

- Within 90 days of account opening, complete 5 qualifying transactions: debit card purchases, Chase QuickAccept℠ deposits, Chase QuickDeposit℠, ACH credits, wires (credits and debits), and/or bill pay.

- Bonus will be credited to your account within 15 days of meeting the requirements.

at Chase

Chase Total Checking®

- Bonus Amount

- $300

- Account Type

- Personal Checking

- Availability

- Nationwide

- Offer Expires

- April 16, 2025

- Bonus Requirements

-

- Open a Chase Total Checking® account.

- Within 90 days, have a direct deposit of at least $500 made from either your employer (paycheck or pension) or the government (any benefit such as Social Security).

- Receive your money within 15 days of the deposit posting.

at Chase

Chase College Checking℠

- Bonus Amount

- $100

- Account Type

- Student Checking

- Availability

- Nationwide

- Offer Expires

- April 16, 2025

- Bonus Requirements

-

- Open a new Chase College Checking account using the link below.

- Within 60 days, complete 10 qualifying transactions.

- Bonus will be deposited into your new account within 15 days of meeting the requirements.

at Chase

Chase Private Client Checking℠

- Bonus Amount

- up to $3000

- Account Type

- Personal Checking

- Availability

- Nationwide

- Offer Expires

- April 16, 2025

- Bonus Requirements

-

- Receive an upgrade code using the link below (you may need to use a private or incognito browser).

- If you don't already have a Chase Private Client Checking℠ account, meet with a Chase Private Client Banker to open or upgrade to one.

- Within 45 days of enrolling in the coupon, transfer a total of $150,000 - $249,999 in new money or securities to one or a combination of your eligible accounts (see fine print), earn $1,000; $250,000 - $499,999 earn $2,000; $500,000+ to earn $3,000

- Maintain that balance for 90 days from the coupon enrollment.

- Bonus will be deposited into your Chase Private Client Checking℠ account within 40 days of meeting the requirements.

at Chase

Chase Secure Banking℠

- Bonus Amount

- $100

- Account Type

- Personal Checking

- Availability

- Nationwide

- Offer Expires

- April 16, 2025

- Bonus Requirements

-

- Open a new Chase Secure Banking account.

- Complete 10 qualifying transactions (debit card purchases, online bill payments, etc) within 60 days of coupon enrollment.

- Bonus will be deposited within 15 days of completing the requirements.

at Chase

Ink Business Preferred® Credit Card

- Bonus Amount

- 90,000 Points

- Account Type

- Business Card

- Availability

- Nationwide

- Bonus Requirements

-

- Apply for a new Ink Business Preferred® Credit Card using the link below.

- Within 3 months, spend $8,000 using your new card.

- Bonus will be credited within 6 to 8 weeks in the form of 90,000 points, which can be redeemed for $900 cash or $1,125 in travel rewards when redeemed through Chase Travel℠.

Chase Sapphire Preferred® Card

- Bonus Amount

- 60,000 Points

- Account Type

- Personal Card

- Availability

- Nationwide

- Bonus Requirements

-

- Apply for a new Chase Sapphire Preferred® credit card using the link below.

- Within 3 months of account opening, spend $4,000 using your new card.

- Bonus will be credited within 6 to 8 weeks in the form of 60,000 points.

Chase Sapphire Reserve®

- Bonus Amount

- 60,000 Points

- Account Type

- Personal Card

- Availability

- Nationwide

- Bonus Requirements

-

- Apply for a new Chase Sapphire Reserve ® credit card using the link below.

- Within 3 months, spend $4,000 using your new card.

- Bonus will be credited within 6 to 8 weeks in the form of 60,000 points.

IHG One Rewards Traveler Credit Card

- Bonus Amount

- 80,000 Points

- Account Type

- Personal Card

- Availability

- Nationwide

- Bonus Requirements

-

- Apply for a new IHG One Rewards Traveler Credit Card using the link below.

- Within 3 months, spend $2,000 using your new card.

- Bonus points will be credited to your IHG® Rewards account within 6 to 8 weeks.

Chase Freedom Unlimited®

- Bonus Amount

- $250

- Account Type

- Personal Card

- Availability

- Nationwide

- Bonus Requirements

-

- Apply for a new Chase Freedom Unlimited® credit card using the link below.

- Within 3 months, spend $500 using your new card.

- $250 Bonus will be credited within 6 to 8 weeks.

Chase Freedom Flex℠

- Bonus Amount

- $200

- Account Type

- Personal Card

- Availability

- Nationwide

- Bonus Requirements

-

- Apply for a new Chase Freedom Flex℠ credit card using the link below.

- Within 3 months, spend $500 using your new card.

- Bonus will be credited within 6 to 8 weeks in the form of 20,000 points, which can be redeemed for $200.

Ink Business Unlimited® Credit Card

- Bonus Amount

- $750

- Account Type

- Business Card

- Availability

- Nationwide

- Bonus Requirements

-

- Apply for a new Ink Business Unlimited® credit card using the link below.

- Within 3 months, spend $6,000 using your new card.

- Bonus will be credited within 6 to 8 weeks in the form of 75,000 points, which can be redeemed for $750 cash.

Ink Business Cash® Credit Card

- Bonus Amount

- up to $750

- Account Type

- Business Card

- Availability

- Nationwide

- Bonus Requirements

-

- Apply for a new Ink Business Cash® Credit Card using the link below.

- Within 3 months, spend $3,000 using your new card, earn $350.

- Earn an additional $400 when you spend $6,000 within the first 6 months.

- Bonus will be credited within 6 to 8 weeks in the form of points, which can be redeemed for cash.

Refer-A-Friend

- Bonus Amount

- up to $500

- Account Type

- Personal Checking

- Availability

- Nationwide

- Bonus Requirements

-

- Enter your information on the program page linked below.

- Share your unique URL with friends using the Chase Mobile App, sending your URL directly, or using the "email friends" feature found on the program page.

- Bonus will be credited to your account within 8 weeks after your friend signs up.

at Chase

Summary: Chase's Current Bonuses

Here’s a recap of the current Chase Bank promotions and offers that you can claim right now:

| Account | Account Type | Amount | Expires | Requirements | |

|---|---|---|---|---|---|

| Chase Business Complete Checking® | Business Checking | up to $500 | Apr 17 | Min Balance, Card Spend (optional) | Details |

| Chase Total Checking® | Personal Checking | $300 | Apr 16 | Direct Deposit | Details |

| Chase College Checking℠ | Student Checking | $100 | Apr 16 | Bill Pay (optional), Card Spend (optional) | Details |

| Chase Private Client Checking℠ | Personal Checking | up to $3000 | Apr 16 | Min Balance | Details |

| Chase Secure Banking℠ | Personal Checking | $100 | Apr 16 | Bill Pay (optional), Card Spend (optional) | Details |

| Ink Business Preferred® Credit Card | Business Card | 90,000 Points | Card Spend | Details | |

| Chase Sapphire Preferred® Card | Personal Card | 60,000 Points | Card Spend | Details | |

| Chase Sapphire Reserve® | Personal Card | 60,000 Points | Card Spend | Details | |

| IHG One Rewards Traveler Credit Card | Personal Card | 80,000 Points | Card Spend | Details | |

| Chase Freedom Unlimited® | Personal Card | $250 | Card Spend | Details | |

| Chase Freedom Flex℠ | Personal Card | $200 | Card Spend | Details | |

| Ink Business Unlimited® Credit Card | Business Card | $750 | Card Spend | Details | |

| Ink Business Cash® Credit Card | Business Card | up to $750 | Card Spend | Details | |

| Refer-A-Friend | Personal Checking | up to $500 | Limited Time | Referral | Details |

Expired Offers From Chase

These bonuses were recently offered by Chase, but are not available right now.

Check back often as Chase may revive these deals or offer similar promotions in the future. In the meantime, it can sometimes be helpful to compare Chase's current bonuses to their previous deals.

Chase Total Checking® - $225 bonus (Expired)

Expired: April 7, 2022

Chase previously offered $225 for opening a Chase Total Checking® account.

To earn the bonus, you needed to:

- Open a Chase Total Checking® account.

- Within 90 days, have a direct deposit made from either your employer (paycheck or pension) or the government (any benefit such as Social Security).

- Receive your money within 15 days of the deposit posting.

Chase First Banking℠ - $25 bonus (Expired)

Expired: September 2, 2021

Chase previously offered $25 for opening a Chase First Banking℠ account.

The steps to earning this bonus were:

- Be an existing Chase checking customer.

- Open a new Chase First Banking℠ account for your child who is 6-17 years old.

- Bonus will be credited into the new youth account within 15 days of account opening.

Chase Savings℠ - $150 bonus (Expired)

Expired: April 14, 2021

Chase previously offered $150 for opening a Chase Savings℠ account.

Earning this bonus required you to:

- Open a Chase Savings℠ account using the link below.

- Within 30 days, deposit at least $10,000 and maintain that balance for 90 days.

- Bonus will be deposited into your new account within 15 days of meeting the requirements.

Chase Premier Plus Checking℠ - $300 bonus (Expired)

Expired: October 14, 2020

Chase previously offered $300 for opening a Chase Premier Plus Checking℠ account.

The requirements for this bonus were:

- Open a new Chase Premier Plus Checking℠ account using the link below.

- Within 60 days, complete a direct deposit.

- Bonus will be deposited into your new account within 10 business days of meeting the requirements.

Chase Total Checking® - $200 bonus (Expired)

Chase previously offered $200 for opening a Chase Total Checking® account.

To earn the bonus, you needed to:

- Open a Chase Total Checking® account.

- Within 90 days, have a direct deposit made from either your employer (paycheck or pension) or the government (any benefit such as Social Security).

- Receive your money within 15 days of the deposit posting.

J.P. Morgan Self-Directed Investing [New Customers] - up to $600 bonus (Expired)

Chase previously offered up to $600 for opening a J.P. Morgan Self-Directed Investing [New Customers] account.

Earning this bonus required you to:

- Open a J.P. Morgan Self-Directed Investing account.

- Within 45 days, fund your account with qualifying new money; $100,000 - $249,999 = $300 bonus, $250,000 = $625 bonus.

- Your bonus amount will be determined on day 45.

- Maintain your new funds for 90 days (losses due to trading or market fluctuation will not be taken into account).

- Bonus will be received within 15 days.

Chase Freedom® Student credit card - $50 bonus (Expired)

Chase previously offered $50 for opening a Chase Freedom® Student credit card credit card.

To earn the bonus, you needed to:

- Apply for a new Chase Freedom® Student credit card using the link below.

- Within 3 months, make a purchase using your new card.

- Bonus will be credited within 6 to 8 weeks in the form of 5,000 points, which can be redeemed for $50.

Chase Slate Edge℠ - $100 bonus (Expired)

Chase previously offered $100 for opening a Chase Slate Edge℠ credit card.

The requirements for this bonus were:

- Apply for a new Chase Slate Edge℠ credit card using the link below.

- Within 6 months, spend $500 using your new card.

- Bonus will be credited within 6 to 8 weeks in the form of a $100 statement credit.

Checking + Savings Combo - up to $600 bonus (Expired)

Chase previously offered up to $600 for opening a Checking + Savings Combo account.

Earning this bonus required you to:

- Open both Chase Total Checking and Chase Savings accounts using the link below.

- Within 90 days, receive a direct deposit into your new checking account to earn $300.

- Within 30 days, deposit $15,000 into your new savings account and then maintain that balance for 90 days to earn $200.

- Earn an additional $100 from Chase by completing both the checking and savings account offers at the same time.

- Bonus(es) will be deposited into your new account(s) within 15 days after meeting each requirement.

Why Chase Bank?

Chase Bank is one of the largest banks in the U.S., and one of our top picks for national banks. You'll have access to more than 4,700 physical branches, more than 15,000 ATMs, and a well-liked mobile app that makes it easy to skip both (it averages 4.8 stars in the App Store and 4.4 stars on Google Play).

Chase offers everything from credit cards, home and auto loans, personal accounts, business and commercial products, and investment products under their J.P. Morgan umbrella.

Like most of the national banks, their rates aren't great, but their product breadth makes it easy to conveniently bank all at one place.

Plus, when it comes to bank bonuses and coupon codes, Chase has some of the best out there. The bank is constantly trying to attract new customers with sign-up bonuses and promotional offers.

Learn more about Chase Bank in our full review

Chase Bank Locations

You may sometimes be required to visit a branch in-person to take advantage of a welcome offer. Or, you may just prefer the convenience of banking with institutions that have locations near you.

Get a better idea of how well Chase Bank can serve you by checking out their branches closest to your area:

118 East Grand River

Fowlerville, MI 48836

7 West Main Street

Riverhead, NY 11901

203 East Berry Street

Fort Wayne, IN 46802

1475 Ruben M. Torres Boulevard

Brownsville, TX 78521

4011 San Pedro Avenue

San Antonio, TX 78212

3800 East 42nd Street

Odessa, TX 79762

6300 Harry Hines Boulevard

Dallas, TX 75235

200 South Tenth Street

Mcallen, TX 78501

111 S Garland Ave

Garland, TX 75040

700 East Main Street

Grand Prairie, TX 75050

990 North Walnut Creek Drive

Mansfield, TX 76063

600 Bailey Avenue

Fort Worth, TX 76107

How Can You Earn a Chase Bonus?

Banks are always looking to attract as many new customers as possible.

One of the most popular ways that Chase and other banks lure in new customers is by offering account opening bonuses, which are financial incentives you can get for opening a new account and meeting certain terms and conditions.

These new account offers are a win-win for both the bank and you, the customer.

The exact requirements for each sign-up bonus varies depending which new account you're opening.

For example, to score a Chase checking account bonus, you'll need to set up direct deposit if you're opening a Chase Total Checking® account. Business checking customers on the other hand, are required to deposit some cash into their new account and then complete 5 qualifying transactions like debit card purchases, ACH credits, or bill pay in order to earn their welcome bonus from Chase.

Chase Bank also offers deals to new credit card holders, but to earn this type of bonus you'll typically need to spend a certain amount within the first few months of having your new card.

Like all bank promotions, sign-up bonuses from Chase Bank are constantly changing. Deals expire, requirements are tweaked, and payout amounts change. We keep track of all of this for you, so check back here often to stay up-to-date on the best Chase Bank promotions available right now!

Tips and Tricks for Chase New Account Bonuses

In order to earn the "free" cash from Chase, you'll need to follow the rules of each bonus offer.

These are clearly outlined in the fine print of every offer, but there are some common themes that are helpful for you to know up front:

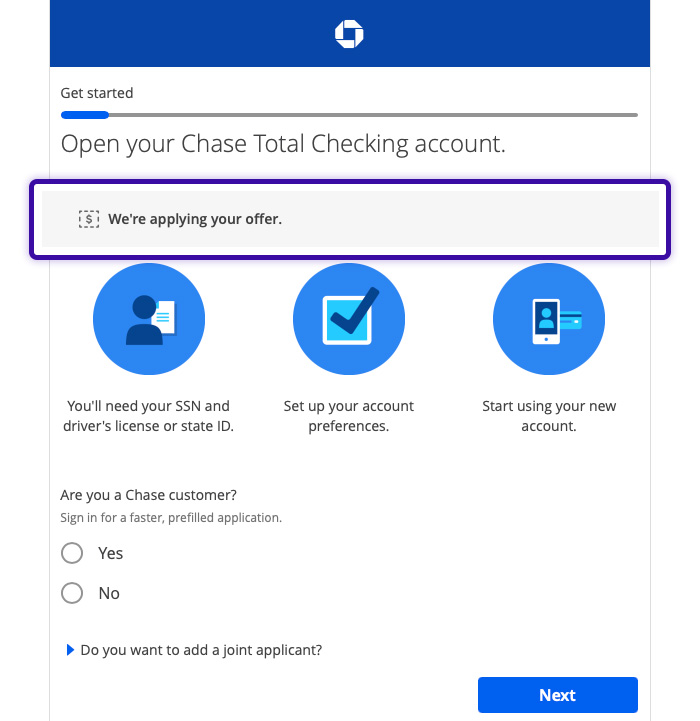

01. Chase coupons

With most offers from Chase, you'll need to either request a "Chase coupon" by submitting your email address on that bonus offer's landing page, or apply for the account directly from that page. Each bonus has a unique landing page, which we link to from the individual bonuses above.

After submitting your email address, Chase will then send you a personalized code by email. Receiving that unique coupon code allows you to open the account at a later time (if you're not ready to go through the application process right then), or to take that coupon into your local Chase branch.

Regardless of which path you take, you want to be sure that the coupon is being applied at the time you open the account. If not, you won't receive the bonus, regardless of whether or not you meet the other requirements.

To verify, be sure you're seeing the "we're applying your offer" call out (or something similar) on your application screen:

Sincerely, we can't underscore this enough. Chase's internal systems track these codes and automatically reward you with the bonus once you've met the requirements.

Their online application is clear and intuitive, but if you're at all unsure, take the coupon to your local branch and have the banker verify that you're being enrolled in the offer.

02. Existing versus new customers

Most Chase bonus offers only apply to new customers.

That means you're not eligible if you currently have an existing account in that product category or if you've closed an account in that category within the past 90 days.

By "product category", we mean "consumer checking account", "business savings account" or the like.

For example, having an existing Chase Total Checking® account would not exclude you from opening a Chase Business Complete Banking℠ account and receiving that account's welcome bonus. But having a Chase Total Checking® account would exclude you from earning a Chase Secure Banking℠ welcome bonus.

03. Every 2 years limit

For nearly all Chase bonus offers, Chase limits you to receiving a welcome bonus only once every 2 years. This keeps customers from trying to churn through offers.

Like the distinction between new and existing customers, this limit is per each product category or credit card.

04. Clawbacks

For banking products, Chase will take back the welcome bonus if you close the account within 6 months. This 6-month clause also applies if Chase is the one who closes the account – if you're violating their terms, for example.

05. Chase credit card restrictions

Chase is well known for its 5/24 rule, which says cardholders cannot get a new Chase credit card if they have 5 credit card inquiries in the last 24 months. This is why many will advise you to sign up for any Chase credit cards first, before moving onto other issuers.

Beyond the 5/24 rule, Chase limits the bonus per card to once every 2 years, like we mentioned earlier.

06. Taxes

Remember that like all bank promotions, bonuses from Chase Bank are taxable. Unlike your regular salary, Chase does not withhold interest from your earned bonuses. Instead, Chase will send you a 1099-INT at the end of the year, and that bank interest will be taxed as ordinary income.

The exception here are credit card offers. Credit card rewards are typically treated as a rebate or discount by the IRS, rather than income. So earning a welcome bonus for opening a new Chase credit card is not usually taxable.

07. Fine print

Ultimately, every offer is unique. While the above tips are typical of most Chase coupons, they aren't guarantees. Make sure to thoroughly read the fine print of the bonus you're interested in.

Also know that offers can be changed at any time. Until you've fully enrolled in that offer by opening the account, the terms aren't "locked in".

That also means that the promotion may end earlier than the advertised expiration date – and truly, that happens all the time, even from a relatively consistent bank like Chase. If you're interested in a bonus, don't wait until the last minute to enroll.

How Do Chase Promotions Compare?

As we mentioned earlier, Chase has some of the best bonuses out there. The bank is constantly trying to attract new customers with sign-up bonuses and promotional offers, which means that new customers can almost always score some kind of sign-up bonus for opening a new Chase account.

When you're comparing banking offers, it's important to not only look at the actual bonus amount, but also the requirements attached to earning that reward.

For example, the Chase Total Checking® bonus has recently increased to $300 (historically was around $200) and only requires a single direct deposit sometime within the first 3 months. On the other hand, the Citi Priority Account bonus starts at $500 and up to $1,500 at the highest tier, but requires a significant deposit and has a monthly maintenance fee.

Ultimately, our advice here remains the same as ever: If you're indifferent between one big brand to the next, follow the cash. If Chase offers convenience or customer service that you find valuable, don't let a one-time bonus sway you.

Chase Bank Promotions FAQs

How do I find a Chase coupon code?

You can find most of Chase's active coupon codes right on this page. From time to time Chase offers targeted offers that may vary slightly from what you see here.

Are sign-up bonuses from Chase Bank taxed?

Yes, all bonuses coming from Chase promotions will be reported to the IRS and taxed as income. Keep this in mind when you're figuring out your total return on any given offer.

The exception here is credit card bonuses. Since most credit cards require a minimum spending amount to qualify for a bonus, the reward doesn't count as taxable income.

Do Chase offers expire?

Yes. As with most bank bonuses, Chase offers usually have expiration dates (see above examples).

Again, bonuses are fluid. Don't feel like you have to jump on one just because it's about to expire. There will be others later on.

With that said, if you find a great bonus with an account you want, there's no point in waiting. It could be a while before the same coupon becomes available again. So if you're sure, just go for it.

How long does it take to get paid a bonus from Chase?

Account bonus payouts vary in the amount of time they take to hit your account. With Chase, most bonuses will arrive within 15 days of completing the qualifying activities.

If you haven't received your bonus in the expected amount of time, double-check to make sure you didn't miss anything in the requirements, and contact the customer support team to find out what the hold up is.

Can I use multiple Chase promotions?

Probably not. Most coupons are only available to new Chase customers, and you usually only get one shot at a particular bonus.

Keep in mind that by "new", we mean new for that particular account category. For example, receiving a Chase Total Checking® sign up bonus doesn't keep you from also getting a savings account bonus. It only excludes you from other checking account promotions.

The only exceptions are referrals and bonuses that require you to upgrade to a premium account (e.g., Private Client Checking).

For example, if you already received a sign-up bonus for your initial account, you'll still be eligible for upgrade incentives. However, you may also have to deposit a huge sum of money to qualify for that upgrade bonus, which counts the average consumer out.

Which Chase Promotion is Best for You?

When it comes to sign-up offers, it's hard to find a big bank that does it better than Chase.

And while you should never choose a bank solely based on a sign-up bonus, there's plenty to like with Chase once you get in the door. Check out the full Chase review.

As you comb through your options, keep two other things in mind: Always watch out for disclaimers and fine print.

If you miss a specific requirement, you could miss out entirely. You should also weigh any account fees against what you'll be earning in a bonus.

For example, a $25 monthly account fee can nullify a $200 sign-up bonus pretty quickly.

Now that you know all about the coupons available from Chase, you are a step or two closer to deciding whether or not it's the right banking partner for you.

Good luck!