While personal checks work similarly to business checks, cashier’s checks, and other types of checks, there are a few key differences that you need to be aware of to make sure you can make the most out of them.

In this article, we will be looking at everything there is to know about checks. We’ll cover how they work, where to get them, and what to be mindful of when writing them.

What’s a Personal Check?

A personal check is a slip of paper tied to your bank account, usually a checking account, that financial institutions such as banks and credit unions issue to customers.

Some banks also offer checks tied to other types of bank accounts, including savings accounts. In this case, for example, the money will come out of your savings account.

A personal check is not a payment but rather a promise of payment. While it is a promise, it’s not just any promise but a legally binding one. Failure to keep that promise can land you in all sorts of trouble – from fines to legal action.

When you write a check, the money will come out of your bank account. It is illegal to fill in a check that you know cannot be cashed, and as such, you should use it with caution.

Banks also tend to levy hefty fees when checks bounce, which is another reason why you should use them with caution.

When To Use a Personal Check:

Although checks do not enjoy the popularity they once did, they are still a valid form of payment, and many people still use them in many situations.

Today, electronic money transfers have all but replaced checks since they are more efficient, faster, and safer. Either way, checks can be used in several situations, although there might be some restrictions.

These restrictions stem from the fact that personal checks are not a guaranteed form of payment, such as money orders or cashier’s checks. Neither the payee nor whoever is cashing the check knows if there are enough funds to cover the check amount, which makes them risky.

Still, people use personal checks to pay for products and services and transfer money between accounts. Some businesses still prefer checks, including many landlords and small businesses that might not have the facility to take debit cards or credit cards.

Of course, a bank transfer would be a reasonable alternative in such situations; however, it often boils down to a matter of personal preference. Some people might feel safer having physical paper at hand rather than waiting for a bank transfer to come through.

How Can I Get Personal Checks?

Before we get into filling in checks, it’s important to note that you must first have a checkbook. A checkbook is a book of checks that you can fill in. If you do not have one, you must order checks from your bank.

The process can differ from one bank to another, so be sure to check their website or give them a call if you’re unsure how the procedure works.

Ordering Customized Checkbooks

Some banks also offer customized checks that come in a variety of different themes and check designs. These can help you make sure you stand out.

Such checks may include:

- Disney checks

- Animal checks, including with various dog breeds

- Patriotic checks

- Photo checks

- Religious checks

- Scenic checks

You might also want to think about getting yourself a checkbook cover to protect your checkbook, especially if you find yourself carrying it around often.

Banks may offer checkbooks for free; however, frequently, they are against payment. Be sure to check this with your bank beforehand to avoid any surprise charges.

It’s well worth noting that not all banks offer checks. Some banks do not provide any check-writing facilities will others only offer them if you have a specific type of account.

Some banks also offer the facility to order checks online. In such cases, all you need to do is fill in the information online, and the bank will send it for you, saving you time and hassle.

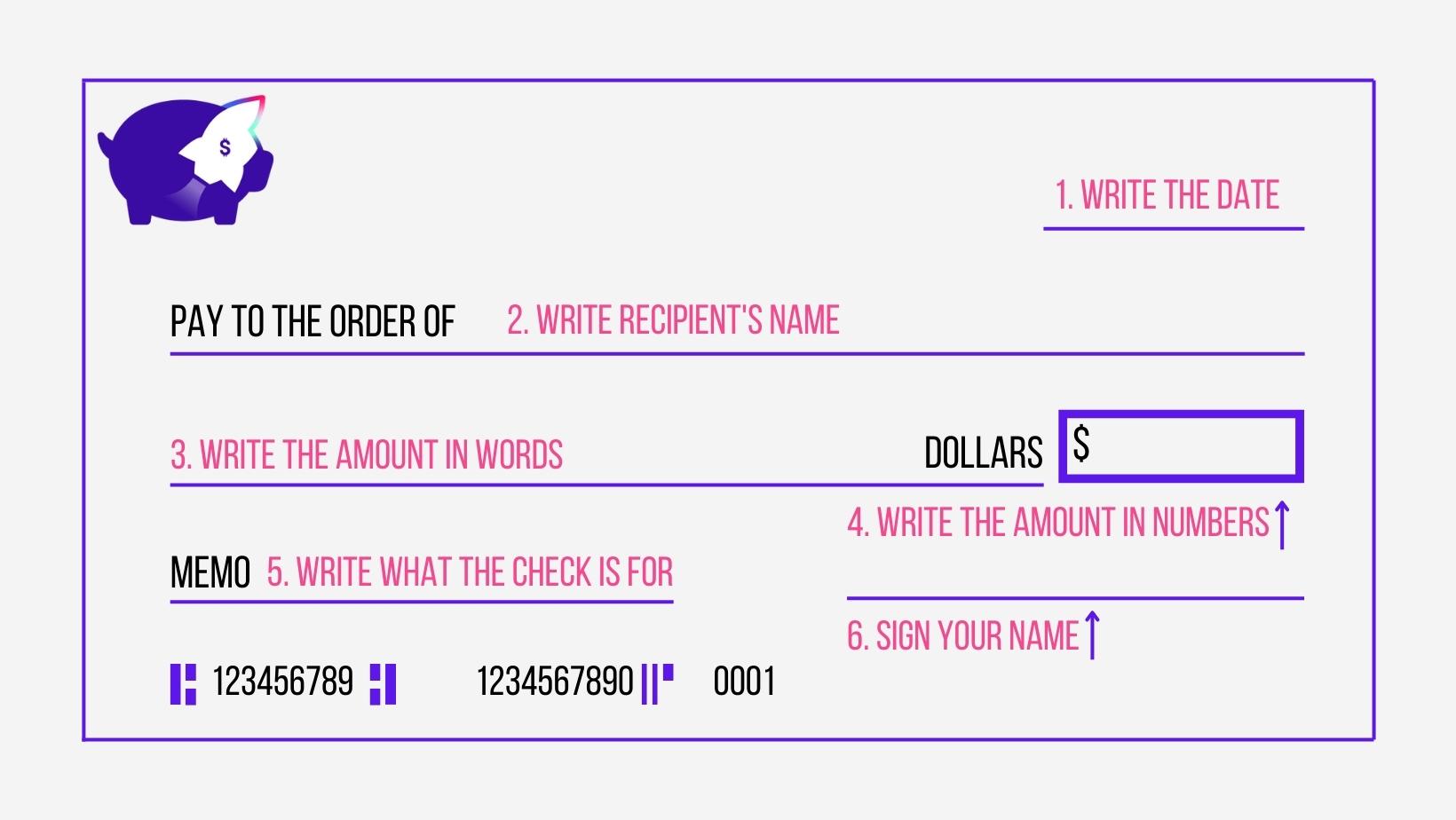

How To Fill in a Personal Check

Filling out a check is an essential part of the process as through it, you will be determining whom you are paying and how much. Fortunately, the process is relatively straightforward.

If you’re filling out the check yourself the old-fashioned way, you will need two pieces of information – the name of the person or company you’re writing the check to and the amount you want to pay.

There is no need for bank account numbers or routing numbers – the check comes pre-printed with all the required information to ensure that the money comes out of the correct account.

You will also need to write the date on which the check was issued and sign it. If you’re sending it to someone via a postal service, make sure you print the address carefully or use address labels if required.

The last thing you’re going to want is for the check to end up in the wrong hands. You might also want to skip the standard shipping options and opt for a registered letter instead so that you’ll have confirmation that it was delivered.

Learn More:

Common Personal Check Writing Mistakes to Avoid

Make sure that you fill out the check fully. Never leave empty spaces and certainly avoid handing out a blank check.

You should also avoid asking someone else to fill in the check for you unless you trust them with your entire account – since this is what you’re effectively doing.

If you have trouble filling the check yourself for one reason or another, you might be better off ordering a cashier’s check directly from your bank or paying for a money order.

Cashing a Personal Check

If you have received a personal check, you have quite a few options where to cash it. Your first option should be your bank or credit union, as this is by far the easiest and cheapest one.

If you don’t have an account, you might want to consider cashing it as the issuing bank. Some stores such as Walmart also cash personal checks; however, there might be some limitations.

Either way, make sure you get a deposit slip to have what to quote should the money not arrive in your account within the stipulated timeframe.

Learn More:

Pros & Cons

Just like everything else, checks are not perfect and have their own set of pros and cons. Knowing what these are can help you understand whether checks are suitable for you or not.

Make sure you check the Alternatives section below to see what other options might be available to you.

Pros:

- Accessible. Checks are a relatively easy way to make payments and are used all over the world

- Cost-effective. When compared to other forms of payments such as wire transfers, they are relatively cheap

Cons:

- Safety concerns. Checks are not known for their high security since they can easily be lost, stolen, or misplaced

- Fraud. Check fraud is not unheard of, so you need to be very careful when accepting or writing checks

- Damage. Paper checks can undergo damage easily, such as being torn or ripped

Alternatives to Personal Checks

While checks are convenient, they are not perfect. With the advancements in technology we have today, there are safer, faster, and more secure ways of making payments.

Here are some of the options that you might want to consider:

ACH Transfer

ACH transfers are what is usually referred to when talking about bank transfers. Most banks offer ACH transfers for free and can take up to 3 days to reach the payee’s account.

There are several ways to do an ACH transfer, including mobile banking, internet banking, or visiting your local branch.

ACH transfers are very secure; however, you must know the account number, routing number, and the payee’s name.

Wire Transfer

Wire transfers work very similarly to ACH transfers. They tend to be faster but generally incur fees. Like ACH transfers, you will need to have the payee’s name, bank account number, and routing number.

Zelle

Many banks offer Zelle with their mobile banking app, which allows you to transfer money quickly and cheaply. The person you’re sending money to must also have access to Zelle for this to work.

Payment App

Payment apps such as PayPal make it super easy to transfer money to third parties without involving the bank. Of course, both you and the person you’re paying must have a PayPal account; however, these are free to set up.

PayPal might charge a transfer fee, so be sure to check before making the transfer. You will also need to verify who is responsible for paying the fee since this is usually the payer’s responsibility unless the payee asks for PayPal specifically.

Bill Pay

If you’re using checks to pay bills, your mobile banking app might have a safer and more convenient option for you – Bill pay.

Through Bill pay, you can pay bills from your mobile phone and even set up recurring payments if you would like. This payment option is very convenient as it allows you to pay from anywhere as long as you have your phone and an internet connection.

Avoid logging into your bank account using public Wi-Fi since these types of networks are not considered safe.

While apps are very safe and secure, they are not impenetrable, and someone might steal your information if you use a public network.

Debit or Credit Cards

If the payee accepts debit cards or credit cards, swiping your card might be easier than writing a personal check.

Cashier’s Checks

Also known as bank checks, cashier’s checks are generally considered safer and more secure than personal checks. To get a cashier’s check, you will need to visit your local branch and pay the bank the total amount of the check so that they can issue it on your behalf.

Frequently Asked Questions

How do I order checks?

You should order checks from your bank or credit union. Since financial institutions don’t all have the same procedures, it’s best to contact your bank and credit union and ask about their check ordering process.

Where can I cash a personal check?

You can cash personal checks at your bank or credit union, the issuing financial institution, or any of the other personal check cashing facilities. Remember that since personal checks are considered risky, there might be limitations if cashing somewhere other than a bank.

How safe are personal checks?

Personal checks are reasonably safe, but the lack of security features makes them challenging to track and makes personal checks more susceptible to fraud.

Learn More:

Comments are closed.

Comments are closed here.