All bank accounts in the United States and the rest of the world have a number referred to as a bank account number.

Knowing your bank account number is important. Although you might not need it to make a simple ATM withdrawal, you’ll need it for setting up a wire transfer or direct deposit.

If you’re not quite sure where to find your bank number, keep reading to find out.

How Do I Find My Bank Account Number?

Fortunately, your account number is relatively easy to find. Here are a few quick ways:

- Method 1: Checks

- Method 2: Bank Statements

- Method 3: Mobile App and Internet Banking

- Method 4: Bank’s Customer Support

1. Checks

If your checking account comes with a checkbook, one of the easiest ways to locate your bank account number is by looking at the checkbook.

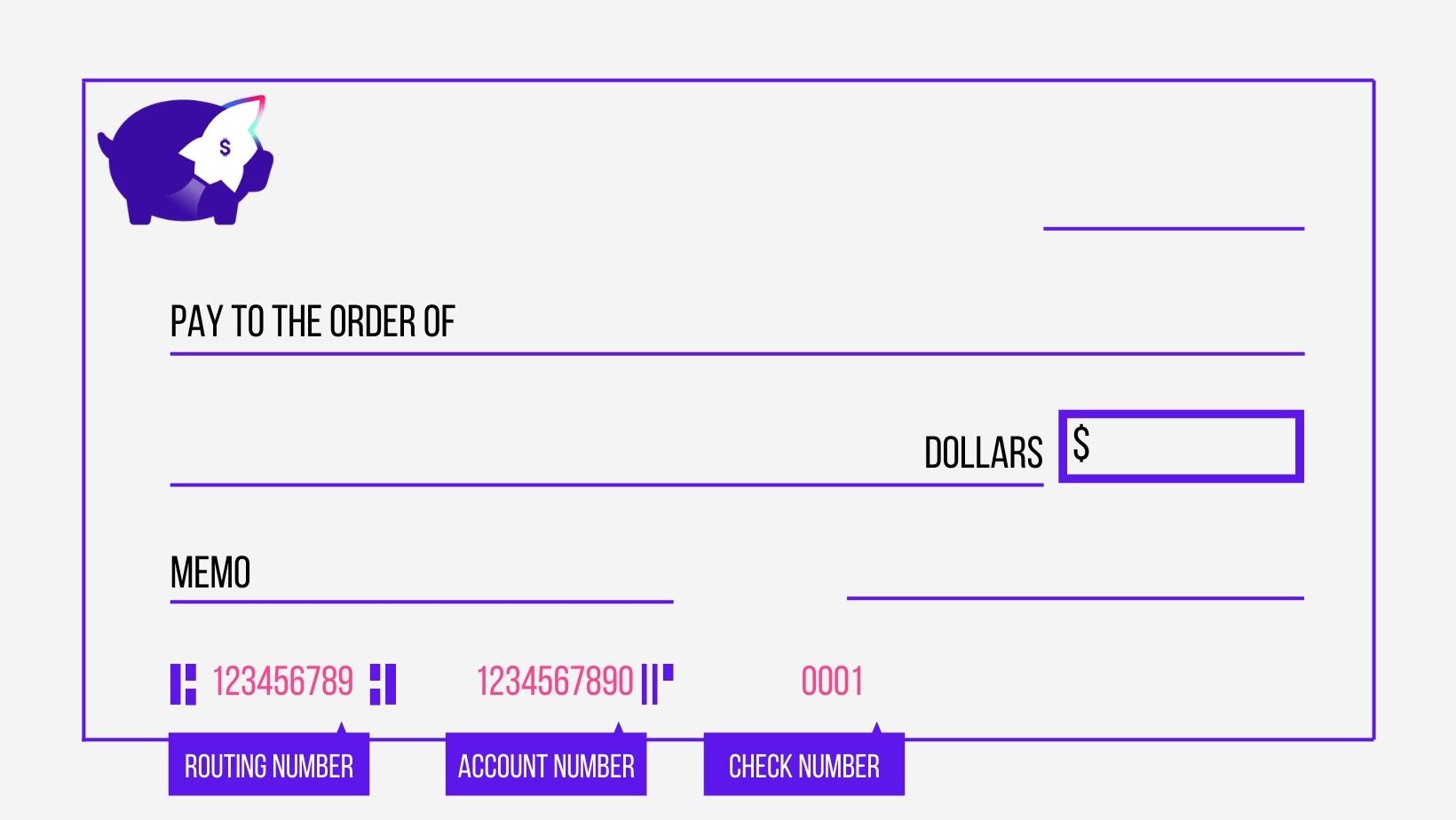

Each check has three numbers, which you’ll find at the bottom:

- The first set of numbers is 9-digits long: That’s your routing number.

- The second set of numbers is going to be between 10 and 12 digits long: That’s your account number.

- The third number is the check number: This represents that particular check.

Exceptions

The above method applies to most if not all personal checks. Other types of checks might not follow the same procedure, even if they have numbers written in the same place.

Cashier’s checks and business checks are two such examples. Let us have a look at each one and see why they are different.

Cashier’s Checks

Cashier’s checks are checks printed by a cashier at the bank. They are used by people who do not have a checkbook but would like or need to send a check. Essentially, what happens here is that the person pays the bank the total that he or she would like the check to amount to, and then the bank issues the check for that amount.

Since it is the bank that issues the cashier’s check, you will not find the account number of the person that sent you the check. In most cases, this goes to an account that the bank uses to pay bills.

Business Checks

Business checks, such as checks for payroll, might also have a different account number. This can be the case for several reasons, including using an intermediary to print and send the checks.

2. Bank Statements

Not everyone has a paper checkbook, as these have fallen out of favor. Today, many people prefer the convenience of instant bank transfers, which makes finding your bank account number on your checkbook a little bit difficult. Fortunately, there are other ways to find your account number.

One easy and straightforward way to find a bank account number is by looking at your bank statement. Your bank statement offers more than just a list of debit card and funds transfer transactions.

This method works for both printed statements that you might receive in the post and e-statements you can download through your mobile banking app or internet banking.

Bank statements will typically have the account number written within the header of the statement. You will need to look at the very top of each page. The number is usually preceded by the letters’ ACC NO.’, which stands for an account number.

3. Mobile App or Banking Website

If you use online banking or have a mobile banking app, finding your account number should be very easy.

Though mobile banking apps and online banking websites generally look similar, there will still be some differences in the layout – so there is no one way to find your bank account. You might need to do a little bit of exploring before you find your account number.

Either way, you will need to make sure you log in first and then head to the banking accounts section. Here you will be able to see account information for each of the accounts you have linked in your app or online banking, including your bank account.

Find the specific account you want the number for, and then look for the information button. This might be presented in different ways, such as ‘checking account number’ but will differ from one bank to another.

4. Bank Customer Support

If none of the above methods work, don’t give up just yet. Banks have customer support who should guide you and help you with any banking-related questions or concerns, including finding your bank account number.

Banks tend to offer several different ways to get in touch, including email, telephone, and increasingly live chat.

Please make sure you check their availability since not all banks operate 24/7.

What is a bank account number?

A bank account number is a unique number that is assigned to every bank account. But it’s not the only number that’s required. Bank account numbers are usually accompanied by another number – the routing number.

Account Number vs. Routing Number

Think of the routing number as the address, while the bank account number is the account’s name. Knowing both numbers means you can send money to that account.

Routing numbers are 9 digits long. The number sequence in a routing number tells us a lot of things, including. The financial institution is a state or federally-chartered institution and has an account with the Federal Reserve.

It also tells us which bank the routing number belongs to, so a routing number is like an address. Smaller regional banks might have just one number for all of their accounts, while bigger national banks might have several. In most cases, big banks will have one routing number for each state they operate in.

Sometimes, routing numbers are also referred to as ABA routing numbers (American Bankers Association) or routing transit numbers.

Having a routing number on its own is not going to get you very far. This is why there is a second piece to the puzzle – the bank account number.

Bank account numbers work alongside routing numbers, as we discussed earlier. Account numbers are generally between 8 to 12 digits long, and they identify your particular account. This means that if you have multiple accounts, each account will have its own number.

Routing numbers tend to be public information and can easily be retrieved by just about anyone.

IBAN

Some countries also use what is called an IBAN. This number, which includes letters, is 34 characters long and, as such, much longer than the bank account numbers in the US.

Its length is because it also consists of the country code, among other things, making them ideal for transferring money to an account in a different country.

Can bank account numbers and routing numbers change?

Although bank routing numbers and bank account numbers do not change regularly, certain events might cause them to change.

There are two things to keep in mind here – the change does not happen overnight, and the bank will give you ample time to update everything.

Bank mergers and acquisitions are one of the reasons why a bank account and routing number might change. Consolidations are another reason. As you might imagine, these do not happen every day, so there is nothing to worry about.

Even so, if the bank where you hold your account is going through a merger or is being acquired by another bank, here are some things that you should keep in mind:

- Make sure you read all of your bank’s communications. When such a big change occurs, banks give their customers ample time to update their affairs. In most cases, you will be notified months in advance of the change. The old routing and bank account number might remain active even after the change is done, giving you peace of mind.

- Take action as soon as you can. While you might have ample time to update automatic withdrawals and deposits, taking care of it at your first available opportunity is a good idea. It’ll help you make sure that it doesn’t fall through the cracks and help you avoid negative consequences such as NSF fees should you forget to make the switch by the final deadline.

- Review and confirm. Review your bank statements to make sure you’ve covered all of the payments you need to cover. In some cases, such as direct deposits, you might have to file new paperwork, so it’s always good to start early so that you’ll give yourself ample time to rectify any teething issues that may arise.

Frequently Asked Questions

Why should you know your bank account number?

Those who want to pay into your bank account will need to know your bank account number. For example, your employer might ask you for your routing number and bank account number to pay you directly into your bank account by direct deposit. You’ll also need your routing number if you want to pay a bill online or make a wire transfer to another account.

Do all bank accounts have a routing number?

All bank accounts have a number. This is important as it allows money to flow in and out of the bank account. The routing number and the bank account number make a unique number that lets you and anyone else send money into the account. It also allows you to transfer money out of the account.

How do I identify my bank account number?

Bank account numbers are between 8 to 12 numbers long, while the routing number is 9. You can find your account number at the bottom of your check, on your bank statement, or through your mobile banking app or online banking portal.

Does my credit card have an account number?

Account numbers are only applied to a bank account, so credit cards do not have a bank account number. However, credit cards do have their own credit card numbers.

Can my account number change?

Although it’s quite rare, bank account numbers can change. Your account number might change if your bank recently went through a merger or acquisition. The bank will advise you well in advance, giving you ample time to update your records before any changes are made final.

Is it safe to give people my bank account number?

Generally, yes. As this information is printed on your checks and is generally easy to find, it’s not like a password that should be kept secret. Your employer will need it – as well as your friends and family if they want to send you money.

But it would be best if you always were cautious when sharing it with anyone – always ask the following questions before sharing:

- Why do you need my bank account number?

- How will you store my information?

- Who will have access to this information?

It doesn’t hurt to be a bit more careful – though, as long as they don’t have other important pieces of your information (like your social security number), they shouldn’t be able to cause any harm.

Comments are closed.

Comments are closed here.