PNC Bank is one of the nation’s biggest banks—you can enjoy service at approximately 2,300 branches and over 60,000 ATMs nationwide and open some accounts from anywhere online. While PNC’s interest rates could be higher and some competitors have a more sleek banking platform, it’s a solid choice of bank with some rewarding bonuses.

For example, when you open a Virtual Wallet Account (PNC’s hybrid checking and savings account), you can earn up to a $400 bonus. Read on to learn how to access this offer and PNC’s other promotions below.

Current PNC Bank Promo Codes & Bonus Offers

Here are the active PNC bonuses that you can benefit from today:

PNC Points® Visa® Credit Card

- Bonus Amount

- 50,000 Points

- Account Type

- Personal Card

- Availability

- Nationwide

- Bonus Requirements

-

- Apply for a new PNC Points® Visa® credit card using the link below.

- Within 3 months, spend $750 using your new card.

- Bonus will be credited within 90 days.

Summary: PNC's Current Bonuses

Here’s a recap of the current PNC Bank promotions and offers that you can claim right now:

| Account | Account Type | Amount | Expires | Requirements | |

|---|---|---|---|---|---|

| PNC Points® Visa® Credit Card | Personal Card | 50,000 Points | Card Spend | Details |

Expired Offers From PNC

These bonuses were recently offered by PNC, but are not available right now.

Check back often as PNC may revive these deals or offer similar promotions in the future. In the meantime, it can sometimes be helpful to compare PNC's current bonuses to their previous deals.

Business Checking Account - $400 bonus (Expired)

Expired: June 30, 2025

PNC previously offered $400 for opening a Business Checking account.

To earn the bonus, you needed to:

- Open a new Business Checking or Business Checking Plus account.

- For 3 statement cycles, maintain an average balance of $2,000.

- During those same statement cycles, make 20 debit card purchases.

- Bonus will be deposited within 90 days of meeting the requirements.

Enterprise Checking Account - up to $1000 bonus (Expired)

Expired: June 30, 2025

PNC previously offered up to $1000 for opening an Enterprise Checking account.

The steps to earning this bonus were:

- Open a new Treasury Enterprise Plan or Analysis Business Checking account.

- For 3 statement cycles, maintain at least a $30,000 balance to earn $500 or at least $100,000 to earn $1,000.

- Bonus will be deposited within 90 days of meeting the requirements.

Virtual Wallet® - up to $400 bonus (Expired)

Expired: June 30, 2025

PNC previously offered up to $400 for opening a Virtual Wallet® account.

Earning this bonus required you to:

- Open a Virtual Wallet® account online to qualify, See link below.

- Within 60 days, complete the direct deposit requirements for the account package that you opened: Virtual Wallet® - $500+ to earn $100 bonus, Virtual Wallet® with Performance Spend - $2,000+ to earn $200 bonus, or Virtual Wallet® with Performance Select - $5,000+ to earn $400 bonus.

- Bonus will be credited to your account within 60-90 days after meeting requirements.

Virtual Wallet Pro - $200 bonus (Expired)

Expired: April 29, 2025

PNC previously offered $200 for opening a Virtual Wallet Pro account.

The requirements for this bonus were:

- Reside in a state that doesn't have a PNC branch.

- Open an account using the link below.

- Within 60 days, complete direct deposits totaling $2,000.

- Bonus will be deposited within 60-90 days after all conditions are met.

Virtual Wallet® with Performance Select - $300 bonus (Expired)

Expired: December 31, 2021

PNC previously offered $300 for opening a Virtual Wallet® with Performance Select account.

To earn the bonus, you needed to:

- Open a Virtual Wallet with Performance Select account using the link below.

- Within 60 days, have a total of $5,000 in direct deposits.

- Bonus will be deposited into your account 60-90 days after requirements have been met.

Virtual Wallet® with Performance Spend - $250 bonus (Expired)

Expired: October 31, 2021

PNC previously offered $250 for opening a Virtual Wallet® with Performance Spend account.

Earning this bonus required you to:

- Open a Virtual Wallet with Performance Spend account using the link below.

- Within 60 days, have a total of $2,000 in direct deposits.

- Bonus will be credited to your account within 60-90 days after meeting requirements.

Virtual Wallet® - $100 bonus (Expired)

Expired: October 31, 2021

PNC previously offered $100 for opening a Virtual Wallet® account.

To earn the bonus, you needed to:

- Open a Virtual Wallet account using the link below.

- Within 60 days, have a total of $500 in direct deposits.

- Bonus will be deposited into your account 60-90 days after requirements have been met.

PNC Cash Rewards®Visa® Credit Card - $100 bonus (Expired)

PNC previously offered $100 for opening a PNC Cash Rewards®Visa® Credit Card credit card.

The requirements for this bonus were:

- Apply for a new PNC Cash Rewards® credit card using the link below.

- Within 3 months, spend $1,000 using your new card.

- Bonus will be credited within 90 days in the form of a statement credit.

PNC Core® Visa® Credit Card - $100 bonus (Expired)

PNC previously offered $100 for opening a PNC Core® Visa® Credit Card credit card.

Earning this bonus required you to:

- Apply for a new PNC Core® credit card using the link below.

- Within 3 months, spend $1,000 using your new card.

- Bonus will be credited within 90 days in the form of a statement credit.

Why PNC Bank?

PNC Bank is the 7th largest in the U.S., with over 60,000 ATMs and approximately 2,300 physical branches across the country. This includes the former BBVA locations, which they acquired in 2021.

PNC offers "Spend, Reserve and Growth" virtual wallets. Spend is for day-to-day activity, Reserve is for short term planning, and Growth is a long term savings account. A single fee covers the trio of accounts and, like most linked accounts, it's easy to transfer money between the three (plus offers 2-layers of fee-free overdraft protection).

Ultimately, however, PNC isn't our top pick if you're shopping for a new bank. Typical of the big national brands, their interest rates are low in many markets. And while they offer online and mobile banking with all of the major features, their apps feel more dated than competitor products (and definitely more than the tech-based banks).

Learn more about PNC Bank in our full review

PNC Bank Locations

You may sometimes be required to visit a branch in-person to take advantage of a welcome offer. Or, you may just prefer the convenience of banking with institutions that have locations near you.

Get a better idea of how well PNC Bank can serve you by checking out their branches closest to your area:

112 E Pecan St

San Antonio, TX 78205

101 South Main Street

Ann Arbor, MI 48104

115 E Van Buren Ave

Harlingen, TX 78550

2001 Kirby Drive

Houston, TX 77019

8951 Main Street

Frisco, TX 75034

202 East Washington Street

Lebanon, IN 46052

235 West 5th Street

San Juan, TX 78589

200 East Broad Street

Groveland, FL 34736

115 North Dooly Street

Montezuma, GA 31063

200 South Lawrence Boulevard

Keystone Heights, FL 32656

6518 West Highway 146

Crestwood, KY 40014

5817 North 2nd Street

Loves Park, IL 61111

Tips And Tricks For PNC Bank Promotions

In order to earn the "free" cash from PNC, you'll need to follow the rules of each bonus offer.

These are clearly outlined in the fine print of every offer, but there are some common themes that are helpful for you to know up front:

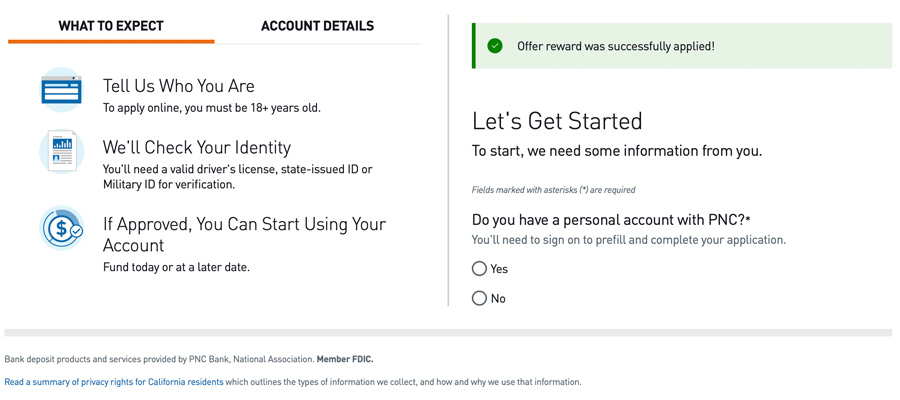

01. Enrolling in PNC offers

With most offers from PNC Bank, you'll need to enroll in the promo by clicking "Apply Now" straight from the promotion's landing page on the PNC website. We link to this unique landing page from the individual bonuses above.

Alternatively, some offers allow you to open an account at your local branch, but you'll need to explicitly request to be enrolled in the offer. Be sure to check to the terms of the bonus offer to make sure this option is permitted.

Regardless of which route you take, you want to be sure that the offer is being applied at the time you open the account. If not, you won't receive the bonus, regardless of whether or not you meet the other requirements.

To verify, be sure you're seeing the "Offer reward was successfully applied!" call out (or something similar) on your application screen:

Sincerely, we can't underscore this enough. PNC's internal systems track these offers automatically. If you open an account by any other means, you won't receive the bonus, regardless of whether or not you meet the other requirements.

02. Existing versus new customers

Nearly all PNC Personal Checking Account offers only apply to new customers.

That means you're not eligible if you currently have an existing account in that product category or if you've closed an account in that category within the past 90 days.

By "product category", we mean "consumer checking account", "business savings account" or the like.

For example, having an existing Virtual Wallet® with Performance Select account would not exclude you from opening a PNC Enterprise Checking Account and receiving that account's welcome bonus. But having a Virtual Wallet® with Performance Select account would exclude you from earning any other Virtual Wallet® welcome offers.

03. Where you live matters

PNC offers different products to customers depending on which state they reside in.

For example, Virtual Wallet® Checking Pro is only available to those who live in AK, AR, CT, HI, ID, IA, KS, LA, ME, MA, MN, MS, MT, NE, NV, NH, ND, OK, OR, RI, SD, TN, UT, VT, WA, or WY.

Because offers are tied to specific accounts, you'll want to pay attention only to the accounts you're eligible to open.

Fortunately, both our website and PNC's website make this fairly straightforward.

On BankBonus.com, we clearly call out each bonus offer's availability.

04. Every 2 years limit

For nearly all PNC bonus offers, PNC limits you to receiving a welcome bonus only once every 2 years.

Again, this is within that product category or per credit card.

05. Taxes

Remember that like all bank promotions, bonuses from PNC Bank are taxable. Unlike your regular salary, PNC does not withhold interest from your earned bonuses. Instead, PNC will send you a 1099-INT at the end of the year, and that bank interest will be taxed as ordinary income.

The exception here are credit card offers. Credit card rewards are typically treated as a rebate or discount by the IRS, rather than income. So earning a welcome bonus for opening a new Chase credit card is not usually taxable.

06. Fine print

Ultimately, every offer is unique. While the above tips are typical of most PNC promotions, they aren't guarantees. Make sure to thoroughly read the fine print of the bonus you're interested in.

Also know that offers can be changed at any time. Until you've fully enrolled in that offer by opening the account, the terms aren't "locked in".

That also means that the promotion may end earlier than the advertised expiration date – and truly, that happens all the time, even from a relatively consistent bank like PNC. If you're interested in a bonus, don't wait until the last minute to enroll.

Reader Experiences with PNC Bank Offers

Here are some of the things our readers have to say about their experience earning PNC promotions, along with some of their helpful tips:

I was aiming for the generous $400 bonus. Unfortunately, I mistakenly signed up for the wrong type of account, and only received $200. Took 3 months from opening to closing. The account names (like many banks) are odd...pay close attention, unlike me!Rebecca PNC Virtual Wallet Bonus

It's a straightforward bonus here by PNC. I did this offer last year and after getting the $400 bonus, I downgraded my account to Virtual Wallet for the easier requirements to avoid the monthly maintenance fee.Jon Snow PNC Virtual Wallet Bonus

I got a $400 bonus. Had to leave in $5000 for about 3.5 months to avoid a fee, but that's OK with me for such a generous bonus. Had to call to close the account.Jamon PNC Virtual Wallet Bonus

This bonus is for PNC's virtual wallet, which is actually comprised of three accounts: spend, reserve, and growth. Be careful when doing this bonus to fund the spend account. Funding the other two will not trigger the bonus. This requirement is mentioned in the terms and conditions.Doug PNC Virtual Wallet Bonus

Is a PNC Bonus a Good Deal For You?

When it comes to bank bonuses, you want to make sure first and foremost that the account is a good match for you long-term.

At the very least, you don't want to be incurring unnecessary fees that will totally wipe out the value of the offer.

Fortunately, there is a lot to like about PNC.

Their Virtual Wallets are a unique and convenient spin on traditional checking and savings accounts. Their business products are straightforward and scale from small start-ups to enterprise accounts. And all but one of these accounts have multiple ways to waive the monthly fee.

Overall, only you can know your exact needs, but PNC should definitely be in the running if you're comparing big banks.

And, fortunately, if you're a non-PNC customer, there's a good chance at least one of their deals could be worthwhile for you.

Good luck!

Opinions expressed here are the author's alone, not those of any bank or financial institution. This content has not been reviewed, approved or otherwise endorsed by any of these entities.