Sometimes, financial institutions deny individuals with a negative banking history to minimize their risk exposure. Other times, your application could be automatically denied based simply on the number of bank accounts on your ChexSystems report.

If that happens, you have options. Based on our experience, we recommend reaching out to the bank—by phone, chat, or an in-person visit to confirm your identity and explain why your application was denied. Even if you have a lot of accounts open, you could still get approved.

And if you’re still having trouble getting approved, you may want to consider a bank that does not utilize ChexSystems reporting.

There are a lot of conflicting reports online about which banks actually use ChexSystems to screen applicants. To clear up the confusion and provide you with the most accurate list possible, we looked into dozens of banks, scoured their terms and conditions, and contacted the institutions directly via phone, chat, and email to confirm whether or not they use ChexSystems.

Banks That Don’t Use ChexSystems

Based on the data we gathered, here are the best banks that either don’t use ChexStystems at all or offer second-chance checking accounts:

1. Varo Bank

- Account: Varo Account

- Monthly fee: $0

- Opening deposit: $0

- Offers bank bonuses: Yes

Bottom Line:

Varo is worth considering if you’re looking for a second chance at banking and building your credit without being held back by your banking history or credit score.

Varo Bank, also known as Varo Money, is a neobank offering full-servicing online banking. Varo was founded in 2015, and while it’s a bank aimed at millennials, it’s a great fit for anyone looking for a different banking experience than traditional banks.

Varo explicitly states that it doesn’t use ChexSystems when it reviews applications:

Past mistakes should never stop you from having access to essential money management tools like a checking or savings account. That's why Varo doesn't use ChexSystems when reviewing account applications.VaroMoney.com

The Varo account has no maintenance fees, no foreign transaction fees, early access to paychecks, and free ATM withdrawals from 40,000 ATMs. There’s also a competitive savings account, a credit building card, and a cash advance service.

Learn More:

2. Chime

- Account: Chime Checking Account

- Monthly fee: $0

- Opening deposit: $0

- Offers bank bonuses: Yes

Bottom Line:

Consider Chime if you want a streamlined mobile banking experience with the fewest fees possible and no ChexSystem requirement.

Chime is an online bank that promises to earn with you and not off of you, making the bulk of its money through merchant fees.

Chime doesn’t use any credit reporting agency – ChexSystems or otherwise when you open an account.

We help you on your path to rebuilding your financial life by offering a bank account that doesn’t use reports such as those furnished by ChexSystems and has no monthly fees.Chime.com

The bank also offers a secured credit card which can add an average of 30 points to your credit score.

Chime Checking has no minimum balances and no monthly charges. Their ATM network gives you access to over 60,000 fee-free ATMs. Furthermore, Chime offers up to $200 of overdraft protection through its SpotMe feature.

Learn More:

3. Navy Federal Credit Union

- Account: EveryDay Checking

- Monthly fee: $0

- Opening deposit: $0

- Offers bank bonuses: No

Bottom Line:

If you’re looking to compare multiple checking account options and access exclusive military perks without worrying about a ChexSystems report, Navy FCU should be at the top of your list.

Navy Federal Credit Union is a credit union for active duty and retired members of the Department of Defence (DoD), the Armed Forces, the National Guard, and their families. It offers deposit accounts, loans, credit cards, and several other personal finance products and services.

Navy FCU doesn’t pull a ChexSystems report. However, a representative explained to us that they will complete a soft credit check when you apply for an account to verify your identity. You can choose from several free checking accounts, including EveryDay Checking, which has no monthly fees or minimums and lets you earn APY and dividends.

Learn More:

4. United Bank

- Account: Gateway Checking

- Monthly fee: $10

- Opening deposit: $

- Offers bank bonuses: No

Bottom Line:

If you live in Alabama or Florida and want a local bank you can visit, United Bank is accepting, regardless of your ChexSystems report. Just be aware that its second chance checking account has some limitations compared to other checking accounts.

United Bank is a community bank serving people in Southwest Alabama and Northwest Florida. United Bank offers many financing options to the agriculture and forestry sector, in addition to several deposit accounts.

That includes a checking account for individuals who might not have the best banking track record. Gateway Checking is designed to help customers rebuild their credit with a second-chance checking account.

While it doesn’t include a debit card or offer overdraft protection, the account comes with mobile deposits, checks, and widespread ATM access, for a $10 monthly fee.

United Bank doesn’t use ChexSystems to vet applicants, but it does reserve the right to verify your identity, as you can see in the policy statement below:

When you open a new account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver's license and other identifying documents.UnitedBank.com

Learn More:

5. SoFi

- Account: Online Checking Account

- Monthly fee: $0

- Opening deposit: $0

- Offers bank bonuses: Yes

Bottom Line:

SoFi is worth considering if you’re looking for an all-in-one account that offers cashback rewards, bears interest, and helps you save automatically.

SoFi is an online-only bank that was founded in 2011 as a student loan provider. It has an impressive list of offerings, including a high-yield checking account that doesn’t use ChexSystems reports as you can see stated below:

If you’re thinking of opening a new bank account, consider the all-in-one online bank account with SoFi — no ChexSystems report required! You’ll pay no management fees with SoFi, and you can earn a great APY when you qualify by setting up direct deposit.SoFi.com

SoFi’s interest-bearing checking account comes with an APY of 0.50%. You can also get up to 15% cash back rewards when you make qualifying purchases with your SoFi debit card. The account provides overdraft protection and extensive ATM access as well.

Learn More:

6. Acorns

- Account: Acorns Checking Account

- Monthly fee: $3-$9 subscriptions

- Opening deposit: $25

- Offers bank bonuses: Yes

Bottom Line:

Acorns is best suited for individuals looking to bank and invest in the same place at a low cost, without being held back by their previous banking experiences.

While its program agreement states that Acorns may use data from credit reporting agencies to vet applicants, a representative confirmed to us that it doesn’t use ChexSystems.

Acorns’ highly-rated banking app allows you to manage your investments, retirement plans, and free checking account.

To open a checking account, you’ll need to opt for at least a Personal Acorns subscription, which costs $3 per month. This fee gives you access to online checking and savings, investment accounts, and a ton of learning resources.

Learn More:

7. Current

- Account: Spend Account

- Monthly fee: $0

- Opening deposit: $0

- Offers bank bonuses: Yes

Bottom Line:

Current is a great option for boosting your credit while building up your banking history without requiring you to open a secured credit card account.

Current is a financial technology company backed by Choice Financial Group, Member FDIC. Current aims to make banking simple and accessible, and it doesn’t use your credit report or ChexSystems.

We don't run a credit check when you open an account. We use your Social Security Number (SSN) to verify your identity and keep our systems and customers safe from fraud.Current.com

Current’s mobile banking account comes with several benefits, including overdraft protection, competitive APY on savings, 2-day pay advances, and rewards on your Current debit card purchases. While Current doesn’t have any local bank branches, it does come with access to more than 40,000 Allpoint ATMs across the country.

Learn More:

8. FSNB

- Account: E-Standard Account

- Monthly fee: $7.95

- Opening deposit: $19

- Offers bank bonuses: No

Bottom Line:

FSNB doesn’t offer the sleekest banking platform or the best rates, but it’s a good choice of community bank if you’re out to improve your banking history.

Formerly Fort Sill National Bank, FSNB is another promising choice that doesn’t rely on Chexsystems or credit checks. FSNB has numerous locations from Oklahoma to the Carolinas. In addition to its checking, savings, loan, and credit cards, FSNB offers specialized bank accounts and services for military personnel.

The bank has two personal checking accounts, neither of which require a credit check. Both of these accounts come with a $19 opening deposit, one-day early pay, and automated savings round-ups.

Learn More:

9. Go2Bank

- Account: Go2Bank Visa Debit Card

- Monthly fee: $0

- Opening deposit: $0

- Offers bank bonuses: Yes

Learn More:

Bottom Line:

If you’re looking for a simple app-based banking experience and aren’t concerned about having a local branch, keep GoBank on your list.

Part of the GreenDot family, Go2Bank (formerly GoBank) provides simple solutions to banking needs, and we confirmed with a representative that it is a non-Chexsystems bank. GoBank is a platform designed exclusively for personal checking and high-yield savings, and it comes with some useful benefits.

It offers early direct deposits and lets you upload cash to your bank account at over 100,000 participating retailers like Walmart, CVS, and Dollar General. Additionally, GoBank offers a debit card, personal check-writing capabilities, and mobile deposits. You can also send and receive money and pay bills online.

What is ChexSystems?

Like EWS (Early Warning Services) and TeleCheck, ChexSystems is a consumer reporting agency. It collects information about everything from issues with deposit accounts (like checking accounts and savings accounts) to the number of accounts someone has opened and closed.

ChexSystems works with banks and credit unions to supply the information once it’s reported and retrieve it when opening a new account. Some banks also periodically check ChexSystems’ reports on existing account holders.

When this information is retrieved, the bank or credit union will check for negative activities, but also for multiple account applications.

ChexSystems Activity Recorded Can Include the Following:

- Bounced checks

- Overdrafts

- Involuntary closure of accounts

- Negative balances

- Abuse

- Fraud

- Identity theft

- Number of account applications

Why Do Banks Use ChexSystems?

Banks use ChexSystems reports as a form of risk management. In the bank’s eyes, someone who has defaulted or committed fraud before is more likely to do it again in the future. Allowing them to open an account would put the bank at risk.

A 2017 FDIC report showed that 14% of households that do not have a bank account listed a negative report as the reason they didn’t have an account.

But activities on a ChexSystems report aren’t always negative. A bank may automatically deny an application based on the number of previous accounts on your ChexSystems report.

Fortunately, you can usually clear this issue up by contacting a bank representative directly, finding a credit union that doesn’t use ChexSystems, or considering a second-chance bank account.

Before going forward with looking for alternatives, review your ChexSystems report to make sure that the information is factual.

By law, you can get one free report a year by visiting ChexSystems’ website, and when you’re denied a bank account due to the information contained in the report. You can dispute any erroneous information through ChexSystems’ website.

Why Banks Don’t Use ChexSystems?

Most banks use ChexSystems for all account applications, and some banks run ChexSystems on their customers periodically as part of their risk assessment strategy.

Even so, many of these banks offer specialized accounts designed for people with bad credit, bypassing ChexSystems checks altogether. With these accounts, banks give customers who don’t qualify for a regular account the opportunity to open a new bank account.

In most cases, the accounts that don’t use ChexSystems come with perks and features similar to those of a basic checking account.

What You Get:

- FDIC Insurance / NCUA Insurance: In most cases, you’re covered up to $250,000. However, you’ll find extended insurance options with CMAs (Cash Management Accounts).

- Monthly service charge: Most accounts come with a fixed monthly service fee, and others have minimum balance requirements.

- No ATM Fees: You don’t pay ATM fees when withdrawing from the bank’s ATM network.

- Mobile app: A mobile banking app that gives you access to features like online bill pay and mobile check deposit.

- Debit card: Most accounts come with a Mastercard or Visa debit card, which could be a prepaid debit card in some cases.

- Opening deposit: Many banks have an opening deposit requirement, which you can transfer through direct deposit or check.

Alternatives to Banks that Use ChexSystems

If you’re looking for alternatives to traditional banks that use ChexSystems, there are several options.

These alternatives provide banking services without the strict requirements and limitations of ChexSystems.

- Prepaid debit cards: Prepaid debit cards allow you to load funds onto the card and use it for purchases and ATM withdrawals. Since they aren’t linked to a bank account, they don’t require a ChexSystems check. Some well-known prepaid debit card options include Netspend, Bluebird by American Express, and Green Dot.

- Second chance banks: Second chance bank accounts are specifically designed for individuals with a ChexSystems history. These banks understand that people deserve a second chance and offer banking services despite past financial difficulties or a large volume of accounts.

- Credit builder loans: Some financial institutions offer credit builder loans, which are designed to help individuals build credit. These loans can be used as an alternative to traditional banking services and can help you establish a positive banking history, regardless of your ChexSystems record.

- Alternative financial service providers: Alternative financial service providers such as check cashing stores and money transfer services offer basic banking services without conducting ChexSystems checks. While these options may have higher fees compared to traditional banks, they can be a viable alternative for individuals with a negative ChexSystems history.

How to Dispute Your ChexSystems Report

Disputing your ChexSystems report can help you address any errors or inaccuracies in your banking history.

- Review your report: To begin, you should obtain a copy of your ChexSystems report by requesting it online or through mail. Once you get the report, carefully review it to identify any discrepancies or incorrect information.

- Gather documentation: If you spot any errors, gather supporting documentation to back up your claim. This might include bank statements, receipts, or any other relevant proof.

- Write a dispute letter: Next, write a clear and concise dispute letter addressed to ChexSystems, clearly outlining the inaccurate information and providing the necessary documentation to support your case. Ensure that you include your full name, address, and ChexSystems ID number in the letter.

- Be specific: When you write the letter, it’s important to be specific and focused and avoid unnecessary details. After completing your letter, make copies of all the documents as evidence and send the original letter via certified mail with a return receipt requested.

- Check in: Follow up with ChexSystems after a reasonable amount of time to confirm the progress of your dispute and ensure that it’s being resolved.

By following these steps, you can effectively dispute your ChexSystems report and work towards resolving any issues that may be affecting your banking history.

Frequently Asked Questions

Can you open a bank account if you’re in ChexSystems?

Yes. If your bank account application was denied because of the number of accounts you’ve had in the past, you can contact the bank directly to explain the situation and ask them to reconsider your application.

If yourChexSystems record is preventing you from getting approved, consider a second-chance checking account, or apply with a bank that specifies that it doesn’t utilize ChexSystems.

Can I open a bank account if I owe another bank money?

If your ChexSystem report shows that you owe any money to another bank, your application could be denied. In this case, you’ll need to look for a bank that doesn’t use ChexSystems or consider a second-chance bank account.

Can a bank remove you from ChexSystems?

A bank can’t remove you from ChexSystems – they don’t run the system. However, they can make an exception and report timely payments to credit bureaus. ChexSystems records are automatically cleared after five years.

That said, if the information in the report is incorrect, you can open a dispute directly with ChexSystems.

How long are you flagged on ChexSystems?

According to ChexSystems, account information stays on your report for five years, although it can be disputed and removed if there’s an issue. You can also ask banks to update your record by paying off any outstanding balances on old accounts.

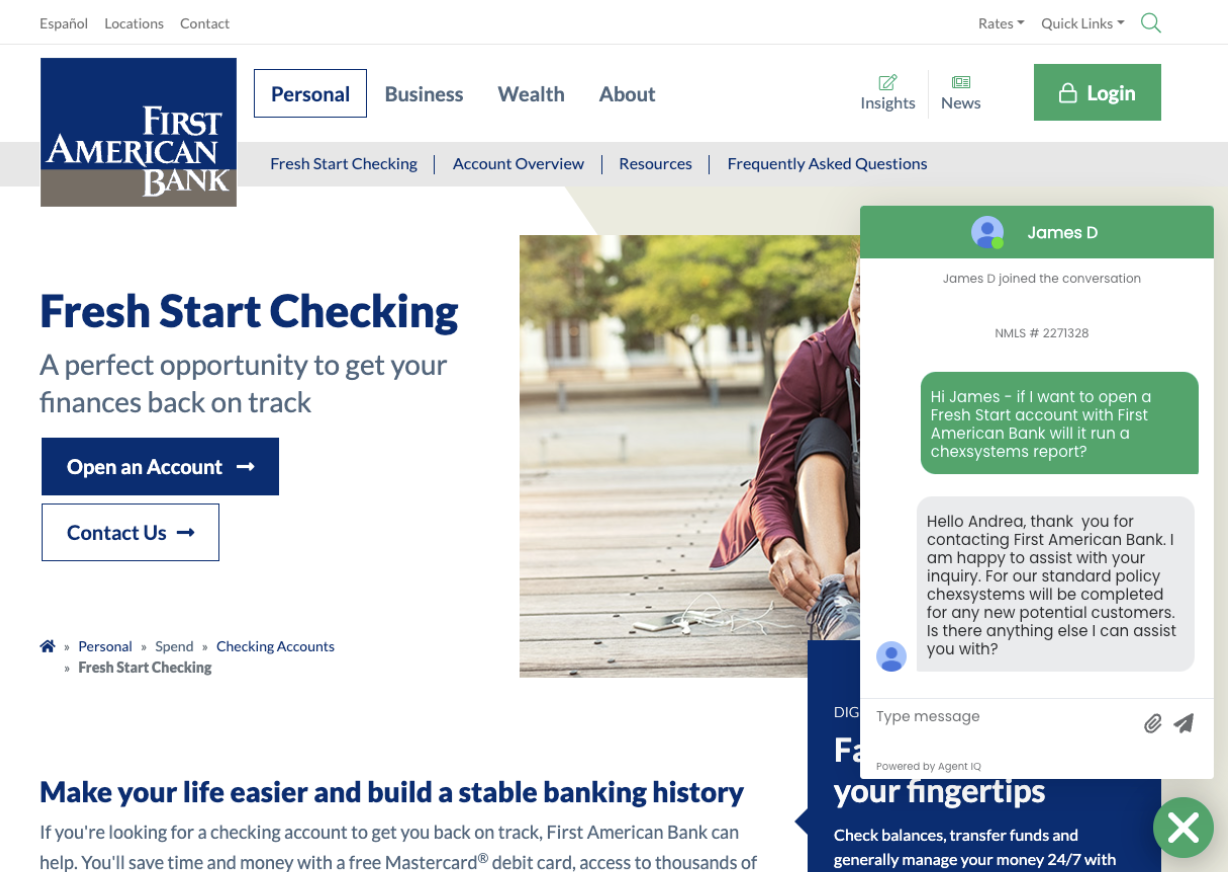

Does First American Bank use ChexSystems?

Yes. While some online sources state First American Bank doesn’t use ChexSystems, we spoke with one of the bank’s representatives, who confirmed that First American Bank does use ChexSystems for all new applicants. However, they accept customers on a case-by-case basis.

Here’s a screenshot with more details:

Does US Bank use ChexSystems?

While U.S. Bank utilizes ChexSystems, it has a reputation for being more forgiving of negative records than other banks. If you don’t have a history of fraud or any outstanding debts with U.S. Bank, you may be able to open an account with them regardless of what’s on your ChexSystems report.

Does PNC Bank use ChexSystems?

Yes. Although PNC Bank has a Foundation Account for applicants who need to improve their banking track record, a representative of the bank confirmed that it does use a third-party system to vet applicants based on their banking history and number of accounts at other institutions.

Does Wells Fargo use ChexSystems?

Yes. Financial sites often claim that Wells Fargo doesn’t use ChexSystems, but when we contacted a representative, we learned that Wells Fargo does run ChexSystems reports, even for its Clear Access Account.

How We Chose the Best Banks That Don’t Use ChexSystems

To narrow down the best banks that don’t use ChexSystems, we conducted a thorough evaluation. Here’s a breakdown of our methodology:

- ChexSystems policy: Our first step was to verify that the banks we considered had a clear policy of not using ChexSystems. We examined each bank’s terms and conditions, reviewed customer feedback, and checked reliable sources to confirm this information.

- Account features: We carefully analyzed the account features offered by each bank, such as minimum balance requirements, monthly maintenance fees, ATM access, mobile banking, overdraft options, and more. We aimed to recommend banks that provided a wide range of features suited to different customer needs.

- Customer satisfaction: We also took real customer experiences and feedback into account, looking at app ratings, third-party ratings, and reviews to gauge customer experience.

- Accessibility: We evaluated the availability and accessibility of the banks’ services. This included considering the number of branch locations, ATM networks, and online and mobile banking features. We aimed to recommend banks that are accessible to a wide range of customers.

- Additional services: We assessed any additional services provided by the banks beyond basic checking accounts. That includes features like savings accounts, credit cards, loans, and investment accounts.

- Financial stability: We also considered the financial stability and reputation of each bank. This involved researching the bank’s asset size, ratings from financial institutions, and history of stability. We aimed to recommend banks that are trustworthy and secure.

- Application process: We reviewed the process for opening an account with each bank. That included considering factors like the ease of application, required documentation, and approval time.

No comments yet. Add your own