You may wonder what happened to all the banks as you drive around your town. We used to see the banks we recognized on every corner. But today, they all seem to be closing.

So, how many banks are in the US, and should you worry about your bank closing?

How Many Banks Are in the US?

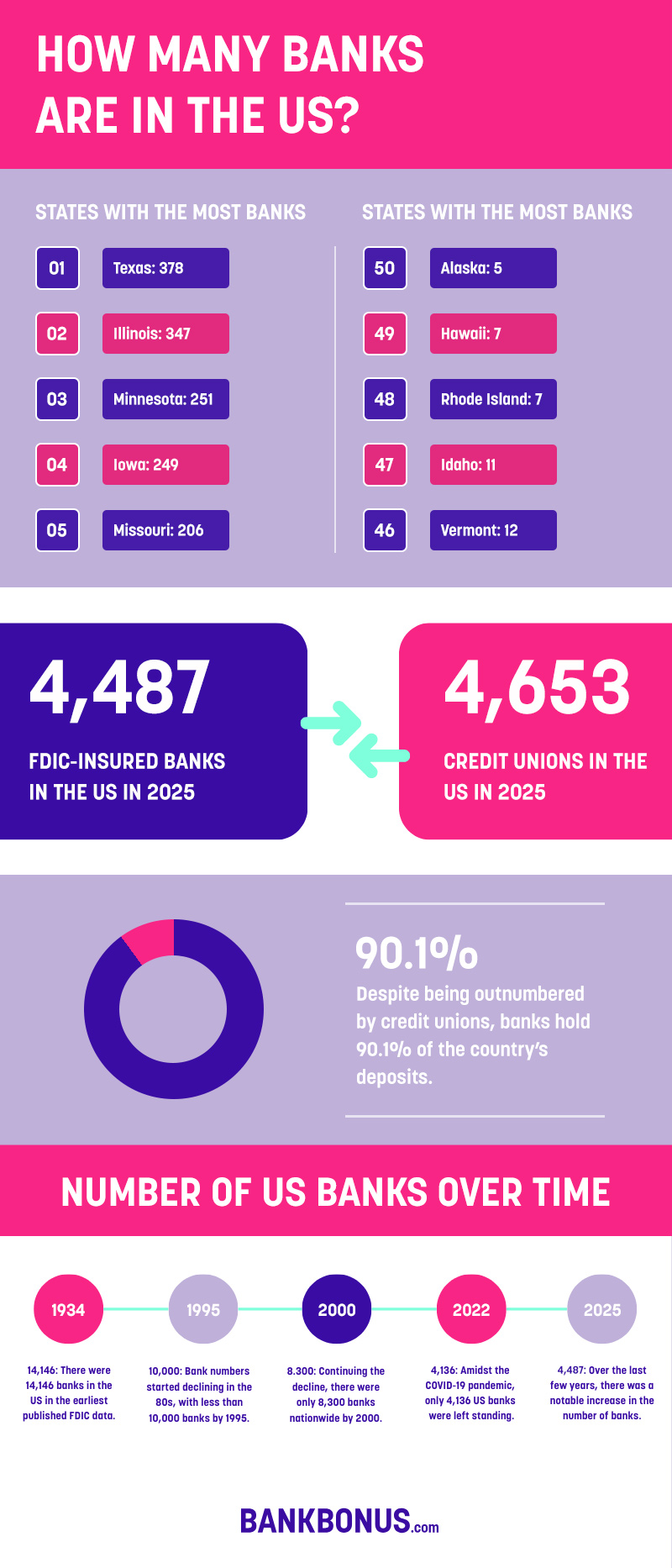

According to the FDIC, there are 4,487 FDIC-insured banks and 2,848 FDIC-supervised banks in the United States as of December 31, 2024.

What Does the FDIC Count as a Bank?

The FDIC counts commercial and savings banks as banks. Commercial banks are the banks you know best. They are the large, national banks on every corner and the names you recognize, like Chase, Wells Fargo, and Bank of America. Commercial banks offer many types of services, including deposit products and loans for personal and business use.

Savings banks are similar to commercial banks but cater to consumers, not businesses. Savings banks often have fewer loan products, focusing mostly on mortgage loans and less on personal or auto loans.

Commercial and savings banks are FDIC-insured. If the bank fails, depositors are protected up to $250,000 per person.

How Many Credit Unions Are in the US?

There are currently 4,653 credit unions in the United States and 141,624,132 credit union memberships. While banks have 90.1% of the country’s deposits, credit unions are an important part of the industry.

States with the Most Banks

Of the 4,487 banks in the United States, the largest concentration is in the following states:

States with the Least Banks

Some states have very few banks, with only a handful to choose from when looking for one that is FDIC-insured. Here are the states with the fewest number of banks:

- Alaska – 5

- Hawaii – 7

- Rhode Island – 7

- Idaho – 11

- Vermont – 12

What Are the Largest Banks in the US?

The largest banks by assets in the US are as follows:

- JPMorgan Chase

- Bank of America

- Wells Fargo

- Citibank

- US Bank

Number of Banks in the US Over Time

The FDIC data regarding the number of banks in the United States began in 1934; there were 14,146 banks at that time. The number of banks in the US remained steady, varying from 13,000 to 14,000 through 1988. Then, the numbers began to decline steadily, reaching just under 10,000 in 1995.

By the year 2000, there were 8,300 banks in the United States, and that number was cut in half by 2022, with only 4,706 banks still standing. That number is slightly lower today at 4,487 banks.

Why Are Bank Numbers Declining?

There are three main reasons bank numbers declined and continue to do so today.

Failing Banks

Banks and the economy are closely connected. Banks often fail when the economy struggles, especially smaller ones that have to go to great lengths to get new customers. This often includes paying much higher interest rates than they can afford.

And if the economy doesn’t correct itself quickly enough, these banks pay out more than they receive and cannot keep their doors open. This was a common occurrence in the 1980s, which is why there was such a sharp decline near the end of that decade.

We saw something similar in the 2000s when high-profile banks purchased mortgage-backed assets that didn’t pay out, leaving them no choice but to close. However, after 2016, the sharp decline tapered off, with less than 30 banks failing between 2016 and today.

Merging Banks

It’s a common trend for large banks to purchase small banks. Large banks do this to keep growing, and small banks give in because they buckle under the pressure of state and federal regulations.

Many small banks also cannot keep up with the online bank growth, succumbing to the pressure of larger banks that can have a large online presence. Most consumers today prefer to bank online (or at least have the option) and will choose larger banks over smaller ones when looking for these features.

Bank Charters

The FDIC began tracking bank charters in 1984; at that time, there were 391. Like the number of banks, they drastically decreased. By 1992, there were fewer than 75 new bank charters.

The United States saw a slight increase in 1999 with 232 new bank charters. But from 2012 to 2016, there was a negligent number of new charters. Since then, we’ve seen a slow increase, with 68 new charters since 2017 – 6 of which were added in 2024.

The Future of Banks in the US

Everyone has their guess regarding what banks will look like moving forward. While no one can say for sure, if technology continues advancing at the current pace and banks continue consolidating, it’s safe to say the number of banks will steadily decrease. This is especially true as there are fewer small banks for larger banks to acquire.

High interest rates can make banks more profitable, but typically not profitable enough to bring more banks into the industry. Fortunately, many fintech apps are making their way to the scene, and an FDIC-insured bank backs each of these apps.

While banking may not look the same, such as sitting at the drive-up or talking to a teller, the same products and services exist to help you reach your financial goals.

No comments yet. Add your own