There are many reasons to have a credit card, but many people sign up for the rewards and bonuses. However, a shocking 23% of credit card holders didn’t use their rewards last year!

While that number is down from 31% in 2021, a sizeable number of credit card holders are letting their rewards go to waste.

Let’s look at the credit card statistics and see how you stack up compared to others.

Credit Card Ownership and Usage

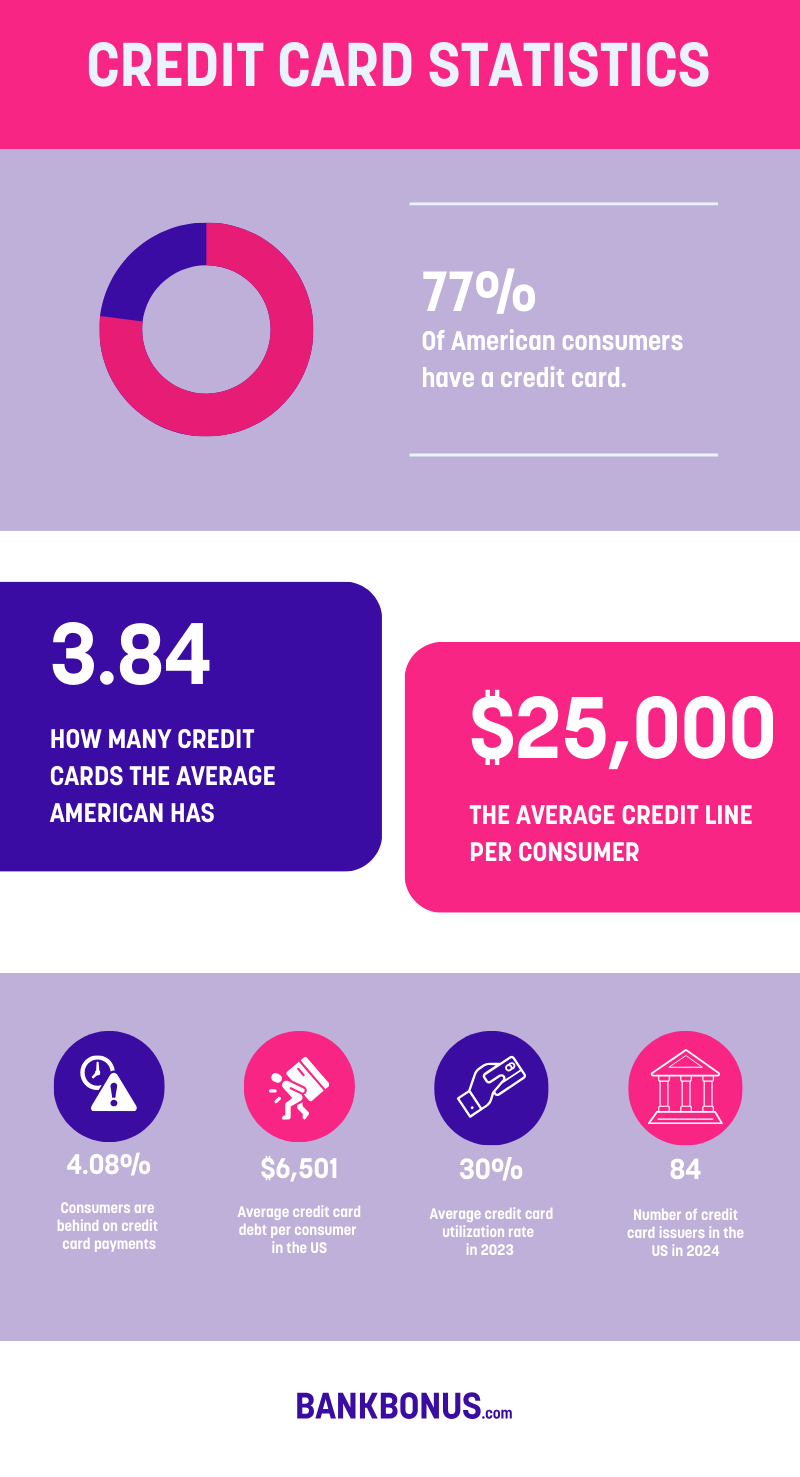

At least 77% of US consumers have a credit card. According to the most recent data, the average credit card debt per consumer is $6,501, a 10% change from the previous year. Total credit card lines have increased 9% over the course of the year, with the average per-consumer credit line hitting $25,000.

The average American has 3.84 credit cards, and the average credit utilization increased 2% from 28% to 30% in 2023, and a total of 4.08% of consumers are behind on their credit card payments:

- 2.01% are 30 to 59 days late

- 1.26% are 60 to 89 days late

- 0.34% are 90+ days late

Trends in Credit Card Ownership Over Time

The second quarter of 2023 saw the second-highest credit card origination in quarter two in history. The first highest was in the second quarter of 2022. However, total credit card balances didn’t fall accordingly. Instead, they increased from quarter 3 2022 to quarter 3 2023 from $866 billion to $995 billion.

As of 2023, there were 84 credit card issuing businesses, which is 1% higher than in 2022. This number has consistently increased 1% year-over-year since 2018.

Frequency of Credit Card Usage for Everyday Transactions

The most popular way consumers pay for everyday transactions is with a mobile wallet, which accounts for 50% of online transactions, according to the latest data. The second most common way to pay for online transactions is with a credit card, which accounts for 20% of these transactions.

Regarding in-person transactions, 66% use an electronic form of payment, including debit and credit cards, and just as many use other online forms of payment, including Zelle and PayPal.

Credit Card Rewards Programs

Credit card reward programs are often why consumers sign up for credit cards, but millions are sitting on unused rewards.

Popularity and Engagement With Credit Card Rewards Programs

Over 70% of Americans have a rewards credit card, and 65% say they focus more on credit card rewards now than ever before. However, 52% of Americans compare their rewards credit cards to what is currently available once every three years or less.

Redeemed Credit Card Rewards (By Generations)

Here’s how different generations are using their credit card rewards when they aren’t going unused.

- Cashback or gift cards: Boomers top the chart at 55%, versus Gen Z at 51%

- Free hotel stay: Gen Z tops the chart at 28%, and Boomers bottom it out at 7%

- Free flights: Gen Z is also most likely to take the free flight (21%) versus Gen X (9%)

Unused Rewards Statistics

39 million adults didn’t redeem their credit card rewards in 2023, but of those that have, 39% maxed their value, receiving as much as $300 in cash back, free hotel stays, and flights.

Overall, older generations, females, and people in lower income brackets were the most likely to not redeem their rewards.

Here’s how reward redemption adds up by age.

- 28% of Gen X and Boomers didn’t redeem their credit card rewards last year

- 15% of Millennials didn’t redeem their credit card rewards last year

- 18% of Gen Z didn’t redeem their credit card rewards last year

Reasons Why Cardholders Are Not Redeeming Reward

It might seem baffling to wonder why cardholders wouldn’t redeem their rewards. Here are some common reasons:

- Unaware of expiration: Without reading the fine print, many cardholders don’t realize their rewards have an expiration date and unknowingly lose them

- Trip cancellation: Some cardholders used their rewards, but then their trip or flight was canceled

- Prefer to stockpile: Some people get anxious when using rewards, kind of like spending money; they would rather stockpile them and don’t end up using them.

Credit Card Fraud

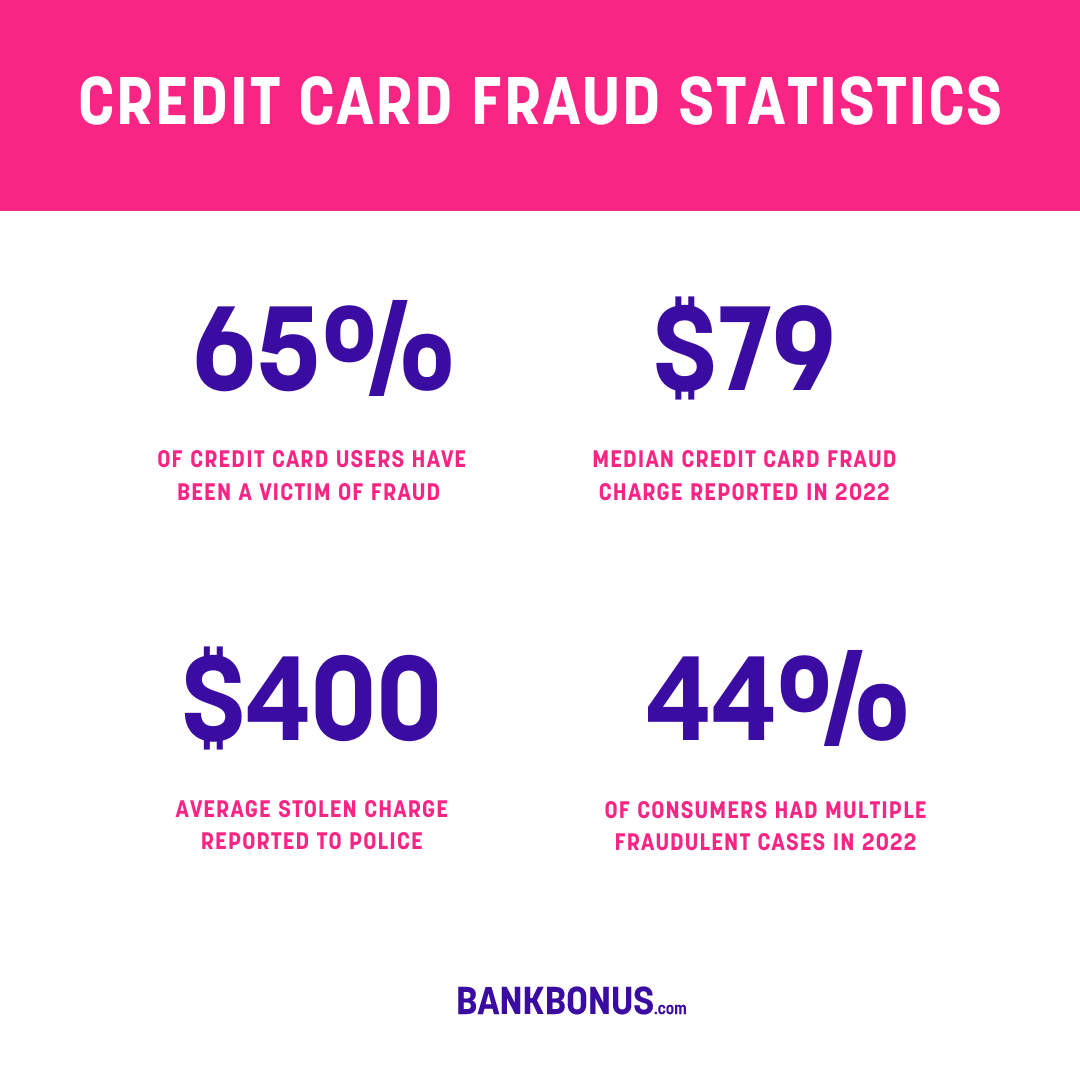

The FTC received 416,582 calls about credit card fraud in 2023, making it one of the worst forms of fraud in the United States.

Incidences of Credit Card Fraud

- 65% of credit card users have been a victim of fraud at some point

- The median fraud charge is $79 in 2022, a 27% increase from 2021

- The average stolen charge reported to police is $400

- 44% of consumers had multiple fraudulent credit card cases in 2022

The Bottom Line

Credit cards can be a good way to make money on the side when used right. The key factor is knowing the fine print so you don’t let your rewards go to waste and protecting your identity so no one makes fraudulent charges.

Using credit cards properly can help you build credit, save money, and manage your finances. It’s important that you don’t use them ‘just to spend’ or spend just to get rewards.

But when paid off monthly and used for everyday purchases, you can earn great rewards, putting money in your pocket or splurging on things you normally wouldn’t consider.

No comments yet. Add your own