CD rates are heavily affected by inflation and the Federal Reserve’s decisions with interest rates. Historical CD rates have seen rates as high as 15.68% and as low as 0.10%. Today, we are in between those rates, with rates high from what we’re used to in the last decade.

Average CD Rates From 1980 to 2023

Over 40 years ago, CDs were ‘the investment’ to have. At the start of 1980, 3-month CD rates were 13.39%, but that was a year of serious volatility. In March, they hit 17.57% but quickly fell to 8.49% in June of that same year. This was due to a quick six-month recession that caused the goods industry to lose 1.4 million jobs.

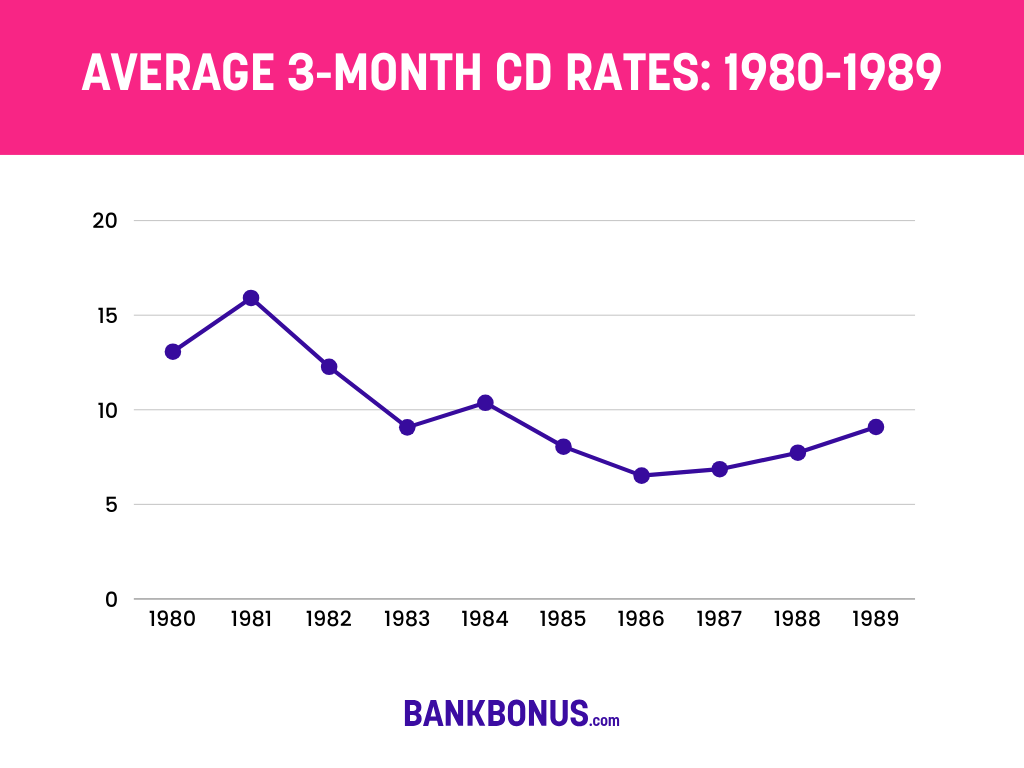

CD Rates From 1980 to 1989

The CD rate volatility continued throughout 1981, with 3-month CD rates drastically increasing and decreasing, but overall, they remained above 15%.

By August 1982, the average 3-month CD rate was down to 10.62%, which continued decreasing from there, thanks to the second recession of the 80s that lasted from July 1981 to November 1982.

The remainder of the 1980s continued to see many ups and downs, with 3-month CD rates ending at 8.32% in December 1989, thanks to inflation rates settling and averaging at 3.5% after a record high of 14%.

Here’s an overview of the annual average 3-month CD rate throughout the 80s, using Federal Reserve data.

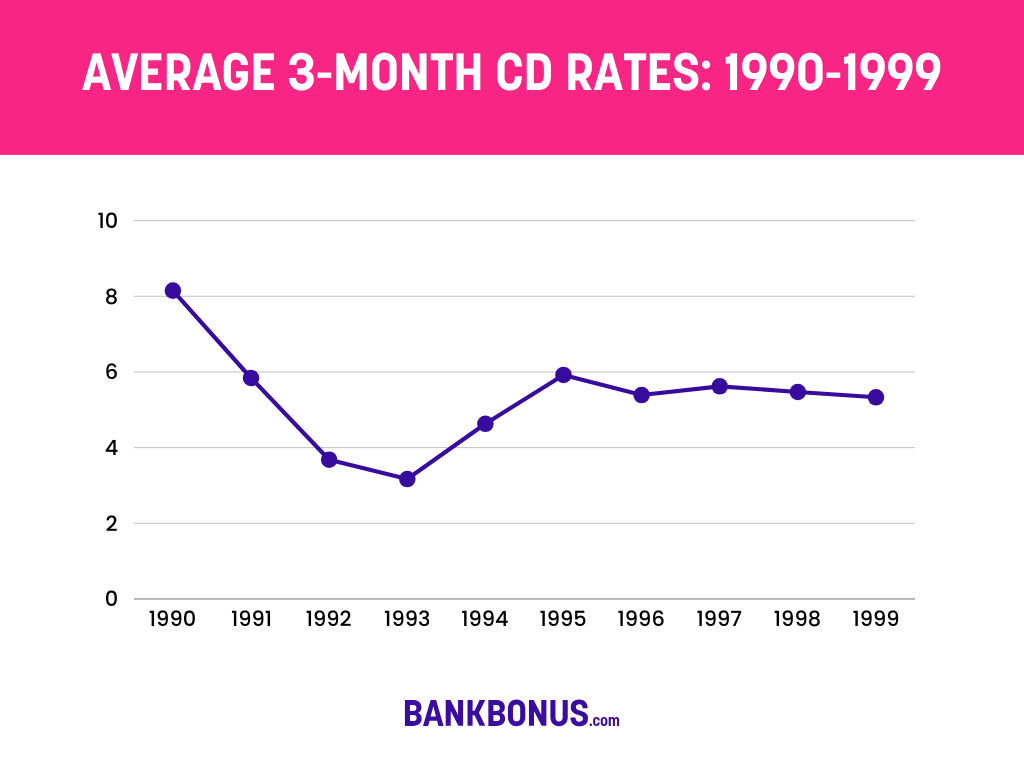

CD Rates From 1990 to 1999

The early 1990s saw yet another recession, this time caused by post-war complications, including job losses due to lower defense spending and the Savings & Loans crisis that caused over 3,000 banks to close.

The inflation rates were 5% and above, which explains the higher CD rates of 8% or above during that time. As the economy settled and inflation rates fell, CD rates fell, too, reaching an all-time low of 3.12% in September 1993.

By 1996, 3-month CD rates settled around 5% up until Y2K.

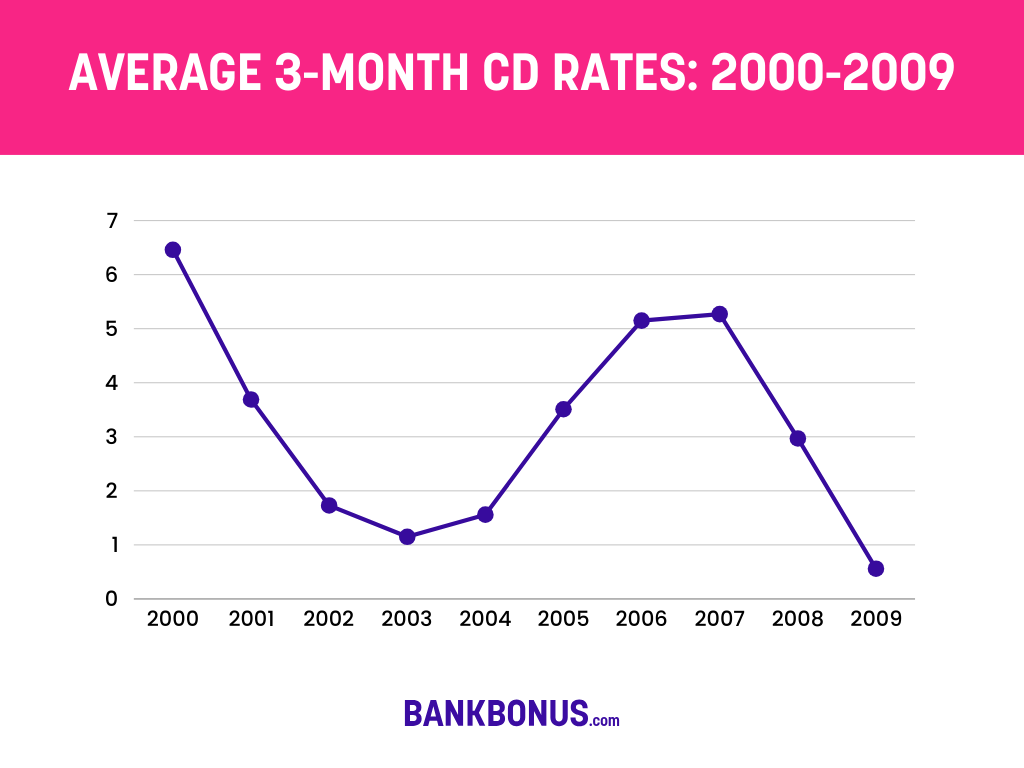

CD Rates From 2000 to 2009

In early 2000, the Fed had to step in and lower interest rates to stimulate the economy. From late 2001 to early 2002, 3-month CD rates fell from 1% to 2% as the aftermath of the dot-com bubble continued to have a chokehold on the economy.

During the mid-2000s, 3-month CD rates bounced back up to over 5%, but the decade finished how it started, in another recession, with rates barely over 1% and the economy in a housing crisis.

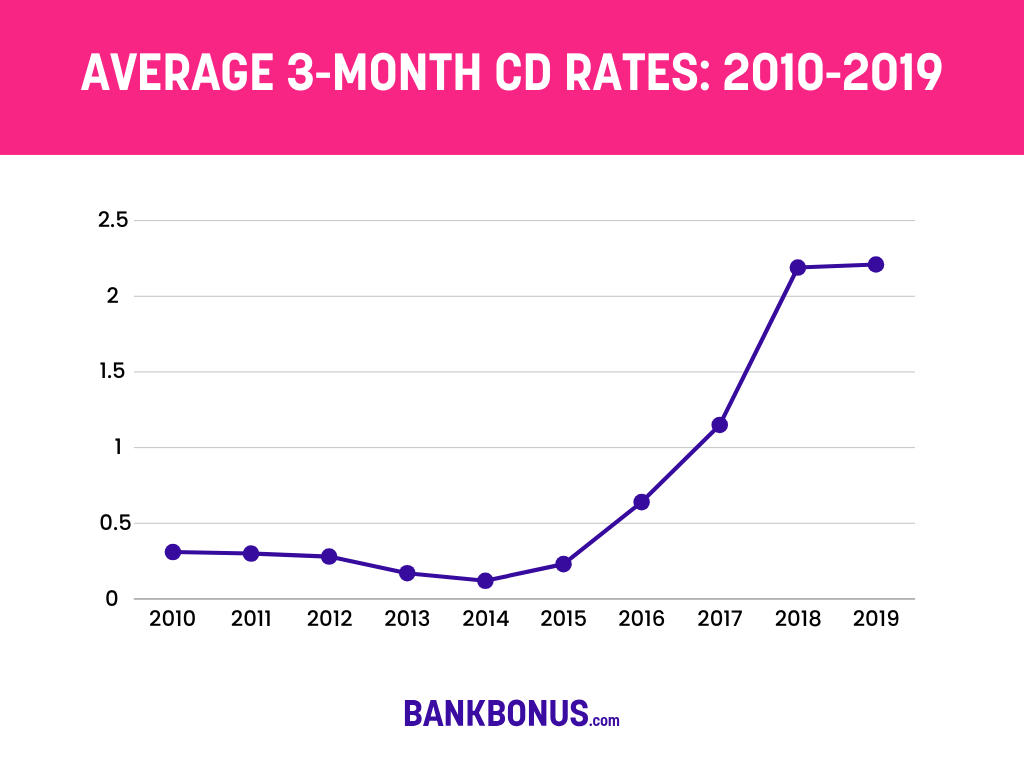

CD Rates From 2010 to 2019

The effects of the housing crisis continued into 2010 and later when banks continued to be bailed out by the government, making them less dependent on deposits. This led to even lower CD rates, with 3-month CDs paying an average of 0.20% to 0.30%, a mere fraction of what they once paid.

It wasn’t until March 2018 that we saw rates increase above 2%, but even that remained low through the end of the decade.

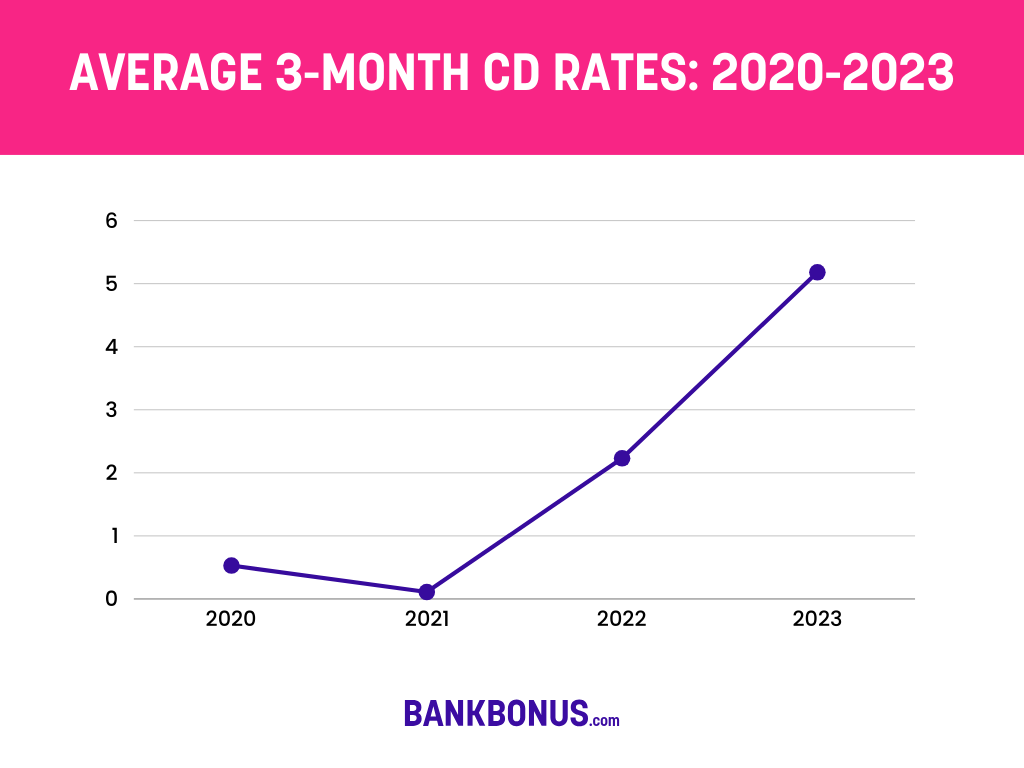

CD Rates From 2020 to 2023

2020 was the year of the COVID pandemic, and 3-month CD rates fell to their all-time lows, barely scraping past 0%. This was due to the Federal Reserve lowering interest rates almost to 0%.

In July 2020, 3-month CD rates were at a low of 0.18%, and they continued to fall to 0.10% from May to September 2021.

Since then, CD rates increased drastically due to the high inflation rates, reaching an all-time high of 5.49% in September 2023.

Factors That Influence CD Rates Over Time

Many factors affect CD rates over time, but the federal funds rate and inflation are the most influential factors.

While CD rates aren’t directly tied to inflation, it’s a natural consequence because the Fed attempts to reduce spending by increasing the federal funds rate when inflation increases.

This allows banks to offer higher CD rates, encouraging more people to deposit funds versus spend them.

A final factor is competition from other banks. Like stores keep their prices competitive, banks keep their CD interest rates competitive to win more depositors. If you had the choice between Bank A paying 2% and Bank B paying 5% for the same CD term, which would you choose?

How To Analyze Historical CD Rates

When looking at historical CD rates, it’s important to consider the economic factors occurring at that time. CD rates don’t necessarily follow a pattern, so it’s not possible to predict future rates based on historical patterns.

When evaluating CD rates, look at the big picture, including inflation rates. Compare the inflation rates to the current rates to see how the rates compare and look at any other factors, such as excessive bank closures or new charters and other economic pressures that could have affected rates then.

Predictions for CD Rates in the Coming Years

Most experts believe the CD rates will remain steady for the next few years. The Federal Reserve has not increased the federal funds rate during the last few meetings.

During their last meeting, they indicated that there might be federal funds rate cuts in the upcoming meetings, which could mean slightly lower CD rates than we’ve enjoyed the last few years, but certainly not a reason not to invest in CDs.

Frequently Asked Questions

Historical CD rates help you understand when a CD is a good investment and when you might want to consider other options. Here are more questions people have about CD rates.

Will CD Rates Continue To Go Up?

CD rates are predicted to stay stable for now and may decrease slightly as we move into 2024. It depends on if and when the Fed cuts interest rates.

What Were the Highest and Lowest CD Rates Recorded?

The highest CD rate ever recorded was 15.68% in November 1980, and the lowest was 0.09% in June 2021.

How Do CD Rates Compare to Inflation Rates?

CD and inflation rates typically go hand in hand. When inflation rates get too high, the Fed increases the federal funds rate to encourage more people to deposit funds rather than spend them. When inflation is low, the Fed tries to encourage spending by lowering the federal funds rate, which causes banks to pay lower APYs.

Where To Find Historical CD Rate Data?

The Federal Reserve is the most accurate place to find historical CD rates and corresponding information.

How Did Inflation Impact CD Rates Historically?

Inflation typically causes CD rates to increase, especially when the Fed increases rates. High periods of inflation require the government’s influence to encourage more people to deposit/save funds versus spend.

Are Long-Term or Short-Term CDs More Affected by Interest Rate Changes?

Currently, short-term CDs are more affected by interest rate changes than long-term. Historically, long-term CDs paid much higher rates than short-term ones, but this has been reversed over the last few years, and experts believe the trend will continue.

How High Will CD Rates Go In 2024?

Most experts agree that CD rates will top out in 2024. So, the interest rates you see now for CDs are about as high as you’ll see rates. While you shouldn’t avoid investing in CDs for fear of an interest rate decrease, now may be a good time if you plan on investing in a CD.

The Bottom Line

Watching historical CD rates can help you determine how to invest your funds, but don’t rely only on history. Look at the current economic outlook and inflation rates.

Listen to what the Federal Reserve says about their monetary policy, and, of course, shop around for the best rates, as CD rates are competitive, like any other banking product.

No comments yet. Add your own