The Pennsylvania State Employees Credit Union is one of the state’s largest financial institutions. PSECU offers in-service and online banking for its customer base of state and local government workers and their families, as well as PSECU-affiliated organizations.

The credit union offers a comprehensive line-up of products for consumers at all stages of their financial journey. This includes no-fee deposit accounts, student accounts, auto loans, home loans, free checks, free overdraft protection, and retirement and investment products. Its referral and new member bonuses are exceptionally generous.

What Is PSECU?

PSECU, the Pennsylvania State Employees Credit Union, was founded in Harrisburg, Penn. in 1934

Struggling financially and unable to get bank loans, a group of 22 founding members pooled their resources together to start the credit union.

The founders’ motto of “People helping people” still drives PSECU’s mission, as it offers a range of products and services for customers of all credit scores and income levels.

PSECU is a full-service financial institution, and it has the potential to be a one-stop shop for most of its customers as it offers checking, savings, money market and CD accounts, IRAs, car loans, mortgages and home equity loans, and online and mobile app banking.

The credit union employs over 800 workers and manages over $8.2 billion in total assets. Among all Pennsylvania-headquartered financial institutions, PSECU is the third largest for total number of customer accounts and the tenth largest for total assets.

LEARN MORE:

PSECU: Checking Account

PSECU offers one checking account to its members that comes loaded with perks. While many other banks offer different-tier checking accounts with different requirements and monthly fee structures, PSECU keeps things simple.

Its checking account, called Checking for Life, features perks and benefits that are better than the top-tier accounts you’d find at most other financial institutions.

Checking for Life

PSECU’s checking account is completely free. It has no minimum balance requirements, free bill pay, free balance transfers, and offers access to your funds 24/7.

Account holders can receive Visa debit card rewards for everyday purchases, earning $0.05 or $0.10 for purchases of $10 or more made with their PSECU Visa card. Cardholders who receive at least $500 in direct deposits every month qualify for the $0.10 per purchase reward rebate.

Other perks include access to over 70,000 fee-free ATMs and reimbursements for out-of-network ATMs, no-fee overdraft protection transfer service, and balances earn interest at a 0.20% APY rate.

LEARN MORE:

PSECU: Savings Accounts

Penn State Employees Credit Union offers two savings account options: Youth savings and general consumer savings.

Savings

As a traditional deposit savings account, it’s designed to help you save for a rainy day. Balances earn a 0.50% APY. While this is a relatively low rate of return, it can be linked to a checking account for free overdraft protection.

In the event your checking account gets overdrawn for purchase or bill payer transactions, PSECU will automatically transfer funds from your checking account to cover the charges.

LEARN MORE:

Youth Savings

This account is designed for teens and children under age 18. Balances up to $500 earn a 2.00% APY, encouraging them to jumpstart their savings and learn money management skills. Balances above $500 earn the general lower-yield savings rate of 0.50%.

LEARN MORE:

PSECU: CD Accounts

Penn State Employees CU offers certificates of deposit (CDs) to customers who want a secure way to earn a higher return on their deposit.

CD accounts offer a guaranteed rate of return on your deposit when funds are left in the account for a set term limit. PSECU CD terms range from 3 to 60 months and a minimum deposit of $500 is required.

The credit union’s current CD rates range from 1.50% to 5.15%. While not the highest you’ll find anywhere in the nation, these are very attractive rates and at the upper end of what banks and credit unions offer.

PSECU does impose a penalty fee for early withdrawals. Additionally, you have 10 calendar days after your CD’s maturity (end of term) to redeem the funds. After those 10 days, your CD will automatically renew for the same terms (length) and at the new dividend rate now in effect.

LEARN MORE:

PSECU: MMA Account

Penn State Employees CU offers a money market account (MMA) which is a spending and savings account rolled into one.

There are no deposit or withdrawal limits, and the PSECU money market account earns higher interest rates than a savings account, and higher balances can earn increased dividends.

Balances of just $500 or greater can qualify for these higher earnings. This is an exceptional feature — with most MMAs, balances of $10,000 to $100,00 may be required to receive a higher-tier APY.

PSECU’s current MMA rates range from 2.50% to 3.00%.

LEARN MORE:

PSECU Additional Products

In addition to PSECU’s deposit accounts, CDs, and money market accounts, it offers an extensive line-up of other banking products and services.

- Student banking

- Student loans

- Auto loans

- Auto warranties

- Debt consolidation

- Credit cards

- No-fee credit card balance transfers

- Personal loans

- Mortgages

- Home equity loans

- Individual retirement accounts (IRAs)

- Financial planning

- Investment services

- Estate planning

- College education savings

- PSECU Protect – insurance for home, life, vehicle, pet, and more

- Business banking

Features

- Highly-rated mobile app: The PSECU cell phone app has a 4.8-star rating in iTunes and a 4.5-star rating for Androids.

- Competitive range of accounts: PSECU boasts a truly, fee-free checking account that is also interest-bearing, and CDs and MMAs with attractive yield rates.

- Helpful loan and rate calculators: COM has many easy-to-use calculators to calculate rates of return or total interest for CDs, mortgages, and other financial products.

- Flexible membership criteria: The PSECU is open to state residents employed at any state and local levels of government, including school district employees and students at affiliated schools. Other individuals can purchase a membership at an affiliate state nature society to join the PSECU.

- Two (2) physical locations in Harrisburg: Strawberry Square Service Center (303 Walnut Street) and Cameron Street Service Center (One Innovation Way).

Pricing and Fees

PSECU does charge fewer service and penalty fees than most other financial institutions, but it does have a schedule of account maintenance fees. Here are some of the more noteworthy charges that PSECU assesses.

- Courtesy Pay: PSECU members are charged a $15 fee for overdraft items that are paid by check or ACH.

- Non-Sufficient Funds (NSF): For unpaid overdraft items, due to insufficient funds, the credit union does not charge any NSF fees. This lack of fees is noteworthy and worth a callout.

- Overdraft Protection: Similar to the fee-free NSFs, there is no fee for overdraft coverage. Customers can link their checking account to a savings or money market account as a backup. As a courtesy, available funds will be transferred to an overdrawn checking account to prevent courtesy pay charges or returned items.

- Wire Transfers: There is no service charge from PSECU for incoming wire transfers, but there is a $20 fee for outgoing domestic wire transfers. Consult with the credit union directly for international wire transfer fees.

- Stop Payment: PSECU will charge a $ 10 fee for a one-time stop payment, or a $15 fee for the stop pay of a series of payments or an ACH permanent stop.

- PIN Mailer / Excessive PIN: If you forget your PIN number more than twice within a 6-month period, there is a $1 “PIN mailer fee” for each additional new PIN request. There is also a separate $1 fee for “excessive PIN” requests, where a change of account PIN is requested more than two (2) times within six (6) months.

- Paper Statement: PSECU charges a $5 fee for a paper copy of your bank statement. However, that fee is waived for the last two monthly statements or the last single quarterly statement.

- Dormant Account: The credit union charges a monthly $2 fee for dormant accounts. An account is considered dormant if there has been no account activity or member-initiated correspondence for at least one year. If the member’s account has a balance of $2 or less, that amount will be charged for the dormancy fee and the account will be closed.

Getting Started

To get started with the Pennsylvania State Employees Credit Union, you can open an account at a PSECU location (there are two branches in Harrisburg) or online.

The process is straightforward and usually takes 10-15 minutes. You’ll need to provide your name, address, Social Security number (SSN), email address, phone number, and some other basic information.

It will take the credit union at least a few days to verify your eligibility. To be eligible to join PSECU, you must meet one or more of the following member criteria:

- Be a Pennsylvania state, local, or municipal government employee, including school districts. More than 1,000 employers provide PSECU

- Attend a college or university with a PSECU relationship, or be an alumnus or staff member of a PSECU-affiliated school.

- Reside with someone who is a current PSECU member, including roommates.

- Be a qualifying family member or relative of an existing PSECU member; qualifying relations include spouse, parent or stepparent, child or stepchild, sibling or stepsibling, grandparent, or grandchild.

- Become a member by joining the Pennsylvania Recreation and Park Society (PRPS). Although it has a Pennsylvania focus, membership is open to residents of any state. Annual membership dues are $20, but PSECU will cover $10 when joining PRPS during the application process.

Promotions

Pennsylvania State Employees Credit Union regularly offers attractive new member bonuses. At the date of this article’s publication, PSECU offered the following promotions.

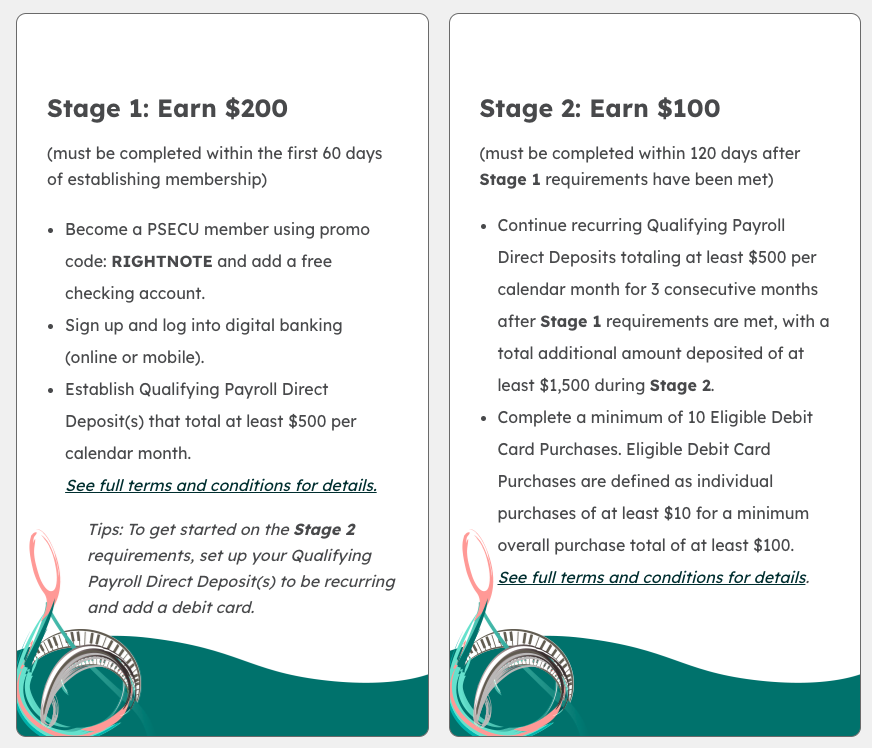

Hit the Right Note

A new member promotion to earn up to $300 in registration bonuses. New members can earn $200 at completion of the first level and $100 for the second level.

Referral Bonuses

Existing PSECU members can refer friends and earn up to $500 in referral bonuses. Members can invite friends and family through a custom link shareable by email, text, or on social media. There’s a $50 bonus for each referral who joins, for up to 10 referrals, or $500 per year.

See all bank promotions and bonus offers in Pennsylvania

Security

Pennsylvania State Employees Credit Union uses many measures to keep your money and your data safe.

As a credit union, PSECU is not FDIC insured as that is a program for banks. But in a similar scheme, your PSECU deposit is insured for up to $250,000 per member per account type by National Credit Union Associations (NCUA) insurance. Like the FDIC, the NCUA is backed by the U.S. government.

In terms of data security, PSECU leverages the latest in cybersecurity methods to protect its customers. This includes data encryption, multi-factor authentication (MFA) for device log-in, PIN mailers, and regular communications to members on privacy tips and alerts.

Customer Support

Although PSECU has limited branch locations, it does offer members many ways to contact customer support.

- By phone: Call 1-800-237-7328 (or 1-717-255-1760) to talk to a customer service agent. Phone line hours are Monday to Friday 8 a.m. to 6 p.m. EST and Saturday 9 a.m. to 5 p.m. EST.

- Self-service phone menu: Call 1-800-435-6500.

- Web form: Send an inquiry via web form on the PSECU contact page. Note these submissions are not secure and you should not submit sensitive information like your account number or PIN.

- Email: For account questions, log into your banking account and submit a secure email.

- Post mail: Send written correspondence to P.O. Box 67013

Harrisburg, PA 17106-7013.

Customer Reviews

PSECU members generally have highly positive things to say about their experience with the credit union. Here’s a sampling of reviews across different online consumer review boards.

5-Star Review

Easy online process, great rates, contacting them is never a problem. Very helpful throughout the process. I would recommend using this credit union to anyone shopping for a car or any loan or credit card. You do not need to live in Pennsylvania to be a member.John

4-Star Review

Happy with PSECU at this time, Have been with them for a long time. Would recommend PSECU to my friends. They have been good to me as a loyal customer.Claire

3-Star Review

Trying to open a new account has been a nightmare...several online sessions, many phone calls...now waiting for US Mail.Mclitherow

Pros and Cons

As with any credit union or financial institution, there are pros and cons to PSECU.

Pros

- Award-winning credit union: PSECU has won national and statewide recognition from Newsweek, Forbes, and other financial outlets for its fee-free checking account and overall member experience.

- Free checking accounts with no minimum balance: There are no gotchas with PSECU’s checking; it truly is a fee-free account with no direct deposit or balance requirements.

- Variety of personal loan products: Solid mix of loan products, including student loans, home loans, auto loans, and debt consolidation loans, to meet the needs of most consumers.

- Specialty saving rates for children’s accounts: Young savers can earn a 2.00% APY on their first $500.

- Rewards debit card: Earn cash back rewards for debit card POS transactions of at least $10.

- Excellent transparency: While many financial institutions will not disclose fees and APY rates online, PSECU is upfront about all of those details. It publishes the information prominently.

Cons

- Relatively low interest rates on savings accounts: The current 0.50% APY is on the low side; many financial institutions have better rates for their high-yield savings accounts.

- Limited branch locations: PSECU only has two (2) physical locations, both in Pennsylvania. The limited presence means most customers, in and out of state, lack access to PSECU’s coin counting, cash deposit, notary services, and other on-site teller services.

- Limited customer service hours: Phone support is available Monday to Saturday during traditional business hours.

Alternatives to Pennsylvania State Employees Credit Union

Beyond PSECU, there are many other solid credit unions and banks to consider for Pennsylvania area residents.

Chase Bank

New York-based Chase Bank has over 100 branch and ATM locations in over 50 cities throughout the Quaker state, as well as over 4,700 branches around the country. Beyond the ultra-convenient accessibility, Chase has tremendous financial security, superior credit card offerings, and offers frequent promotions for its credit cards and checking accounts.

Members 1st Federal Credit Union

Another hometown credit union, Members 1st FCU is headquartered in Enola, Pennsylvania. Members 1st is the 12th largest financial institution in the state (PSECU is the tenth largest) for total assets managed, and it offers 60 convenient branch locations.

Product line-ups are similar, but right now Members 1st CD rates are better (5.25% APY vs 5.15% APY), and it has a wider range of deposit savings accounts. Members 1st CU also offers health savings accounts, long-term care insurance, and other products that PSECU does not have.

Members 1st, however, lacks some of PSECU’s perks like interest-bearing checking accounts and its MMA rates (starting at 0.05% APY) are markedly lower than PSECU.

First National Bank of Pennsylvania

Based out of Pittsburgh, First National Bank (FNB) is the largest, state-headquartered bank in Pennsylvania. It manages nearly $45 in total assets and has over 330 locations throughout the Quaker State.

Compared to PSECU, it offers a higher range of checking account options, higher CD rates (5.25% APY for a 13-month CD), and flex CD options which allow customers to withdraw funds early without being hit with a penalty.

Frequently Asked Questions

Here are some of the most common FAQs that readers have about banking with the Pennsylvania State Employees Credit Union.

What Credit Score is Needed for PSECU?

For a PSECU credit card, you’ll likely need fair to good credit or better to qualify. This means a score of at least 620. If you have poor credit or no credit, then a PSECU secured Visa credit card may be a better option.

Does PSECU Do a Hard Pull?

Yes. When you apply to become a member of PSECU, the credit union will run a hard pull. A poor credit score won’t necessarily make you ineligible for membership as many consumers with poor and very poor credit are members. PSECU runs the pull to determine what loans and products you are eligible for upfront.

If you are applying for a loan as a non-member, you would need to apply for membership and a loan simultaneously. It’s possible you could get approved for membership but declined for the loan.

Who is PSECU Owned By?

PSECU is a member-owned credit union. It is a not-for-profit institution. While profits are earned, they are returned to member-owners in the form of no-fee services and reduced rates on loans.

Can Anyone Open a PSECU Account?

In a way, yes. While it’s a credit union built for Pennsylvania state employees, anyone can join PSECU if they become a member of the Pennsylvania Recreation and Park Society. Annual dues are $20, which essentially means anyone in the U.S. can join the credit union for a $20 yearly fee.

Our Methodology

The BankBonus team has analyzed dozens of banks to provide our readers with thoroughly informed and accurate reviews.

We evaluate digital financial platforms, online banks, regional banks, and national banks across several metrics.

Our assessment of each bank factors in these considerations:

- Product lineup: We review the types of accounts, loans, and services offered by each bank, as well as the number of accounts.

- Fees and pricing: We also consider each institution’s fees, including monthly maintenance fees and other service charges.

- Account features: To compare banks, we take a close look at the features, limits, and capabilities each one has to offer.

- Interest: Along with these features, we consider whether or not the bank offers interest-bearing accounts and compare their rates to industry averages.

- Brand reputation: The bank accounts we recommend have been carefully vetted to ensure they are legitimate, secure, and backed by FDIC insurance.

- User experience: Additionally, we consider the ease of use and availability of resources on each bank’s website and factor in reviews of the mobile app from the Apple App Store and Google Play Store.

- Branch and ATM access: To gauge convenience, we also look at each bank’s branch and ATM availability and consider their ATM reimbursement policies.

- Customer service: In our review process, we also explore banks’ customer service channels, hours of availability, and third-party reviews.

No comments yet. Add your own