Apple is one of the most popular brands in the tech industry. From the launch of Apple Pay in 2014 to the Apple Card in 2019 to the Apple Savings account released in 2023, the company has continued to expand into user-friendly banking products.

What is the Apple High Yield Savings Account?

iOS users with an Apple credit card can now set up a savings account backed by Goldman Sachs Bank that allows them to earn an impressive 3.75% APY on Daily Cash and additional deposits.

In this Apple Savings account review, we’ll unpack all the features the account has to offer.

Apple High-Yield Savings Account Features

3.75% APY

One of the best features of Apple Savings is its competitive annual percentage yield (APY). Since its launch, Apple Savings is currently offering 3.75% APY on all savings balances.

That’s nearly 10 times higher than the national average, according to the FDIC.

Apple’s rates are competitive with the APY offered by the best high-yield savings accounts. Unlike many of its alternatives, Apple Savings doesn’t require you to meet any minimum deposit or transaction qualifications.

That means all the money you put in Savings is eligible for the full APY. Just note that your total account balance can’t exceed $1 million, and you can’t transfer more than $20,000 from Apple Cash in a 7-day period.

Flexible Account Funding

Apple Savings goes hand-in-hand with the Apple Card. Its biggest draw is Daily Cash, which is unlimited cashback on purchases made with the card.

When you set up Apple Savings, the account will automatically put your Daily Cash balance in Savings, where it can earn interest. But it’s up to you whether you want your cash to go to Savings or into Apple Cash to spend.

While you can’t split your Daily Cash election between Apple Cash and Savings, you can change it from one to the other at any time. You can also send some of your Apple Cash balance to Savings and link your external bank account to transfer more money into the account.

Apple Cash funds are available instantly, but Apple notes that it can take a few days for transfers from external accounts to be accessible. However, any funds you put in Savings start accumulating interest the day you initiate the transfer.

Apple Wallet Integration

Apple excels at user experience, and Apple Savings is no exception. The account is seamlessly integrated into Apple Wallet, so you don’t have to download an app or log in to an online banking platform to manage your account.

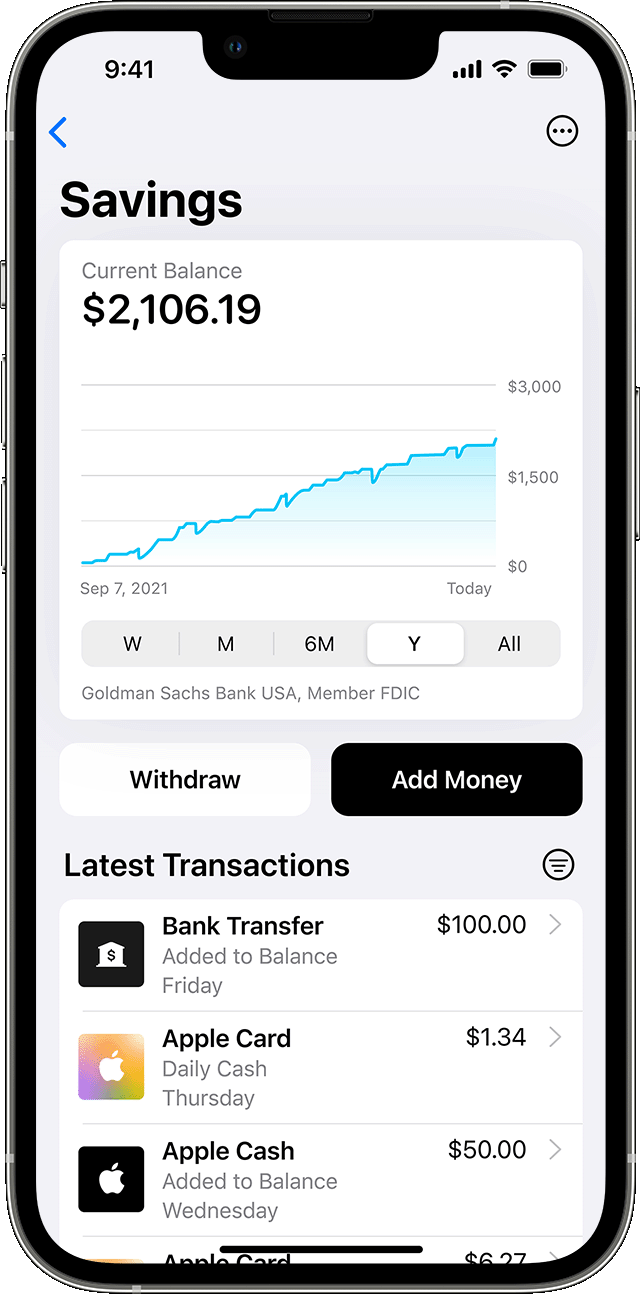

We found the Savings dashboard to be really easy to navigate. Once your account is set up, you’ll be able to see your current balance and a visual of your balance over the last week, month, six months, year, or all time.

You can also view recent and pending transactions and add or withdraw funds.

Fees

Like most accounts from online banks, Apple Savings doesn’t come with any monthly account fees. Apple explicitly states that it doesn’t apply any service charges or maintenance fees.

There are no statement fees because your statements are provided through Apple Wallet. Since you can’t spend directly from the account, you don’t have to worry about ATM fees.

Getting Started

To sign up for Apple Savings, you need to have an Apple Card, be at least 18 years old, and have an SSN or TIN. You also need to be a U.S. resident with a valid address.

Before opening an account, you’re required to install the latest version of iOS and have two-factor authentication set up to proceed.

If you check those boxes, you can set up Apple Savings in a few simple steps:

- Open the Wallet app on your iPhone or iPad

- Tap Apple Card

- Go to the “More” button and select Daily Cash

- Tap the “Set Up” icon

- Follow the prompts to transfer Apple Cash

From there, you can adjust your Daily Cash election, link other accounts, and start earning interest.

Learn More: Can you get cash back with Apple Pay?

Promotions

At this time, Apple Savings doesn’t have any promotions or welcome bonuses. In the future, Apple may offer sign-up or referral bonuses. The Apple Card routinely offers bonus incentives for signing up, referring friends, or making your first purchase.

Security

Apple partners with Goldman Sachs for its financial products. Goldman Sachs Bank is FDIC-insured, meaning up to $250,000 of your deposits are protected. Since Apple limits savings account balances to $250,000, all of your funds will be covered.

When it comes to cyber security, Apple Savings is pretty safe. Your account can only be accessed through your Wallet, and you’re required to set up two-factor authentication before creating an account.

Customer Service

The Apple website provides straightforward guides for setting up Savings and funding your account. You can also start discussions in Apple Support Communities if you have any questions.

If you’re having issues with your account or need assistance with your Apple Card, you can also message Apple Support through the Wallet app or call directly at 877-255-5923.

In some cases, Apple will share the details of your conversation with Goldman Sachs so they can help with your account issues.

Pros & Cons

Pros

- High APY

- No monthly fees

- Automated savings on Daily Cash

- Easy account access with Apple Wallet

- Two-factor authentication

Cons

- Only available to Apple Card users

- No sign-up bonus

- No cash deposit option

Alternatives

Apple Savings has a lot to offer, but it’s always wise to compare financial products to some alternatives. If you’re looking for a one-stop shop for banking that offers high-yield savings and other accounts, you may also want to consider Ally or UFB Direct.

And if your main concern is getting the highest yield, there are a handful of savings accounts offering 5% APY.

Note that some competitors have fees or requirements for obtaining the highest APY offered, while Apple has none.

The key is to know what features matter most to you as you compare banks and accounts.

Frequently Asked Questions

Is Apple Savings account safe?

The Apple Savings account is backed by Goldman Sachs, which is an FDIC member. The Federal Deposit Insurance Corporation protects each account depositor’s funds for up to $250,000. Apple also secures its savings accounts by requiring two-factor authentication to access your account. If you have iOS 15 or later, you can also enable advanced fraud protection for your Apple Card.

Do you need an Apple Card for Apple Savings?

To open an Apple Savings account, you do need to have an active Apple Card account. iPhone or iPad users who don’t have an Apple credit card aren’t eligible to open an Apple Savings account at this time.

Will getting an Apple Card affect my credit?

Simply applying for an Apple Card will not affect your credit score. If you’re approved and accept Apple’s offer, then you’ll be hit with a hard credit inquiry, which can have a minor impact on your score.

Does Apple Cash earn interest?

Apple Cash doesn’t earn interest on its own, but if you deposit your Apple Cash balance into Apple Savings, it will earn a 3.75% APY. When you sign up for an account, your Daily Cash will automatically be distributed to your savings balance to earn interest, but you can change this selection at any time. If you choose not to put your Daily Cash in the savings account, it won’t earn interest.

Is Apple Savings Right for You?

If you’re looking for a full-service banking platform where you can manage all your checking and savings products, you won’t find it here.

But if you want a straightforward savings option with easy mobile access and Apple’s seamless user experience, take a look at Apple Savings.

The account makes saving money effortlessly for cardholders. If you’re a frequent Apple card user, taking a few seconds to enroll in Savings could be a no-brainer.

With its high APY, complete lack of fees, and ease of use, the savings account and accompanying Apple Card are worth considering for any iPhone user.

Comments are closed.

Comments are closed here.