While Cash App isn’t a bank itself, it partners with Sutton Bank to offer prepaid debit cards and Wells Fargo to insure account balances for Cash Card holders.

Cash App is best known for helping users send and receive money in seconds, but it also lets you deposit money, get a cash card, and set up direct deposits with early pay, similar to banks.

Is Cash App a Bank?

Rather than a bank, Cash App is a fintech app, aka a financial platform that provides banking services by partnering with FDIC-insured banks.

In other words, Cash App provides the technology, while its partner banks provide the actual banking services.

While some online sources claim that Cash App uses Lincoln Savings Bank, a representative confirmed to us that Cash App partners with Sutton Bank to issue its prepaid debit cards, and Cash App’s website states that it partners with Wells Fargo to cover Cash Card account balances.

Here’s a closer look into each bank.

Sutton Bank

Sutton Bank, Member FDIC, has been in business since 1878 and acts as an online and in-person bank with a handful of branches throughout Ohio.

As previously mentioned, Sutton Bank is responsible for issuing Cash App’s Cash Card.

Wells Fargo

Wells Fargo is one of the largest and most recognizable banks in the country, with thousands of branches and ATM locations throughout the country.

According to Cash App’s terms of service, if you have a Cash Card or sponsor a Sponsored Account, your stored funds are FDIC insured for up to $250,000 through Wells Fargo.

How to Access Your Money on Cash App

You don’t need a bank account to use Cash App. You are free to connect one if you want, but it’s not a requirement to use the app. Here are a few more ways you can access money on Cash App:

With a Cash Card

If you want to use Cash App with your Cash Card, you use it anywhere Visa is accepted. You swipe or insert the card like normal, and the transaction completes cashless. However, unlike a credit card, the funds come directly from your Cash App balance. As a result, you don’t have a bill to pay, nor will you pay interest.

You can also select ‘cash back’ at certain retailers and get back more than the purchase amount if your balance is high enough.

Remember that if your transaction exceeds your Cash App balance, your transaction won’t go through.

Without a Cash Card

If you don’t have a Cash Card and want to access cash in your account, you must electronically transfer funds to another Cash App user with a Cash Card and can withdraw the funds. This is a confusing way to get your cash, and you should only use it with someone you trust.

The best option is to link your bank account to the Cash App and transfer the funds to yourself when you need the cash.

How to Locate Your Cash App Bank

You rarely need your Cash App bank’s information since everything goes through the app, and the banks work behind the scenes.

However, if you want to set up direct deposit, send e-checks, or set up a recurring bill, you may need to know your bank’s information.

To do this, log into the Cash App and click on the Banking tab. In that tab, you’ll find the bank’s routing and account numbers, which you need to set up any deposits or payments.

How to Set Up Direct Deposit Through Cash App

To set up direct deposit to your Cash App account, you’ll need the bank’s name, address, routing number, and account number. You’ll also need your Cash App account number.

Before setting up direct deposit, confirm which bank you are to use in the Cash App. Since they are a fintech app, the partner banks change often.

Financial Security

Understanding any fintech’s security before trusting them with your finances is essential, especially if you set up direct deposit or conduct other important financial transactions.

Cash App uses encryption technology like other P2P platforms like PayPal and Venmo. However, there’s one major issue.

If you choose not to have a Cash App card, your funds are not FDIC-insured.

Also, Cash App doesn’t provide fraud protection. If someone gets into your account, you may not get the funds back, and if you use Cash App investing, your funds aren’t FDIC-insured, but that’s not unusual.

Expert Take

In my personal experience, Cash App has been an easy and convenient tool for sending and receiving money quickly without paying fees.

And even though it isn’t a bank itself, I’ve found that some of Cash App’s additional features for Cash Card holders are on par with the offerings from online banks.

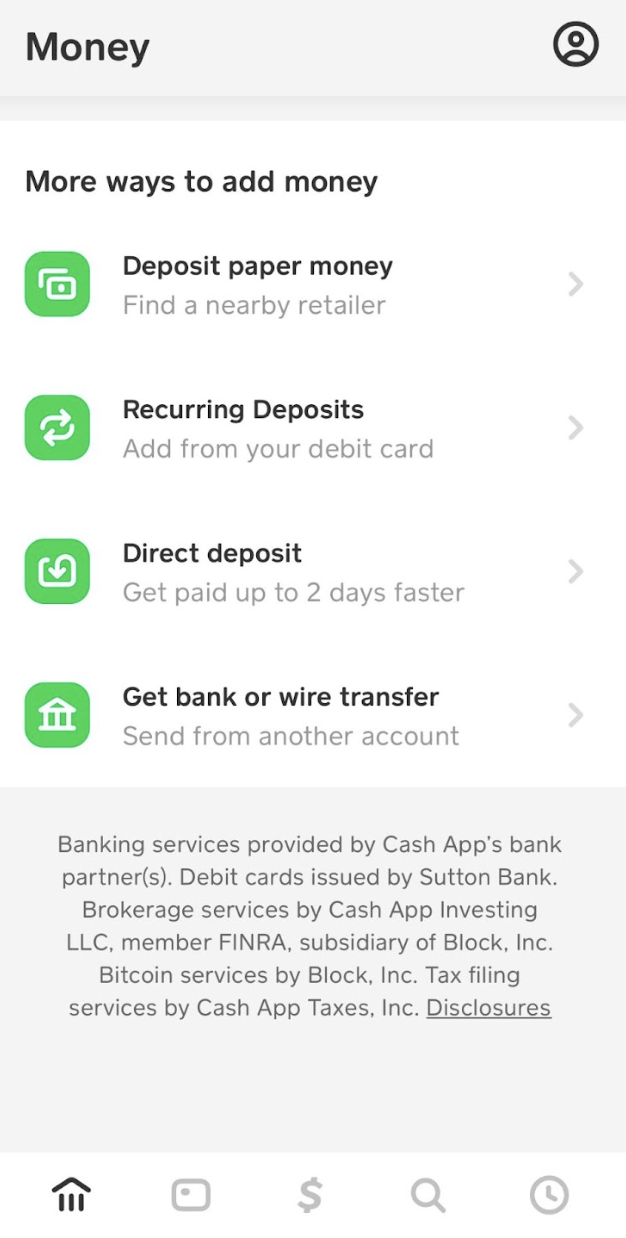

As you can see in the screenshot from my Cash App dashboard below, you can carry out basic banking activities in the app with a few taps, like setting up direct deposits, accepting wire transfers, making recurring deposits, and finding nearby locations for cash deposits. You can also trade stocks and bitcoin.

That being said, there are a few drawbacks to consider, like sending and receiving limits, ATM fees for Cash Card holders, and limited investing options.

If you decide to open a Cash Card account, your funds are backed by FDIC-insured banks. While there are more robust options out there for banking and investing, Cash App is one of the most user-friendly platforms for sending quick cash.

Frequently Asked Questions

Knowing what banks Cash App uses is essential since you’ll deposit your funds with them. Here are other questions people have about Cash App.

Is a Bank Account Required When Using Cash App?

You don’t need a bank account when using Cash App, but not having one makes things more difficult. The only way to access cash is with your Cash Card. You can’t transfer funds to yourself if you don’t have a linked bank account, so it’s best to link a bank account.

Is Cash App Free to Use?

For the most part, Cash App is free. You can download the app and create an account for free. You can deposit cash and send/receive money from other Cash App users. You will, however, pay fees if you want an instant transfer (within minutes) versus waiting a few days for your funds.

You’ll also pay fees for ATM withdrawals and Bitcoin investments.

Are There Transfer Limits With Cash App?

Cash App has some rather strict limits, especially if you’re unverified. To verify your account, you must provide your full name, the last four of your Social Security number, and date of birth. You must also provide your driver’s license.

If you’re unverified, you can send up to $250 in 7 days and receive up to $1,000 in 30 days.

The limits increase drastically when you’re verified. After that, you can send up to $7,500 in 30 days, and there’s no limit to inbound transfers.

Is Cash App FDIC-Insured?

Cash App is only FDIC-insured by its partner banks. So you must have a Cash App card to have your funds insured. Any funds sitting in Cash App itself are not FDIC-insured.

Does Cash App work with Plaid?

Yes. Plaid is compatible with Cash App. You can link a bank account to your Cash App account to make payments with Plaid.

The Bottom Line

Cash App isn’t a bank but works with a few banks to provide bank-level services on the app. You can instantly transfer money to other Cash App users or spend money on your Cash App card like any other Visa debit card.

Like any banking decision, use caution, don’t share your credentials, and watch for the banking information Cash App uses to change so you always know where your money is located.

Comments are closed.

Comments are closed here.