Chime and Zelle are two popular personal finance apps. Both are free and offer helpful services. But does Chime have Zelle?

The unfortunate answer is no, but there are ways to work around it.

An Overview of Chime and Zelle

Chime and Zelle may seem similar because they are both online apps, but Chime is a fintech company offering banking services, and Zelle is a payment service that transfers money from one person to another.

Chime

Chime is a financial technology company that offers free banking services. Their model doesn’t have any of the fees that most banks charge, including overdraft, monthly service, or minimum balance requirements.

Chime works with national banks under the hood to provide these banking services along with the protection of FDIC coverage.

Zelle

Zelle is a peer-to-peer payment service that makes paying family and friends simple. The money transfers directly to and from your linked bank account, and you don’t have to bank at the same institution as the recipient or sender.

Zelle works inside 2,000+ banking apps, or you can download the Zelle app for iOS or Android separately.

Does Chime Have Zelle?

Chime doesn’t offer Zelle within its app, so Chime doesn’t ‘have’ Zelle. This is primarily because Zelle only works directly with banks that have physical locations. However, there are workarounds to make Chime work with Zelle.

Does Chime Work With Zelle?

Chime does, however, work with Zelle as long as you have a Chime debit card. You can send and receive money from your Chime account once you link the debit card to your Zelle account.

In case you missed it, the catch is that you’ll need to download the Zelle app separately, rather than finding Zelle integrated within the Chime app the way you might otherwise be used to.

How to Setup Chime to Work With Zelle

To use Zelle within Chime, use these steps.

1. Download and install the Zelle app on your mobile device

To send money via Zelle through Chime, you must download the Zelle app. This is because Chime doesn’t work directly with Zelle. To transfer funds, you must go through the Zelle app.

2. Open an account and connect with Zelle

To send money with Zelle through Chime, you must open a Zelle account. To open an account, you must provide your email, mobile number, and contact information.

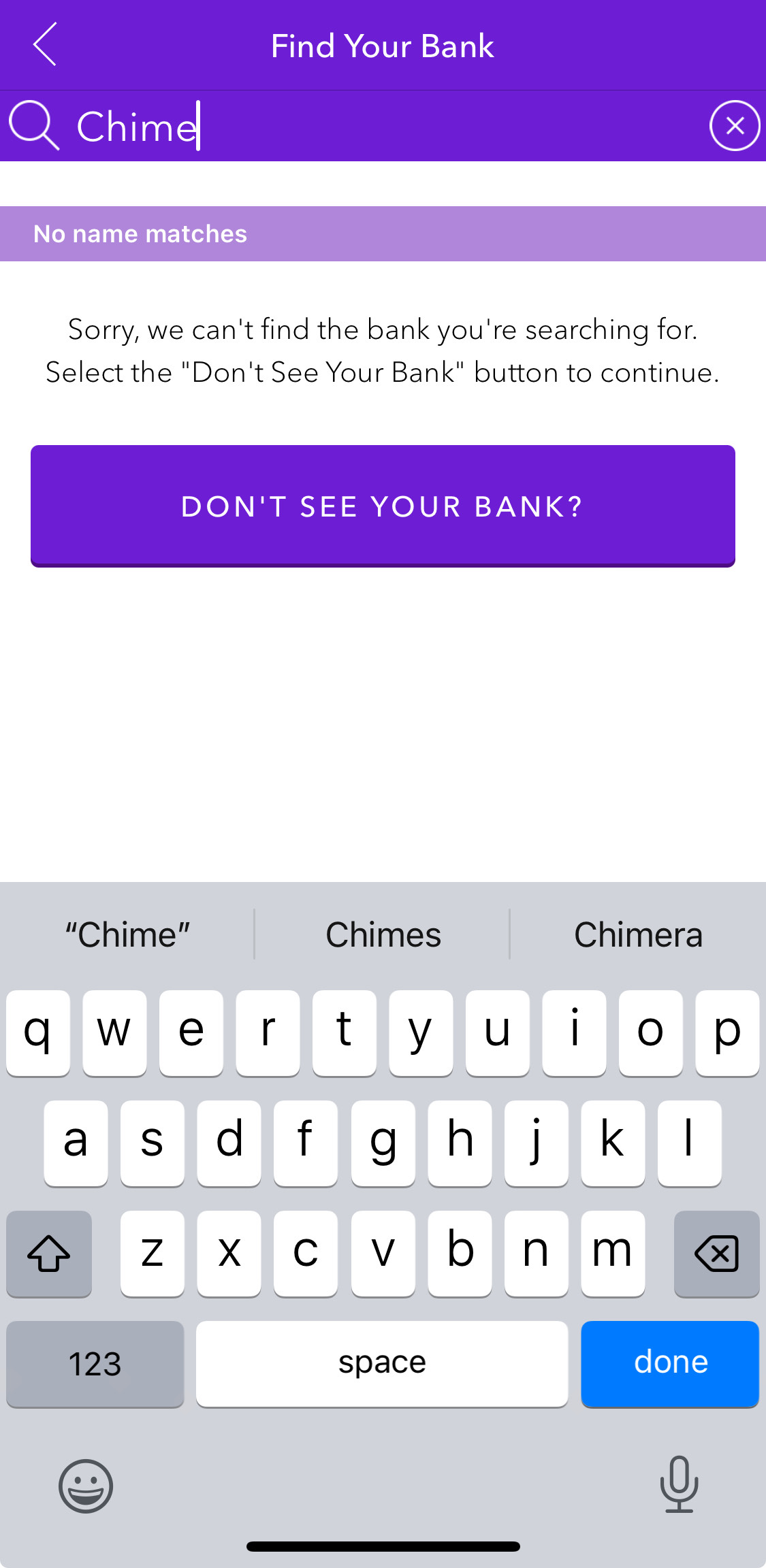

You’ll still search ‘Chime’ in the search bar during this step. You’ll then get a button that says, ‘Don’t See Your Bank?’ Click the button, and then you can enter your email to start your account.

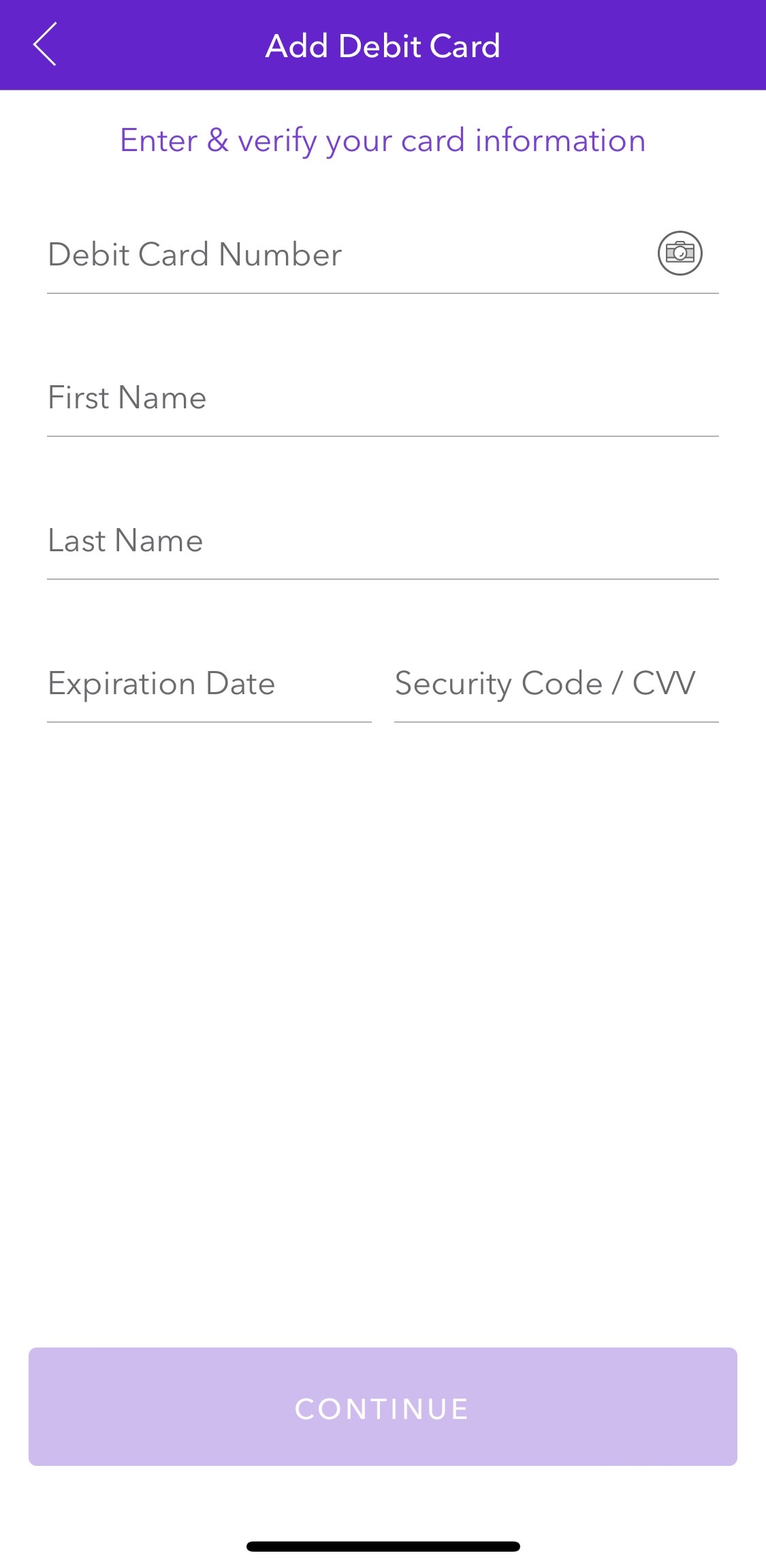

3. Add your Chime debit card

Next, I was prompted to enter my Chime debit card information into the app. This is how you’ll transfer funds to and from your Chime account to Zelle.

4. Verify your identity

Once you’ve linked your account, Zelle will verify the information with Chime.

In addition to verifying your account, Zelle will verify your mobile number and possibly your email address. They do this by sending codes to your phone or email that you’ll then enter into the app.

Once all verifications are complete, you can send and receive money into your Chime account via Zelle.

How To Transfer Money From Zelle To Chime

Transferring money from Zelle to Chime is simple with these steps:

- Open the Zelle app

- Log in

- Click ‘transfer money’

- Enter the recipient’s information

- Enter the dollar amount

- Confirm the transaction

- Send money

Transfer Fees and Limit

Neither Zelle nor Chime charges fees for transfers. However, there are strict limits since Chime doesn’t have Zelle. You can send up to $500 weekly and receive up to $5,000.

Pros and Cons

While you can use Zelle with Chime, there are pros and cons to consider.

Pros

- Can transfer money instantly

- No fees from either service

- User-friendly

Cons

- Takes multiple steps to set up Zelle with Chime

- You can only send funds to users who use a bank that uses Zelle

- Only works with U.S. accounts

Alternatives

While using Chime with Zelle is free, they don’t work together directly.

These alternatives to using Chime with Zelle work much the same way:

- Chime’s “Pay Anyone” feature: Chime has its own ‘version’ of Zelle, called “Pay Anyone”. As long as you have the person’s email address or phone number, you’re able to send money to anyone – even to family and friends who aren’t Chime members. The catch is that only other Chime members are able to send you money this way. If someone with an account outside of Chime wants to send you cash, you’ll need to connect to a P2P service like Zelle.

- Venmo: If your recipients or senders don’t use a bank that has Zelle, Venmo may be an option. You’ll set it up the same way, adding your Chime debit card to the app, but you don’t have to worry if the other person’s bank doesn’t have Zelle.

- PayPal: This is one of the oldest peer-to-peer payment services and can be linked with Chime. However, be careful how you send/receive the funds, or there could be a fee.

- Cash app: If both parties have the Cash App, it’s free and easy to send and receive money to each other.

Frequently Asked Questions

While Chime doesn’t have Zelle, it works in it. Here are some more questions about the service.

Are all Chime accounts compatible with Zelle?

Only the Chime checking account is compatible with Zelle within the Zelle app. You must have a Visa or Mastercard debit card to link to the Zelle app for it to work.

Can I send money instantly using Zelle on Chime?

Yes, you can send money instantly using Zelle on Chime as long as you link a valid debit card and the recipient has a bank that integrates with Zelle.

Can I use Zelle with Chime to send money internationally?

No, only Zelle transfers are strictly for domestic money transfers.

How quickly are Zelle transactions processed through Chime?

Most transactions are sent within a few minutes when using Zelle. However, instant transfers are not guaranteed, so always double-check whether the money was sent or received.

What bank does Chime use for Zelle?

Chime doesn’t use Zelle. You must use the Zelle app separately to use Zelle with your Chime account.

What cards work with Zelle?

Only Visa or Mastercard debit cards work with Zelle. Prepaid debit cards do not work with the app.

Does Chime work with Venmo like Zelle?

Yes, Chime and Venmo work the same way as Chime and Zelle. You use the apps separately from one another but can transfer funds using your Chime account.

Why is Zelle not working with Chime?

Currently, Zelle only works with banks with physical locations. Plus, Chime has its own peer-to-peer payment service called Pay Anyone. It’s completely free, and the recipient doesn’t need a Chime account.

Read 1 comment or add your own

Read Comments