Going to the bank to deposit a check can be a real pain. Fortunately, mobile check deposit makes it much easier to get checks deposited faster, giving you access to your funds and letting the issuer balance their books.

But what is a mobile check deposit, and how does it work? Keep reading to find out more.

What Is a Mobile Check Deposit?

Mobile check deposit allows the option to deposit your check using your smartphone or tablet. You don’t have to go to the bank or even an ATM. You can deposit checks from your house, work, or any place you have a secure internet connection.

What Type of Checks Can You Deposit with Mobile Deposit?

You can use mobile deposit for most types of checks, including payroll, personal, government-issued, business, and cashier’s checks. Some banks limit the types of checks you can use for mobile deposits, including:

- Third-party checks

- Money orders

- Foreign checks

- Traveler’s checks

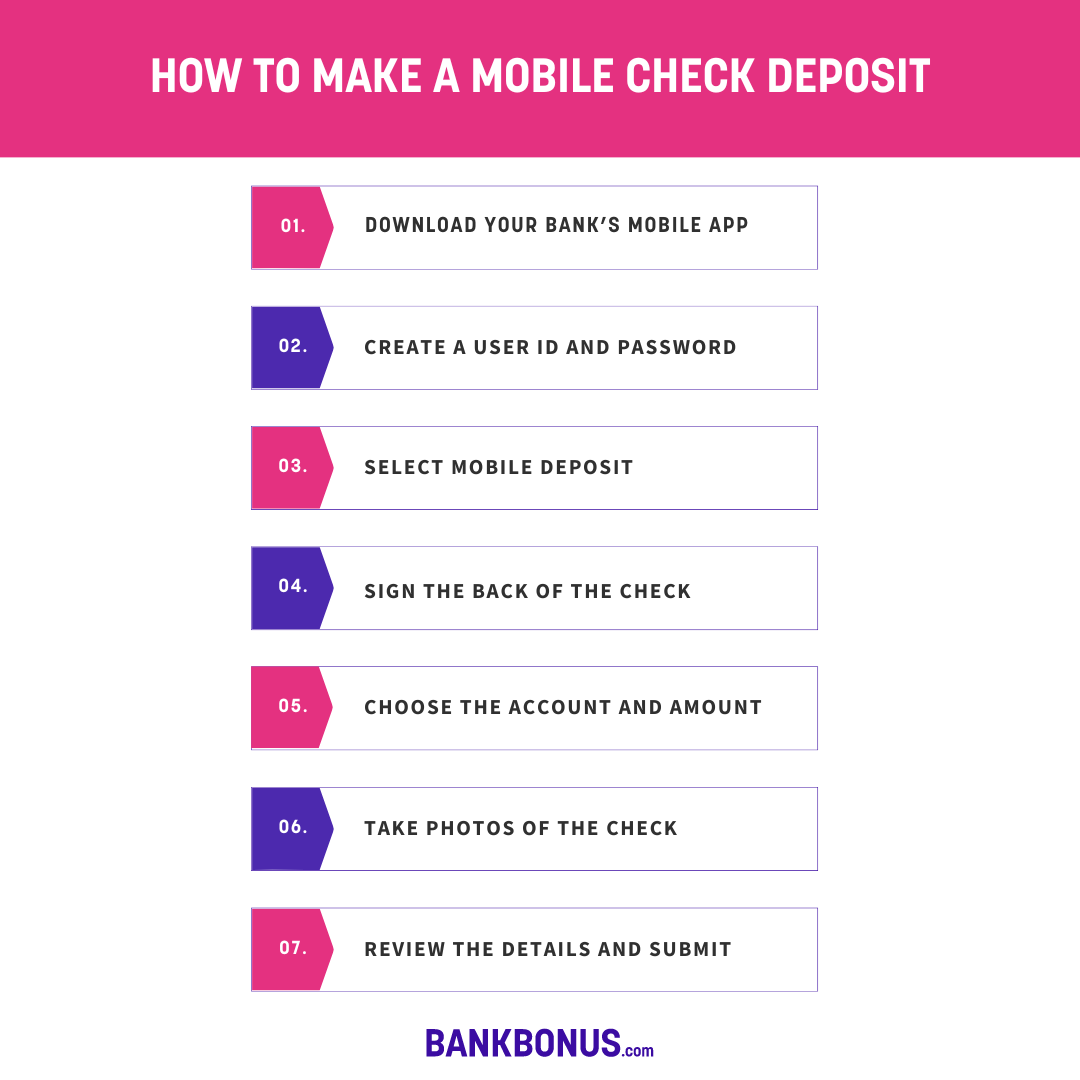

How to Make a Mobile Check Deposit

Mobile check deposit uses remote technology that captures an image of the check for processing. Here are the steps to make a mobile check deposit.

1. Download your bank’s mobile app

You must have your bank’s mobile app to use mobile deposit. Most bank apps are free, and you can do many other tasks, such as checking balances, transferring funds, and paying friends or family.

2. Create a User ID and Password

You’ll need a unique user ID and password to sign up for your bank’s mobile app. Make sure to use a secure password and consider changing it every couple of months to avoid the risk of being hacked.

If you already have an ID and password, log into the app.

3. Select Mobile Deposit

On your bank’s menu, select ‘mobile deposit’ and have the following information ready:

- Amount of check

- Account you want to deposit it in

- The physical check is ready for a picture

4. Sign the Back of the Check

You must endorse the check to deposit it like you would at the bank. Do this right before you start the mobile deposit process to reduce the risk of anyone stealing and depositing your check.

5. Choose the Account to Deposit the Check and Enter the Amount

If you have multiple accounts at the bank, choose the one where you’ll deposit the check. Next, you’ll enter the exact amount of the check. Double-check this number before submitting it.

6. Take Photos of the Check

Follow the prompts in your bank’s app to take photos of the check. Typically, you take a picture of the front first, and once that’s accepted, they’ll prompt you to take a picture of the back of the check.

7. Review the details

The last step is to review the details before hitting submit. Ensure the check amount is right, as well as the account you’re depositing the funds in, and hit submit.

How to Endorse a Check for Mobile Deposit

Endorsing a check for mobile deposit is a little different than endorsing a check at the bank. Because you’re sending it in for mobile deposit, Federal Regulation CC requires depositors to endorse the check with ‘for mobile deposit only.’

Check your bank’s requirements before depositing a check via mobile deposit. They may not accept the check if you don’t follow their exact regulations.

Of course, like any check, make sure you sign the check clearly in blue or black ink, and ensure there is no other writing on the back of the check except the required mobile deposit wording.

Avoid Mobile Deposit Scams

Bank scams are increasing today, and that includes mobile deposit scams. While it’s safe to deposit funds via mobile deposit, there are some important ways you must protect yourself.

- Only deposit using a secure internet connection (at home is best)

- Change your passwords regularly

- Don’t share your passwords

- Don’t deposit checks from people you don’t know or checks you didn’t expect

- Use multi-factor authentication to lower the risk of hacking

- Set up biometric authentication on your phone to make it harder to get into your apps

Pros and Cons

Mobile deposits have pros and cons to consider before using it.

Pros

- You can deposit your checks from anywhere you have a secure internet connection

- You’re just as protected as if you deposited the check with a teller at the local bank

- Anyone can learn how to use mobile check deposit

Cons

- Banks don’t accept all checks, so your deposit may not go through

- You should hold onto the paper check for a while to ensure there aren’t any problems

- There’s a higher risk of being hacked

Mobile Deposit Isn’t Working

The most common reason mobile check deposit doesn’t work is a poor-quality photo. This often happens with user-printed checks or if your camera is poor quality. Other reasons it may not work include improper endorsement, bounced checks, or an app glitch.

If you don’t receive confirmation that the check deposited, call your bank’s customer service line to determine if it’s a problem with the app or your check. If all else fails, you may need to take it to your local branch to deposit.

Frequently Asked Questions

Mobile check deposits are one of the best conveniences banks have come up with in a long time. But people still have questions about how it works. Here are the answers.

What banks offer mobile check deposits?

Today, most banks offer mobile check deposits, especially the country’s largest banks, including Chase, U.S. Bank, PNC, Capital One, Citi, and Wells Fargo. Many small banks and credit unions offer it, too, because they recognize the demand for it and want to retain customers.

How long do mobile deposits take to make?

Depositing the funds using mobile deposit takes only a minute or two. However, that doesn’t mean your deposit is immediately available. Most banks have a cutoff time that you can deposit checks for next-day posting. Read your bank’s funds’ availability policy to know for sure.

What should you do with a check after making a mobile deposit?

It’s best to hold onto the paper check for at least a few months after depositing it. You never know if there will be an issue with the app or the check quality that forced the bank to reverse the deposit. Plus, you’ll need the check if you must go to the bank to fix the issue.

Can you cancel a mobile check deposit?

Each bank has different guidelines regarding if and when you can cancel a mobile deposit. Since most post as soon as the next business day, your opportunity to cancel it will be relatively short, if there is one at all.

Should You Use Mobile Check Deposit?

Mobile check deposit is safe, as long as you use a reputable bank and ensure your internet connection is secure. It can be a great way to get money deposited into your account faster while reducing the number of times you must head to the bank!

Today, most banks have electronic deposits at the bank branches via ATMs, so why not save yourself a trip and enjoy your free time? Mobile check deposit takes only a few seconds, and then you can move on with your day.

No comments yet. Add your own