A savings bond is a loan issued by the U.S. Treasury to benefit the U.S. Government.

In other words, you’re lending money to the U.S. government whenever you buy a savings bond. The government then owes you the money, and you can redeem it with interest in the future.

You can register yourself as the savings bond holder or another person, even a minor (under 18 years of age). Savings bonds are sometimes given as birthday gifts (a little unusual, but who doesn’t like getting money that grows as a gift!).

Only a bond’s owner or beneficiary can cash the bond, and no one else. There are three types of savings bonds available in the U.S. today.

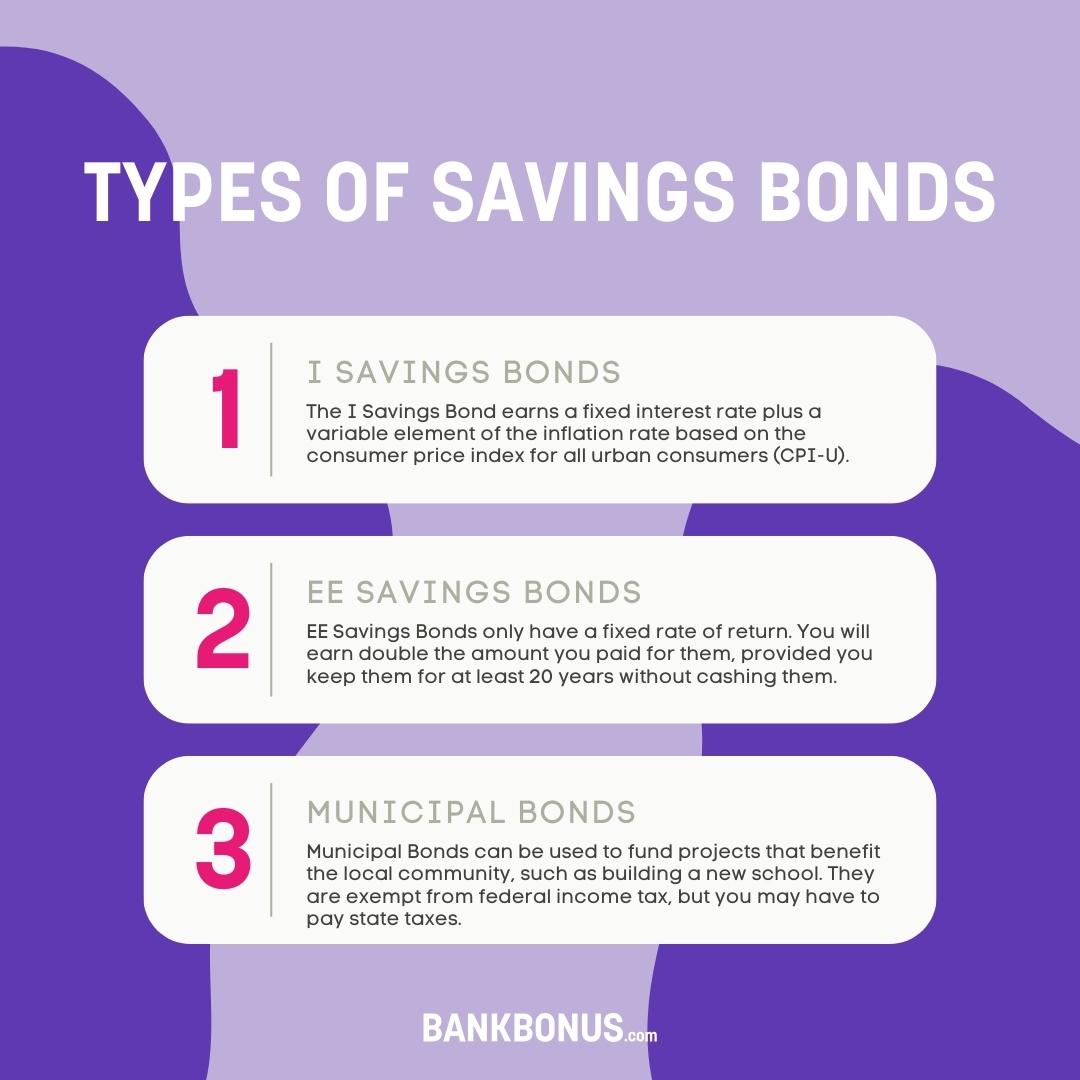

3 Types of U.S. Savings Bonds

I bonds and EE bonds are issued by the federal U.S. government. On the other hand, municipal savings bonds (often referred to as “muni bonds”) are issued by local governments.

1. I Savings Bonds

I savings bonds were issued for the first time in 1998, and the interest rate you’ll earn on these bonds will vary based on when that was.

They earn a fixed interest rate plus a variable element – the inflation rate based on the consumer price index for all urban consumers (CPI-U).

The rate can change approximately every six months.

Learn More about I Savings Bonds at TreasuryDirect.gov

2. EE Savings Bonds

Unlike I savings bonds, EE savings bonds only have a fixed rate of return.

You will earn double the amount you paid for them, provided you keep them for at least 20 years without cashing them. No surprises there – just a guaranteed way to double your money over time!

Series EE savings bonds have been on the market since 1980.

Rules have changed over time, so if you have an EE bond issued before May 2005, you may earn either variable or fixed rates, depending on the date the bond was issued.

At the moment, EE Savings bonds only offer a fixed rate you’ll know right at the time of purchase.

You can easily buy EE savings bonds online by visiting treasurydirect.gov.

Learn More about EE Savings Bonds at TreasuryDirect.gov

3. Municipal Bonds

Local or state governments usually issue municipal bonds (aka “munis”).

These bonds can be used to fund specific projects that will benefit the local community, such as building a new school or paying for day-to-day state obligations.

They are exempt from federal income tax, but bondholders might have to pay state taxes instead. Whether you need to pay will depend on where you live and where the bond was issued.

These bonds earn and pay interest at regular intervals and have a set maturity date you’ll know right from the start.

Learn More about Municipal Bonds at Investor.gov

No Longer Exists: Series HH Savings Bonds

You may have heard of the series HH bonds or know someone who owns this bond series.

This kind of bond doesn’t exist anymore, so if you have it, you must have purchased it a long time ago! The offering of these bonds ended in September 2004.

You can’t purchase series HH bonds anymore. However, if you have one, it’s still possible to redeem it at your local bank, so there is plenty to get excited about anyway!

Learn More about Series HH Savings Bonds at TreasuryDirect.gov

How to Buy a Savings Bond

In the past, all federal bonds were sold as paper documents with a serial number and you could only buy them through the mail.

Buy EE Bonds

Now, times have changed, so the most recent EE bonds are available to buy online via the Treasury Direct website.

Buy I Bonds

You can still buy paper savings bonds: you’ll have to choose series I bonds and use federal income tax refunds to purchase them while filing federal taxes. To do so, use IRS form 8888.

In summary, series EE bonds must be purchased online, while I bonds can be purchased online or as paper bonds. You can also buy electronic bonds in penny increments, unlike paper bonds.

However, most people buy their bonds through their website simply because it’s more convenient.

There are still cases in which a paper bond makes more sense. For example, if you are planning to buy one as a gift.

Individuals can buy up to $10,000 in electronic bonds each calendar year and per Social Security Number (SSN), but the paper bonds limit per person is $5,000.

Buy Municipal Bonds

Municipal bonds are a bit different. You can buy them from various financial institutions like banks, brokerage firms, bond dealers, or sometimes directly through the municipality.

How Much Is a Savings Bond Worth After 30 Years?

Here’s an overview of the value of EE savings bonds issued in October 1990 up to their maturity date in 2020.

| EE Bond Face Value (Purchased 1990) |

Value in 10 years (2000) |

Value in 20 years (2010) |

Value in 30 years (2020) |

| $50 | $45.16 | $69.78 | $103.68 |

| $100 | $90.32 | $139.56 | $207.36 |

| $200 | $180.64 | $279.12 | $414.12 |

| $500 | $451.60 | $697.80 | $1,036.80 |

| $1,000 | $903.20 | $1,395.60 | $2,073.60 |

Keep in mind that interest rates and maturity dates can vary depending on the issue date and type of savings bond you purchase.

You can find a full breakdown of the interest accrual dates for savings bonds here.

How to Find the Value of Your Savings Bonds

If you want to know how much your bond is worth on any given day, you can easily determine its value using the U.S. Department of the Treasury calculator.

The calculator will ask you for these details:

- Issuing date

- Serial number

- Series (type of bond)

- Denomination (face value)

Once you enter the information, the online calculator will do the work for you. The result displayed should be accurate as long as the information you input is correct.

If you don’t have the serial number, you can still get an estimate by entering the other details requested.

How to Redeem a Savings Bond

Now that you know the answer to ‘what is a savings bond,’ it’s time to learn how to redeem them.

Old savings bonds are usually cashed in at financial institutions such as banks or credit unions. If you own a paper bond, that’s usually the best way to cash it in.

Municipal bonds are also bought and cashed in at financial institutions, at least in most cases.

Electronic savings bonds should be redeemed from the TreasuryDirect account, the same website through which you bought them.

They are automatically deposited into your bank account within a couple of days after you redeem them, which is pretty convenient. You can have them deposited in your checking account or savings account. The choice is up to you.

For electronic bonds, keep in mind the minimum redemption amounts and minimum remaining balances required if you plan to redeem the bond only partially.

After you cash in a bond, you should receive a Form 1099-INT stating your taxable gain.

If you redeem a bond in paper form, the financial institution can give it to you immediately. With electronic bonds, you should receive the form via email by the end of the year.

Pros & Cons

Savings bonds are a safe investment for most Americans. However, being low-risk, they don’t offer a very high return on investment (ROI).

Here are the pros and cons of savings bonds.

Pros

- Low risk: Savings bonds are one of the most secure investments ever made. There is no risk of losing your principal; you’re guaranteed to get some return in the future, even if not very high. You are essentially a lender to the U.S. federal government, so it should be a safe bet to say they have to pay you back.

- Available to kids: Underaged children can have savings bonds in their name. It might be an unusual gift, but many people give a savings bond as a present to children for their birthday. They can then use this money for higher education or anything else they want in the future.

- Support your government: When you buy a savings bond, you benefit not only yourself but also the U.S. government. Thanks to you, there might be the money to start a new local project in your area. You never know!

- Tax benefits: There are no state or local income taxes on the interest you earn with savings bonds. There is only the federal income tax to pay, but that won’t be a problem until you redeem your bond. Furthermore, some taxpayers could be eligible for a tax break if that income is used for education expenses.

Cons

- Low ROI: Savings bonds are a low-risk, low-return kind of investment. They may be great as a gift to a child or teenager learning about building personal finances. However, if you are 30+ years old and earning a nice salary, you could find better investments, such as investing in the stock market. These investments will be riskier – but they will most likely bring you a higher return. That doesn’t mean savings bonds don’t remain an option. It’s okay to be conservative about money and prefer a safe savings plan. Some people like a challenge, while other savers are a little more risk-averse. Always choose based on your needs and personal preferences.

- Early withdrawal penalty: Avoid withdrawing money too early from a savings bond. There are options for you to redeem your savings bonds before it has reached full maturity. Still, usually, it’s better to wait, or you’ll lose part of the return.

- Low liquidity: Savings bonds are debt securities that take a long time to mature (around 20 to 30 years). That means your money won’t be available to you for a long time from when you invested.

Frequently Asked Questions

How much does a $100 savings bond cost?

Most savings bonds are purchased in electronic form at half their face value, which means the cost of a $100 savings bond should be $50, the price for a $200 savings bond should be $100, and so on.

How long does it take for a $50 savings bond to mature?

A bond isn’t worth its face value when you buy it. For example, a $50 bond isn’t worth $50 immediately. A bond usually doesn’t reach its face value (in our example, $50) until after 20 years from purchase.

Fortunately, you don’t have to wait for the bond to completely mature before cashing it in. It’s possible to cash in a bond after only 12 months from the purchase if you want.

However, remember that if the bond you’d like to redeem is less than five years old, you’ll lose three months of interest when you cash it in. The Treasury guarantees that your bond will reach its face value within 20 years from the date of purchase.

So the $50 face value bond you bought for $25 must be worth at least $50 in 20 years for the Treasury to keep its promise. But if that isn’t the case with regular interest payments, the Treasury will make a one-time adjustment to fulfill its guarantee.

How much is a $200 savings bond worth after 30 years?

As a rule of thumb, a $200 savings bond (that you would have paid $100, so half its face value) should be worth at least $200 after 20 years. That’s because the Treasury guarantees a bond will reach its face value after a maximum of 20 years.

Comments are closed.

Comments are closed here.