Your routing number is an essential and integral part of the financial system as we know it. They allow money to move from one account to another, whether through check payment or electronic transfer.

While you might not know your routing number by heart, there are quite a few situations where you’ll need to supply it.

Fortunately, finding the number is not too difficult and should take less than a minute of your time.

Where is the Routing Number on a Check?

In a nutshell, a routing number is a nine-digit number that identifies banks. They act as an address through which banks can make sure that the money reaches the right account.

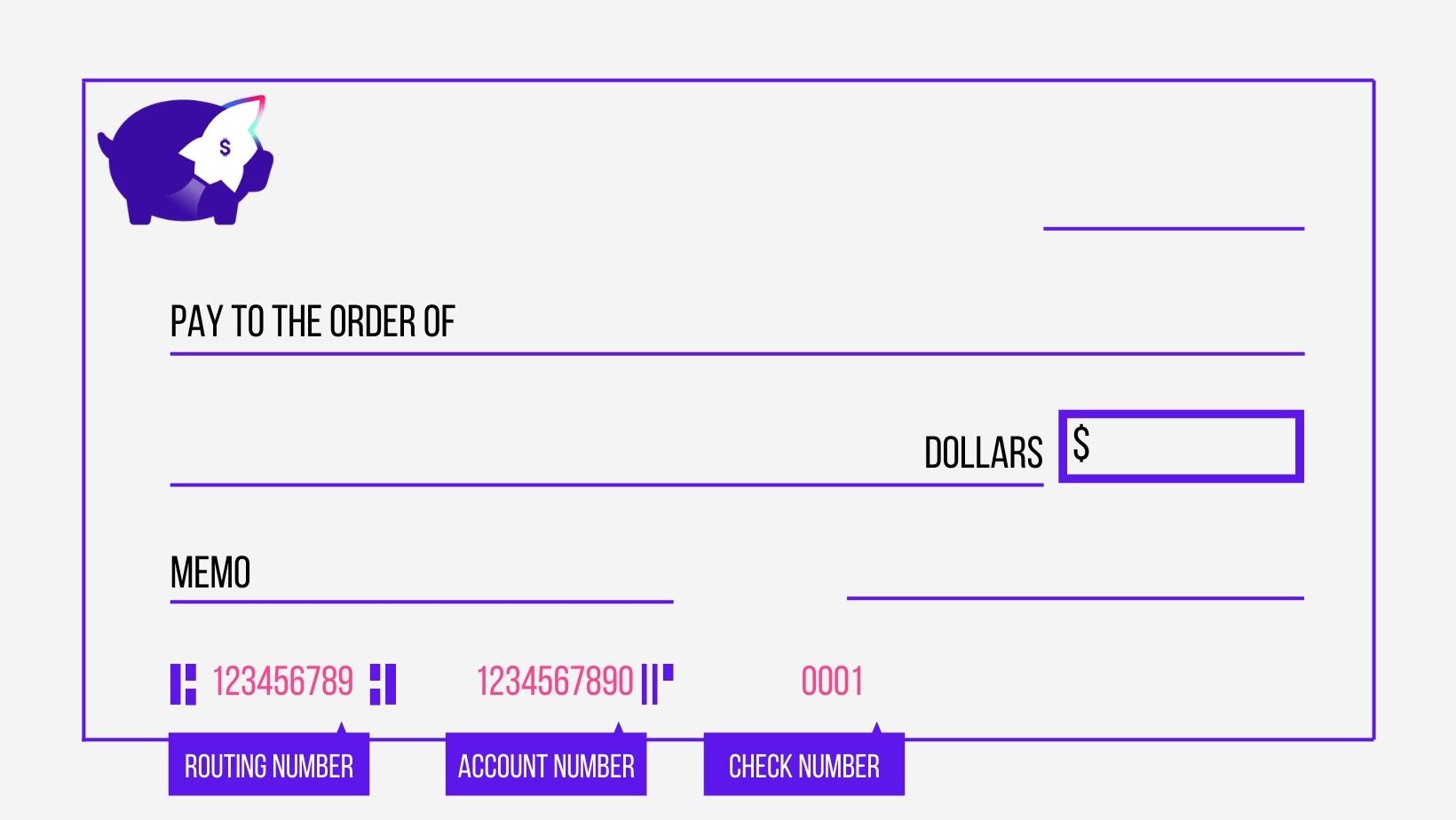

One of the easiest ways to find it is to look at a check. Fortunately, most, if not all, personal checks follow the same format, so this method applies to virtually any check issued by a credit union or bank in America.

Checks typically have three numbers, and recognizing them can help you make sure you do not mistakenly supply the wrong number:

- The first set of numbers (nine digits) is typically going to be your routing number.

- The next set of numbers represents your personal account number, and it is the account from which the payment will go out.

- Finally, the check number is the third set of numbers.

How to Find Your Routing Number Without a Check

With the internet and banking apps increasingly becoming the norm, many people do not use checks anymore. Both internet and mobile banking make transferring funds easier and more secure than checks since there is no physical paper and no need to mail anything.

Online and mobile banking use electronic transfers, which are either ACH or wire transfers. These payment forms also happen to be faster than checks, making them the preferred payment method for individuals and businesses alike.

If you don’t have a checkbook, there are a few other ways to find this coveted nine-digit number. Thankfully all of them are easy and straightforward, and you should have access to at least one (if not all of them).

Method 1: Bank Statement

All banks and credit unions offer customers bank statements for all of their accounts. It is increasingly common for bank statements to be sent electronically instead of by mail. Doing this avoids paper waste since many people are happy reading their bank account statements on their computer screens anyway.

You might also have opted in for paper statements, in which case you’ll receive them in your mail. Banks typically charge a monthly fee for printed statements to cover the extra work and postage needed to obtain your statement in this format. On the other hand, you can view and download your electronic statements from internet banking or mobile banking app.

You will typically find it alongside your account number within the header of the statement – the top part of the first page, where you’ll find all of your other details, including address and type of account.

Method 2: Bank’s Website

Many banks include their routing number on their website. You might need to login into your online bank to find it, but some banks also allow you to look up their routing number without logging in.

Since banks might place this information in different parts of the website, your best bet will be the website’s search function. Look for the icon that is shaped like a magnifying glass and then type ‘routing number.’

Method 3: ABA Online Lookup

The ABA’s website includes an online lookup tool that allows you to look up a bank’s routing number. At the very least, you’ll need to know the financial institution’s name and in which state it is. To help you narrow your search down, you can also include the bank’s city and ZIP code.

Method 4: Contact your bank

If you get stuck, you can also contact your bank and ask them for the information. Many banks offer different ways to get in touch, including telephone, email, and live chat.

What is a Routing Number?

Routing numbers also referred to as ABA routing numbers or routing transit numbers, have been around for quite a long time. The American Bankers Association (ABA) introduced them in 1910.

As we said earlier, routing numbers consist of nine digits, but this is only half the story. Each routing number has five different numbers rolled into one long number. These five numbers all represent different things that need to work together to ensure that the money is routed correctly.

This section will be looking at each of these numbers individually and explain what each one does.

The First Four Numbers

The first four digits were traditionally assigned by the Federal Reserve Routing number. Originally they represented the bank’s physical location so that anyone could tell exactly where the bank is located just by reading these four numbers. In this sense, they work as an address, only it’s a coded address to make it fit using fewer words and numbers.

It’s important to understand, however, that this is not always the case. When banks merge or get acquired, one of the banks will lose its original number and take on the other. When this happens, the first four numbers will no longer represent the bank’s physical location that lost its routing number.

As we said earlier, smaller banks might not have a different routing number for their location – after all, there are over 100,000 bank and credit union branches in the US – a number that certainly wouldn’t fit in 4 digits.

Fifth and Sixth Numbers

The fish and sixth numbers represent another location. However, this time, they represent which Federal Reserve bank the money will be routed through on its way to the bank. There are 12 Federal Reserve Banks that operate 24 branches, and this number will represent one of them – the one to which your bank is connected.

Seventh Number

This number represents the Federal Reserve check processing center assigned to your bank.

Eighth Number

This number represents the Federal Reserve district in which your bank is.

Ninth Number

The ninth and last number is a checksum resulting from a complicated and secret formula that takes all the other numbers into the equation to output a single-digit number. If the ninth number doesn’t match the checksum number, the transaction will be flagged and processed manually.

What is the Purpose of Routing Numbers?

Routing numbers help make the processing of checks and other forms of payment quicker and easier. While paper checks come with the routing number pre-printed, you need to supply the routing number when making an electronic transfer such as ACH (Automated Clearing House) payment or wire transfer.

The efficiency provided by the routing number comes from the fact that it allows the payment to be routed to where it needs to go. As we saw earlier, the bank routing number acts like an address identifier that allows a funds transfer to move from one account to another.

For example, if your employer pays you via ACH transfer, they’ll use the routing number to ensure the funds reach your checking account. More reasons you might need your routing number:

1. Setting up a Direct Deposit

If you’re setting up a direct deposit, you will need the routing number to ensure that the money arrives where it needs to go. If you’re receiving the direct deposit (such as a paycheck), you will need to supply your routing number alongside your bank account number and other information.

If you’re the one sending the money, such as setting up automatic alimony payments or paying a recurring bill, you will need the routing number of the account where you’re sending the money.

2. Filing your taxes

Tax returns are usually posted straight into your bank account. You’ll need to supply your bank account number and the routing number associated with that account for the money to arrive.

3. Paying someone by check

If you’re paying someone by check or getting paid by check, you’ll need the routing number as this allows the bank to process that check. Fortunately, you’ll find the number on the check, so no need to look anywhere and write it yourself.

Frequently Asked Questions

What’s the difference between a routing number and an account number?

While routing numbers and account numbers are different, they play an equally important part in transferring money. As we discussed earlier, routing numbers work like an address, which helps banks locate an account. The account number, on the other hand, identifies a particular account.

Account numbers tend to be between 8 and 12 digits long. They are unique to each bank account, so that if you hold multiple accounts with the same bank, each account will have a different number, while the routing number will be the same for all accounts.

Ultimately, both numbers are required to transfer money successfully. You need the account number to identify the bank account in which the funds will go and the routing number to find the bank that holds the account.

Where can I find my routing number?

You can easily find your routing transit number by looking at the bottom of your check. You can also find this number on your bank statement or online using either the bank’s website or the ABA online lookup tool.

Is the routing number printed on my bank card?

No, you won’t be able to find it on debit cards or credit cards.

What does a routing number mean?

In a nutshell, routing numbers are the address of your bank account. When a bank has a routing number, it also means that they are FDIC members, meaning the accounts are insured.

Comments are closed.

Comments are closed here.