Transferring money from a peer-to-peer app to a peer-to-peer app seems like it should be simple, but looks can be deceiving. Keep reading to learn how to transfer money from Apple Pay to Cash App.

Can I Move Money From Apple Pay to Cash App?

If you have money in your Apple Pay account, you may want to transfer it to your Cash App if that’s your chosen app for daily spending.

Unfortunately, you can’t send money directly from Apple Pay to the Cash App. However, with a few simple steps, you can.

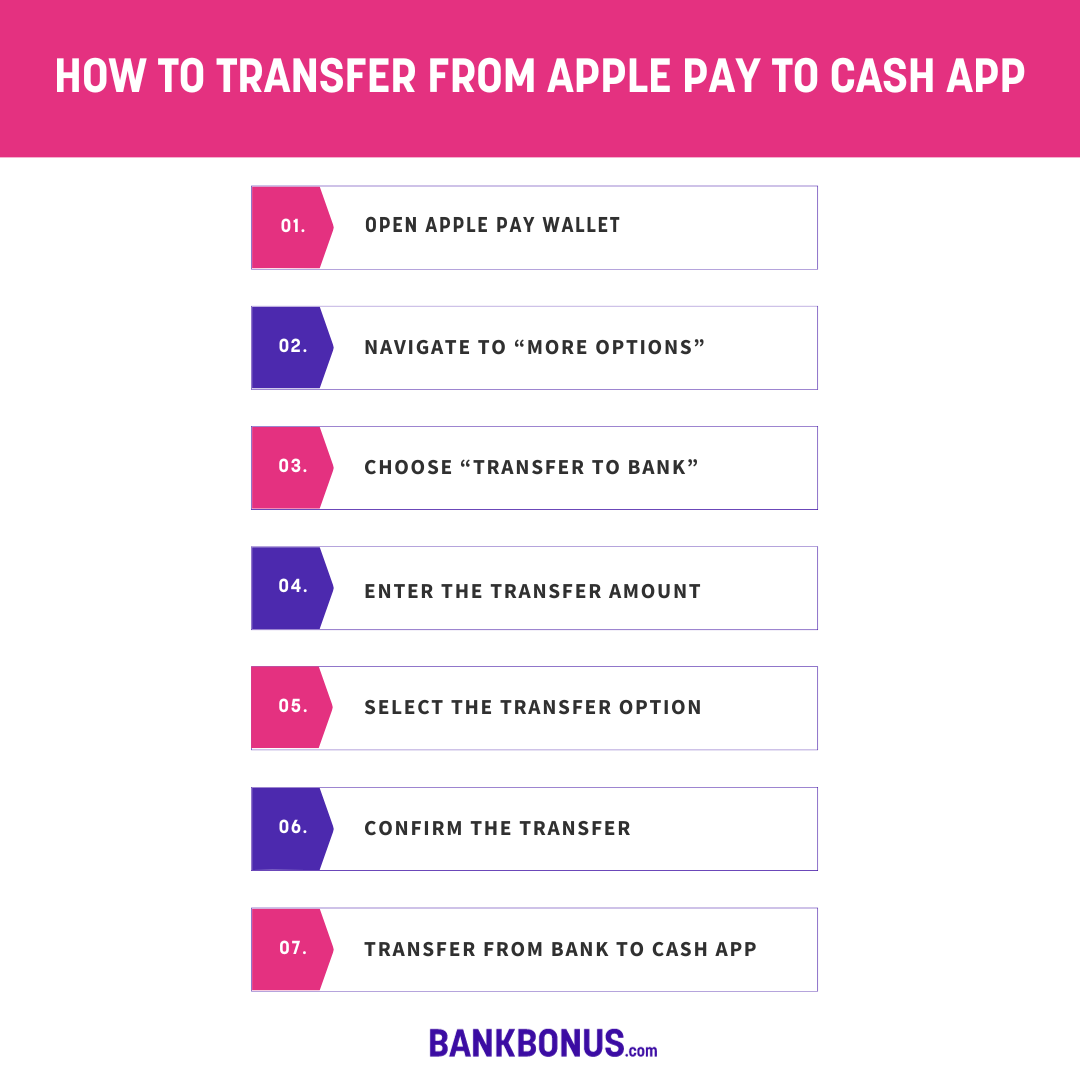

Transferring Money from Apple Pay to Cash App Steps

Transferring money from Apple Pay to Cash App is simple with these steps. It may seem like ‘a lot of steps,’ but it goes fast.

Step 1: Open Apple Pay Wallet

Open the Apple Pay wallet on your smartphone or iPad. Ensure you’re logged in and on a secure internet connection since you’ll be dealing with your financial information.

Step 2: Navigate to “More Options”

On your iPhone, click ‘more options’ under Apple Cash Card. If you’re using an iPad, click Wallet and Apple Pay in settings.

Step 3: Choose “Transfer to Bank”

Either on your iPhone or iPad, click ‘Transfer to Bank.’ This initiates the transfer to your bank account.

Step 4: Enter the Transfer Amount

Next, choose the amount of money you want to transfer from Apple Pay to your bank account.

Step 5: Select the Transfer Option

Choose how fast you want the money to transfer. If you select the standard transfer, it takes 1 – 3 business days and is free. You can also choose ‘Instant’ transfer for a small fee.

Step 6: Confirm the Transfer

After clicking ‘Transfer,’ you must confirm it using Face ID, Touch ID, or your passcode.

Step 7: Transfer from Your Bank to Cash App

Finally, you’ll transfer the money from your bank to your Cash App by navigating to the Cash App home screen and tapping ‘Money.’ Click ‘Add Cash’ and choose the amount to transfer. Like Apple Pay, you must confirm the transaction with Face or Touch ID.

Can You Add Apple Pay To Cash App?

To add Apple Pay to Cash App, take these steps.

- Tap Cash Card on your Cash App

- Choose Add Card to Apple Pay

- Follow the instructions

Verifying Cash App for Apple Pay

To verify Cash App for Apple Pay, follow the prompts when linking the accounts. To complete the transaction, you must verify yourself with your Face or Touch ID.

Transfer Limits When Using Apple Pay With Cash App

To use Apple Pay with Cash App, the transaction limit is $7,000 per transaction/per day, $10,000 per week, and $15,000 per month. However, keep in mind that you cannot add your Apple Card to the Cash App. The Apple Card doesn’t allow cash advances.

Does Apple Charge to add Cash App?

No, Apple doesn’t charge a fee to add Cash App. If you see an Apple transaction on your Cash App, you signed up for an Apple subscription or paid for an Apple app using the Cash App.

How Long Do Transfers From Apple Pay to Cash App Take?

Since you can’t transfer funds directly from Apple Pay to Cash App, the time depends on the methods used. If you pay for an instant transfer from Apple Pay to your bank, you can instantly transfer the funds from Apple Pay to Cash App.

Otherwise, the entire process can take 1 – 3 business days for a standard transfer.

How To Instantly Transfer Money From Apple Cash To Cash App

To transfer money from Apple Cash to Cash App quickly, you must instantly transfer the funds from Apple Pay to your bank account. You can then transfer the funds from your bank to the Cash App instantly.

Apple Pay vs Cash App

Cash App and Apple Pay are both popular mobile wallets offering peer-to-peer transfers, contactless payments, and physical cards (optional). They have many similarities and differences.

Here’s how they compare.

The Similarities

- Free to download and use

- Can pay peers

- Can make contactless payments at top retailers and restaurants

- Offer optional physical cards

The Differences

- Apple Pay is only for iOS devices; Cash App works on multiple devices

- Cash App allows the purchase of Bitcoin

- Apple Pay only offers payment services

- Cash App allows US to UK money transfers if both users have Cash App

Frequently Asked Questions

Transferring money from Apple Pay to Cash App allows you to use both apps to their full extent. Here are some more questions people have about the apps.

Is Apple Pay or Cash App Better?

Choosing between Apple Pay or Cash App is a matter of personal preference and your device type. If you have anything other than an iPhone, Cash App is your only option. Fortunately, both apps are safe, protect your information, and are free to use despite offering somewhat different ‘additional’ services.

Is Cash App Safe?

Cash App uses leading technology to encrypt your information and keep it safe. They also use fraud detection technology to ensure your safety. However, it’s equally as important for users to keep their passwords private, use two-factor authentication, and only use the app on a secure network.

Are There Fees Associated With Transferring Money Between Apple Pay and Cash App?

If you choose ‘standard transfers’ when transferring money from Apple Pay to your bank and then to Cash App, there aren’t any fees. If you request an ‘instant’ transfer, there may be a small fee.

How Do I Link My Apple Pay-Linked Debit Card to Cash App?

You can link any eligible debit card to Cash App, even if it’s linked to Apple Pay. To add it, tap ‘Linked Banks’ and ‘Link Debit Card.’ Next, provide your card information and click ‘Link Card.’

Is There a Limit for Transferring Money From Apple Pay to Cash App?

There is a limit of $10,000 per transfer when transferring money from Apple Pay to your bank account. There isn’t a Cash App limit unless you’re depositing paper money at a retailer. Then, you’re limited to $500 per day.

How Do I Send Money From Apple Pay To Cash App Without a Card?

You can link cards to both Apple Pay and Cash App, so you don’t need a card. You electronically transfer the funds from both apps.

Final Thoughts

Learning how to transfer money from Apple Pay to Cash App is a bit of a learning curve, but after doing it a couple of times, you’ll see how easy it is.

Just be careful with the fees; if you constantly do instant transfers, they will deplete your funds, but with advance notice, you can transfer funds for free in a matter of days.

No comments yet. Add your own